Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with this 8. Imagine that all you have for your dependents in the event of your death is $50,000 from a group life

need help with this

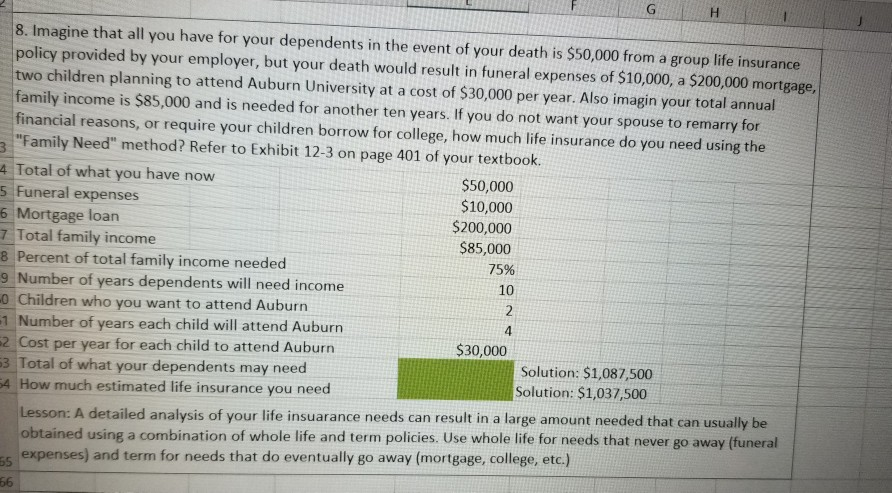

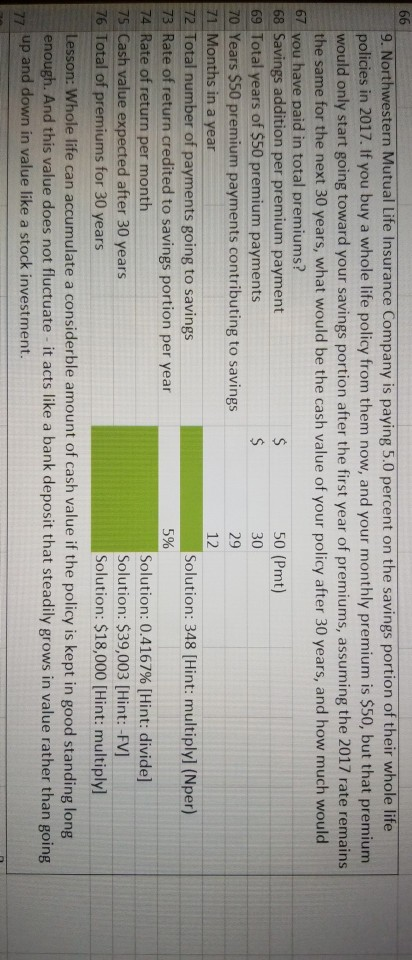

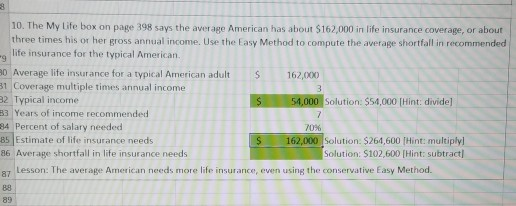

8. Imagine that all you have for your dependents in the event of your death is $50,000 from a group life insurance policy provided by your employer, but your death would result in funeral expenses of $10,000, a $200,000 mortgage, two children planning to attend Auburn University at a cost of $30,000 per year. Also imagin your total annual family income is $85,000 and is needed for another ten years. If you do not want your spouse to remarry for financial reasons, or require your children borrow for college, how much life insurance do you need using the "Family Need" method? Refer to Exhibit 12-3 on page 401 of your textbook. 4 Total of what you have now 5 Funeral expenses $50,000 6 Mortgage loan $10,000 $200,000 7 Total family income $85,000 8 Percent of total family income needed 75% 9 Number of years dependents will need income . Children who you want to attend Auburn -1 Number of years each child will attend Auburn 2 Cost per year for each child to attend Auburn $30,000 63 Total of what your dependents may need Solution: $1,087,500 54 How much estimated life insurance you need Solution: $1,037,500 Lesson: A detailed analysis of your life insuarance needs can result in a large amount needed that can usually be obtained using a combination of whole life and term policies. Use whole life for needs that never go away (funeral expenses) and term for needs that do eventually go away (mortgage, college, etc.) 29 9. Northwestern Mutual Life Insurance Company is paying 5.0 percent on the savings portion of their whole life policies in 2017. If you buy a whole life policy from them now, and your monthly premium is $50, but that premium would only start going toward your savings portion after the first year of premiums, assuming the 2017 rate remains the same for the next 30 years, what would be the cash value of your policy after 30 years, and how much would 67 you have paid in total premiums? 68 Savings addition per premium payment 50 (Pmt) 69 Total years of $50 premium payments 30 70 Years $50 premium payments contributing to savings 71 Months in a year 12 72 Total number of payments going to savings Solution: 348 (Hint: multiplyl (Nper) 73 Rate of return credited to savings portion per year 5% 74 Rate of return per month Solution: 0.4167% [Hint: divide) 75 Cash value expected after 30 years Solution: $39,003 (Hint: -FV] 76 Total of premiums for 30 years Solution: $18,000 [Hint: multiply] Lesson: Whole life can accumulate a considerble amount of cash value if the policy is kept in good standing long enough. And this value does not fluctuate - it acts like a bank deposit that steadily grows in value rather than going 77 up and down in value like a stock investment. 10. The My Life box on page 398 says the average American has about $162,000 in life insurance coverage, or about three times his or her gross annual income. Use the Easy Method to compute the average shortfall in recommended - life insurance for the typical American 80 Average life insurance for a typical American adult S 1 62,000 31 Coverage multiple times annual income 32 Typical income $ 54,000 Solution: $54,000 (Hint: dividel 3 Years of income recommended 14 Percent of salary needed 35 Estimate of life insurance needs $ 162,000 Solution: $261,600 (Hint: multiply] 36 Average shortfall in life insurance needs Solution: S102,600 (Hint: subtract] 37 Lesson: The average American needs more life insurance, even using the conservative Easy MethodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started