need help with the following

______

just part b for this one

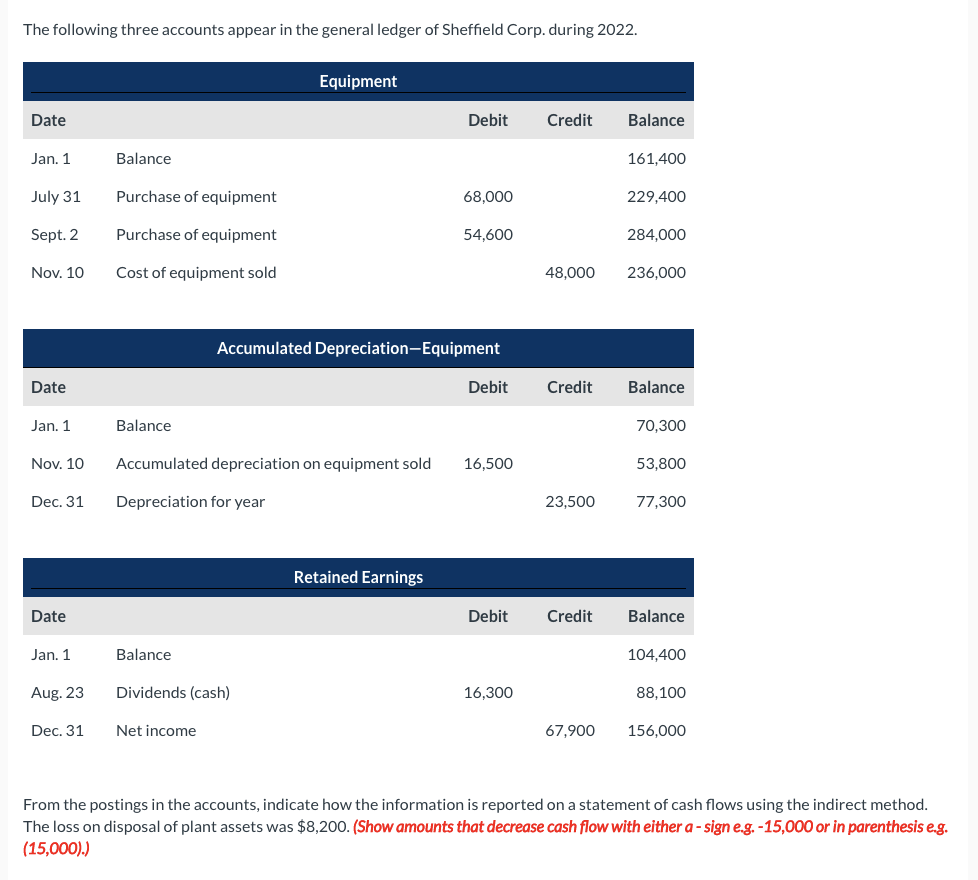

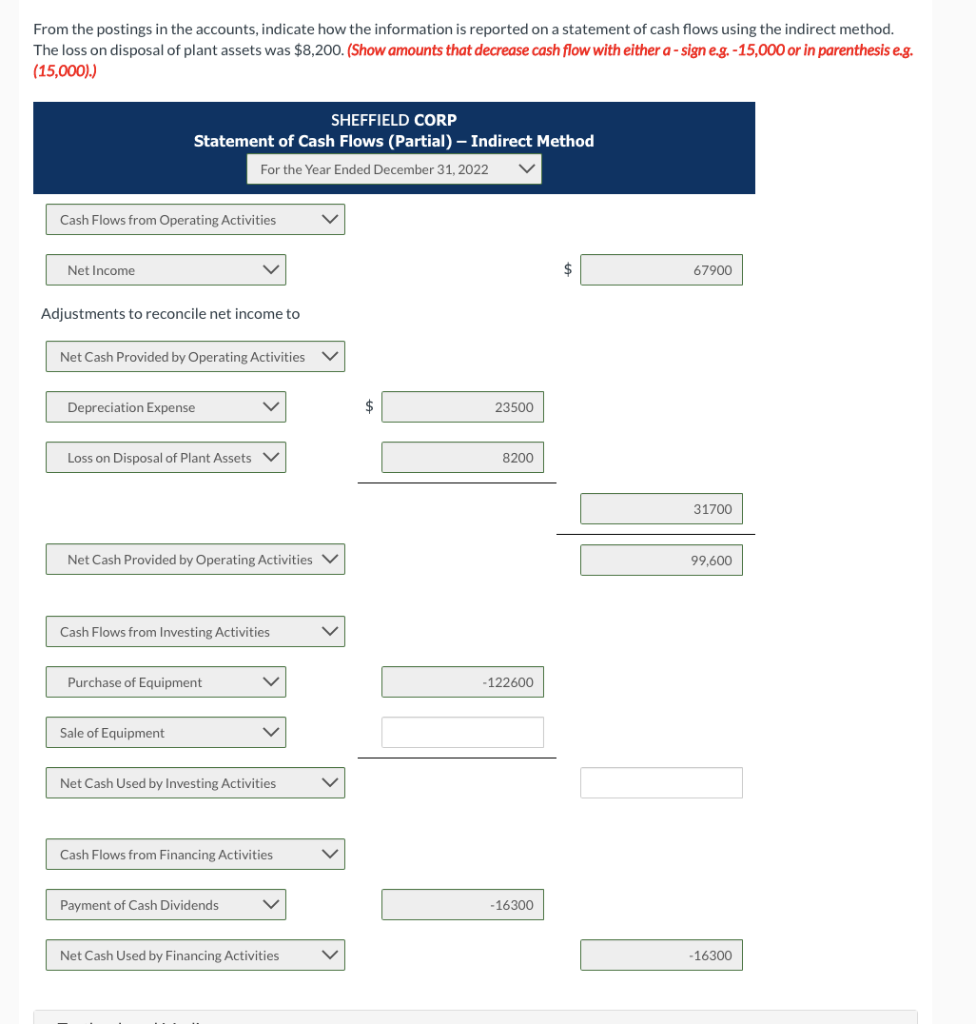

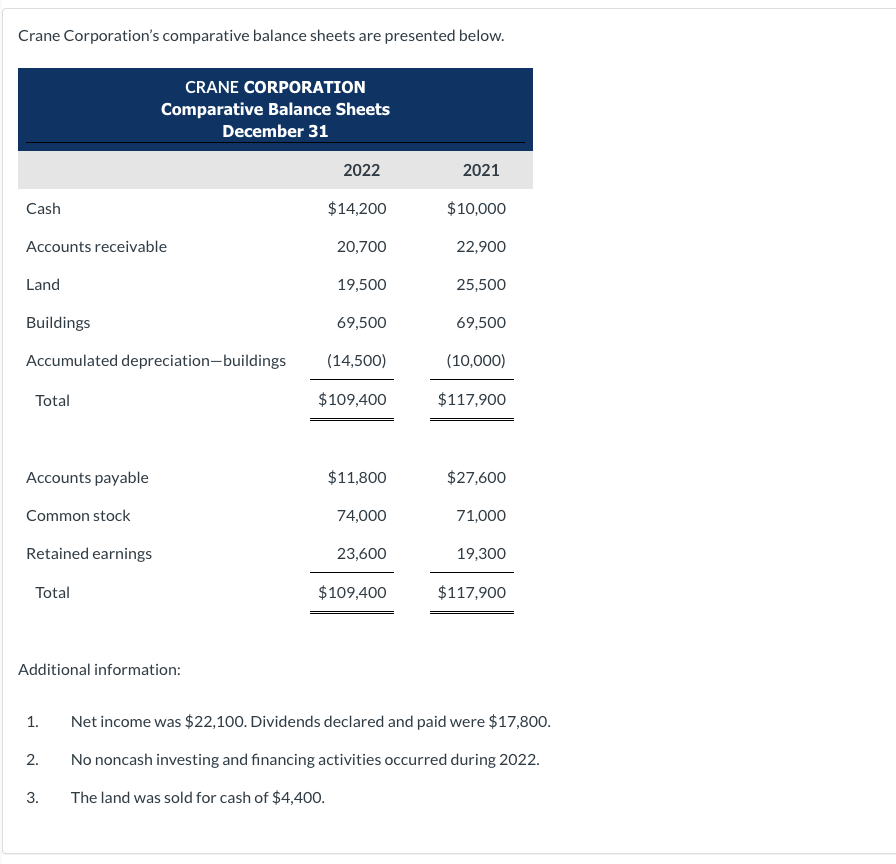

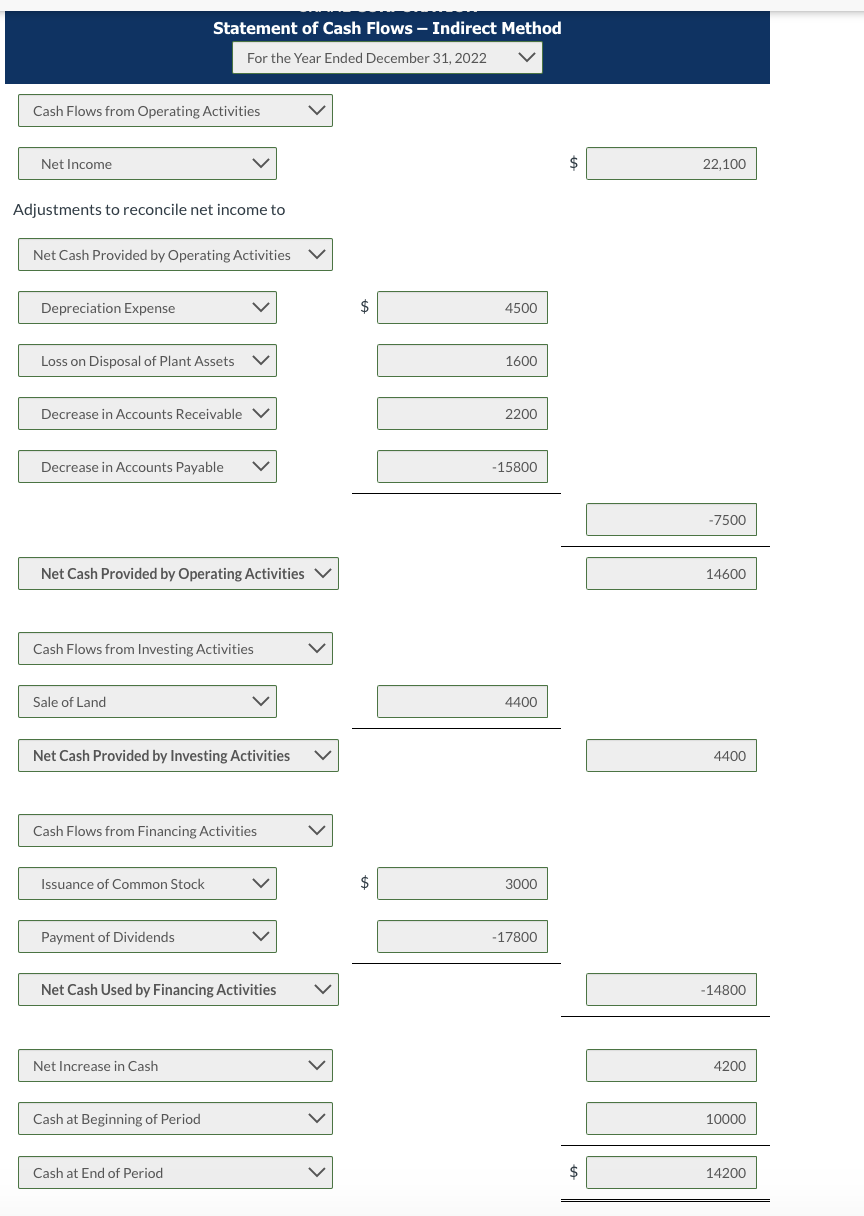

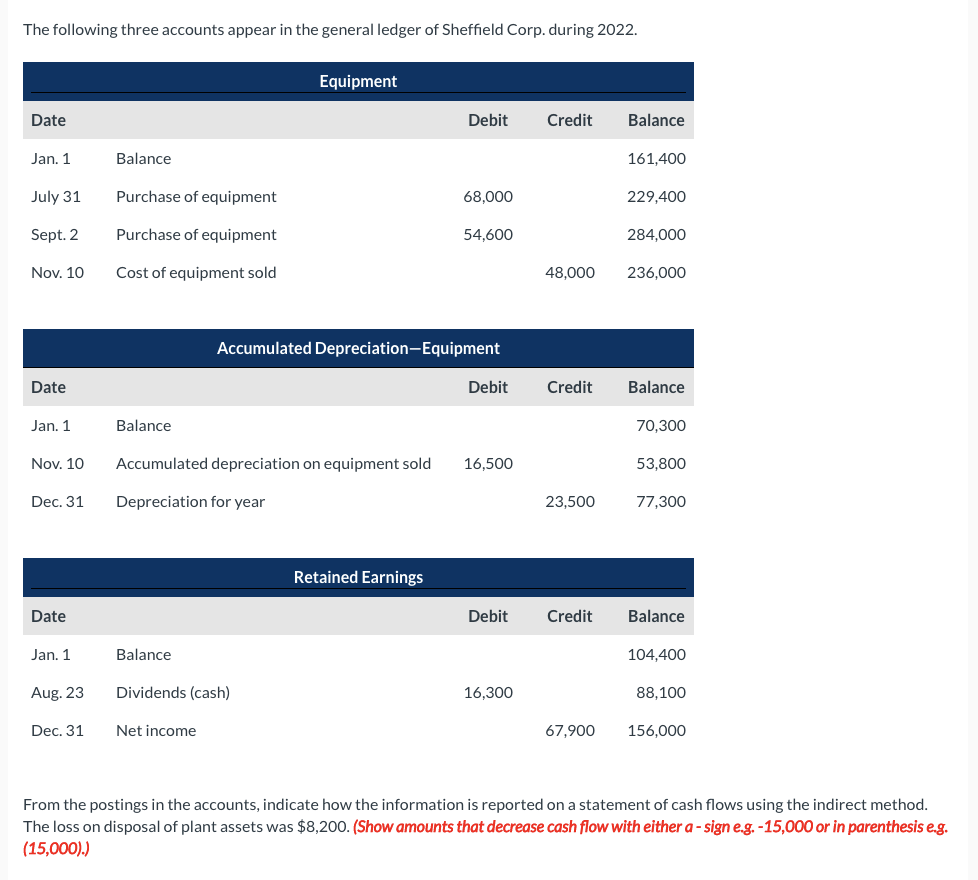

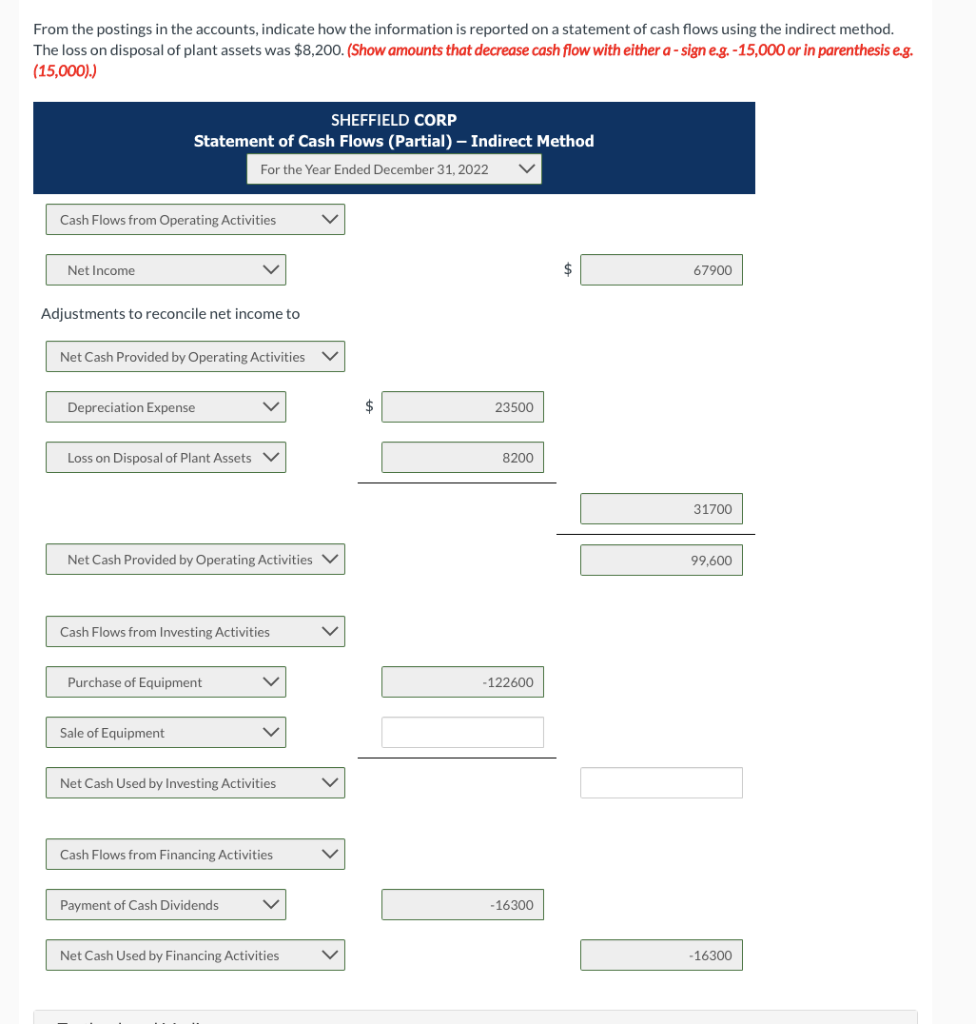

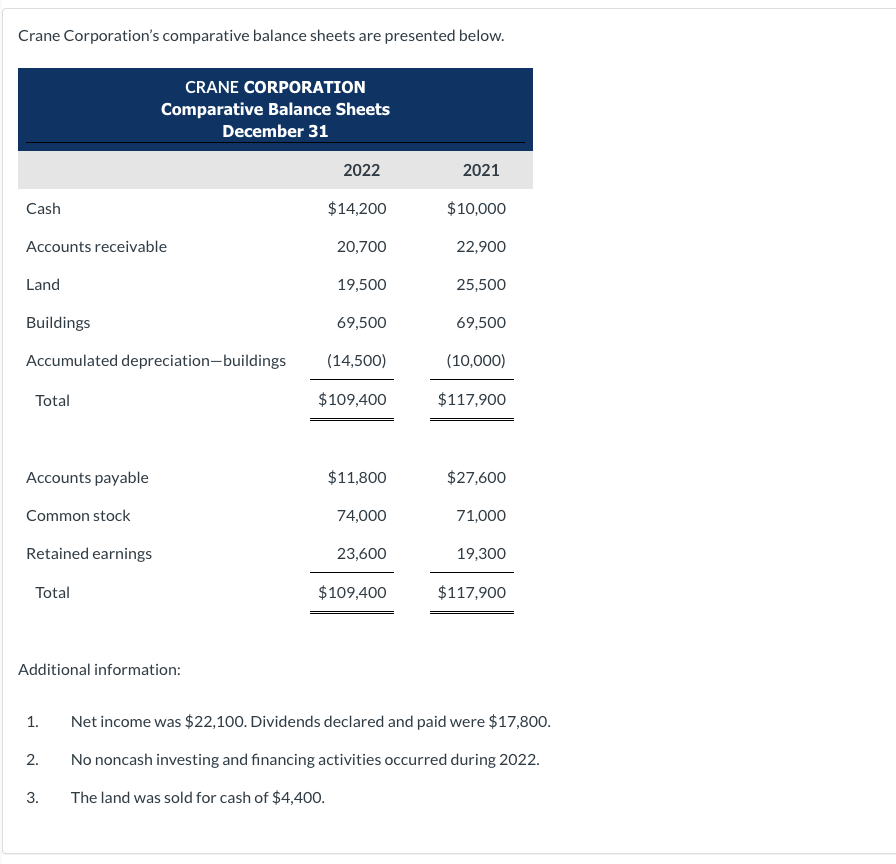

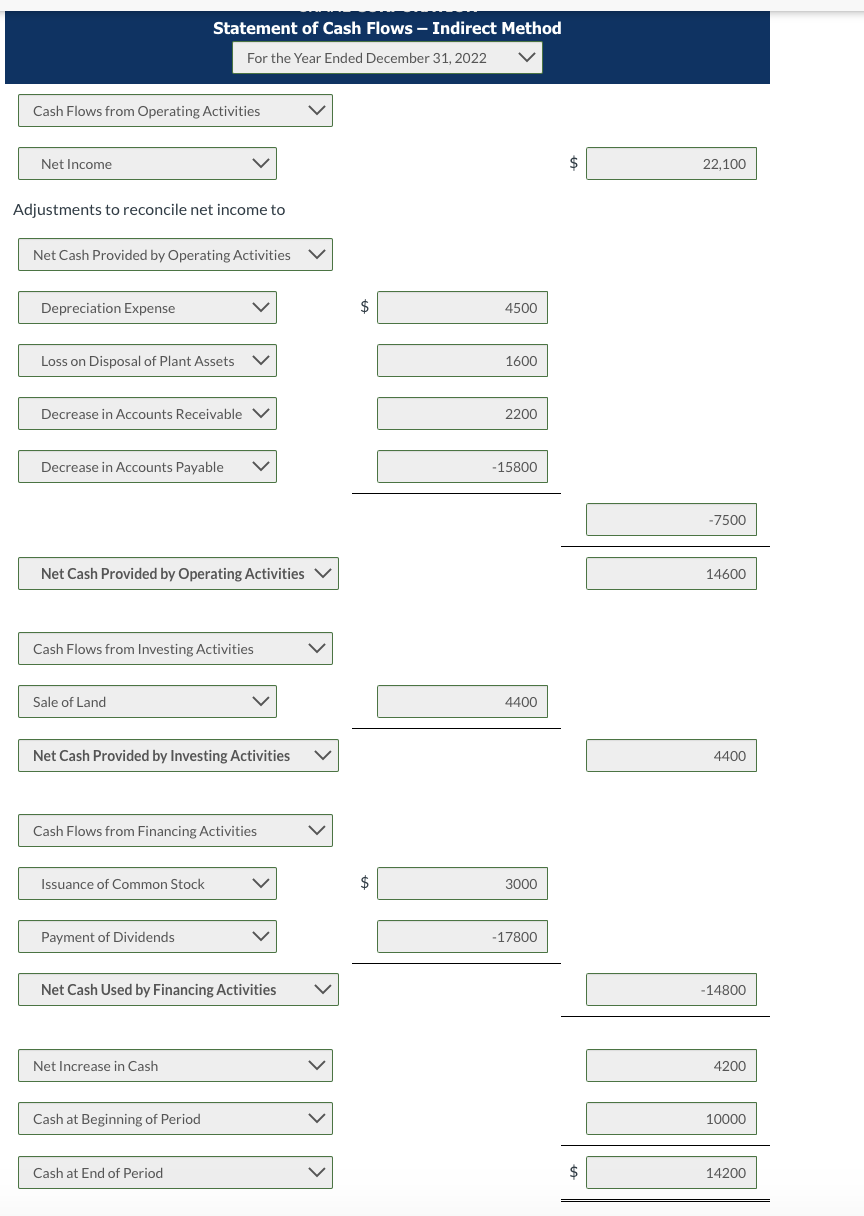

The following three accounts appear in the general ledger of Sheffield Corp. during 2022. Equipment Date Debit