Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with this question. Answer is C. Not sure how to get to that! Seasons Construction is constructing uses the percentage-of-completion method. The contract

Need help with this question. Answer is C. Not sure how to get to that!

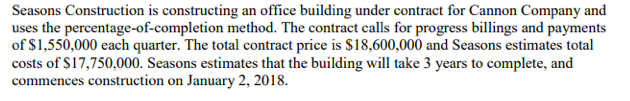

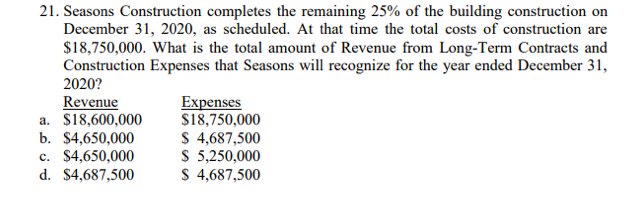

Seasons Construction is constructing uses the percentage-of-completion method. The contract calls for progress billings and payments of $1,550,000 each quarter. The total contract price is $18,600,000 and Seasons estimates total costs of S17,750,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2018 an office building under contract for Cannon Company and 21. Seasons Construction completes the remaining 25% of the building construction on December 31, 2020, as scheduled. At that time the total costs of construction are $18,750,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the year ended December 31 2020? Revenue a. $18,600,000 b. $4,650,000 $4,650,000 d. $4,687,500 Expenses $18,750,000 S 4,687,500 S 5,250,000 S 4,687,500 C. Seasons Construction is constructing uses the percentage-of-completion method. The contract calls for progress billings and payments of $1,550,000 each quarter. The total contract price is $18,600,000 and Seasons estimates total costs of S17,750,000. Seasons estimates that the building will take 3 years to complete, and commences construction on January 2, 2018 an office building under contract for Cannon Company and 21. Seasons Construction completes the remaining 25% of the building construction on December 31, 2020, as scheduled. At that time the total costs of construction are $18,750,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that Seasons will recognize for the year ended December 31 2020? Revenue a. $18,600,000 b. $4,650,000 $4,650,000 d. $4,687,500 Expenses $18,750,000 S 4,687,500 S 5,250,000 S 4,687,500 CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started