Credit Balance Jan. 1 Balance 161,400 July 31 Purchase of equipment 68,000 229,400 Sept. 2 Purchase of equipment 54,600 284,000 Nov. 10 Cost of equipment sold 48,000 236,000 Accumulated Depreciation Equipment Date Debit Credit Balance Jan. 1 Balance 70,300 Nov. 10 Accumulated depreciation on equipment sold 16,500 53,800 Dec. 31 Depreciation for year 23,500 77,300 Retained Earnings Date Debit Credit Balance Jan. 1 Balance 104,400 Aug. 23 Dividends (cash) 16,300 88,100 Dec. 31 Net income 67,900 156,000 From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The loss on disposal of plant assets was $8,200. (Show amounts that decrease cash flow with either a-signe.g.-15,000 or in parenthesis eg. (15,000).) From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The loss on disposal of plant assets was $8,200. (Show amounts that decrease cash flow with either a - signe.g. -15,000 or in parenthesis e.g. (15,000).) SHEFFIELD CORP Statement of Cash Flows (Partial) - Indirect Method For the Year Ended December 31, 2022 Cash Flows from Operating Activities Net Income $ 67900 Adjustments to reconcile net income to Net Cash Provided by Operating Activities V Depreciation Expense $ 23500 Loss on Disposal of Plant Assets 8200 31700 Net Cash Provided by Operating Activities V 99,600 Cash Flows from Investing Activities Purchase of Equipment V -122600 Sale of Equipment Net Cash Used by Investing Activities Cash Flows from Financing Activities Payment of Cash Dividends -16300 Net Cash Used by Financing Activities - 16300 Crane Corporation's comparative balance sheets are presented below. CRANE CORPORATION Comparative Balance Sheets December 31 2022 2021 Cash $14,200 $10,000 Accounts receivable 20,700 22,900 Land 19,500 25,500 Buildings 69,500 69,500 Accumulated depreciation-buildings (14,500) (10,000) Total $109,400 $117,900 Accounts payable $11,800 $27,600 Common stock 74,000 71,000 Retained earnings 23,600 19,300 Total $ 109,400 $117,900 Additional information: 1. Net income was $22,100. Dividends declared and paid were $17,800. No noncash investing and financing activities occurred during 2022. 2. 3. The land was sold for cash of $4,400. Statement of Cash Flows - Indirect Method For the Year Ended December 31, 2022 Cash Flows from Operating Activities Net Income $ 22,100 Adjustments to reconcile net income to Net Cash Provided by Operating Activities V Depreciation Expense $ 4500 Loss on Disposal of Plant Assets 1600 Decrease in Accounts Receivable V 2200 Decrease in Accounts Payable - 15800 -7500 Net Cash Provided by Operating Activities V 14600 Cash Flows from Investing Activities Sale of Land 4400 Net Cash Provided by Investing Activities 4400 Cash Flows from Financing Activities Issuance of Common Stock $ 3000 Payment of Dividends V - 17800 Net Cash Used by Financing Activities -14800 Net Increase in Cash 4200 Cash at Beginning of Period 10000 Cash at End of Period $ 14200 (b) Compute free cash flow. (Enter negative amount using either a negative sign preceding the number eg.-45 or parentheses eg. (45).) Free cash flow $ e Textbook and Media