Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help with This Question take your time I will surely appreciate your effort. I have answers to parts a, b, c solve remaing As

Need Help with This Question take your time I will surely appreciate your effort.

I have answers to parts a, b, c solve remaing

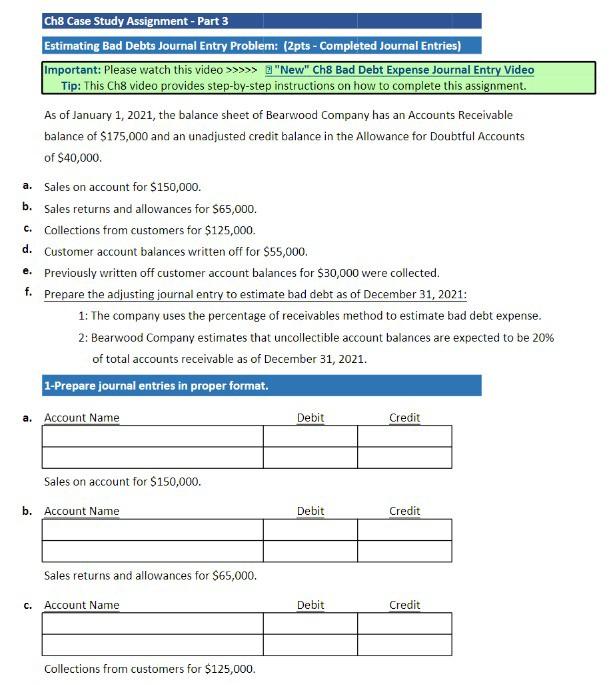

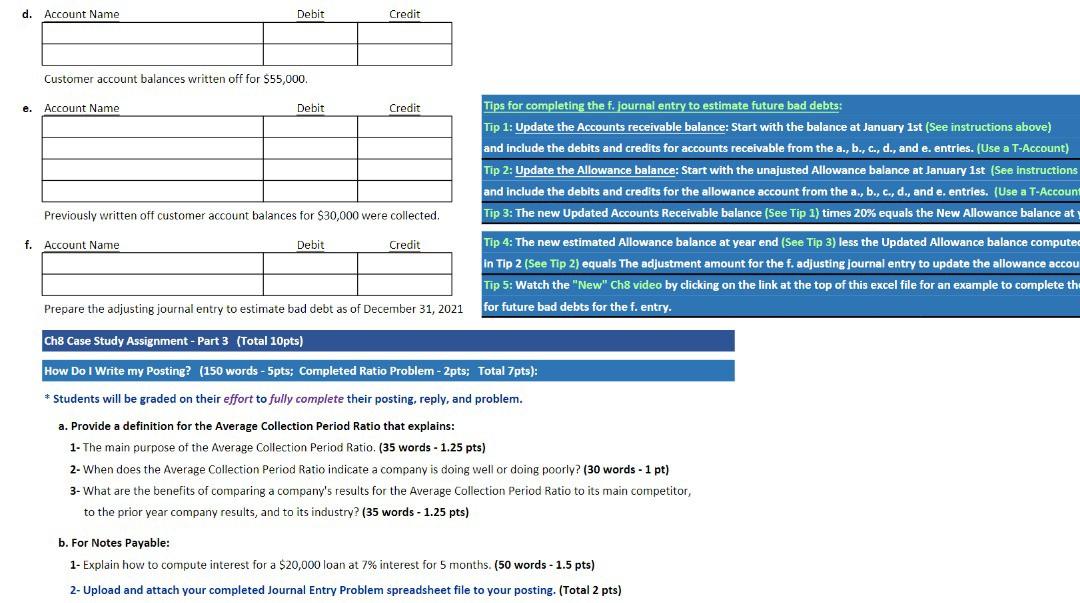

As of January 1, 2021, the balance sheet of Bearwood Company has an Accounts Receivable balance of $175,000 and an unadjusted credit balance in the Allowance for Doubtful Accounts of $40,000. a. Sales on account for $150,000. b. Sales returns and allowances for $65,000. c. Collections from customers for $125,000. d. Customer account balances written off for $55,000. e. Previously written off customer account balances for $30,000 were collected. f. Prepare the adjusting journal entry to estimate bad debt as of December 31, 2021: 1: The company uses the percentage of receivables method to estimate bad debt expense. 2: Bearwood Company estimates that uncollectible account balances are expected to be 20% of total accounts receivable as of December 31, 2021. 1-Prepare journal entries in proper format. a. Sales on account for $150,000. b. Sales returns and allowances for $65,000. c. Collections from customers for $125,000. Customer account balances written off for $55,000. e. Previously written off customer account balances for $30,000 were collected. f. Prepare the adjusting journal entry to estimate bad debt as of December 31, 2021 Ch8 Case Study Assignment - Part 3 (Total 10pts) How Do I Write my Posting? (150 words - 5pts; Completed Ratio Problem - 2pts; Total 7pts): * Students will be graded on their effort to fully complete their posting, reply, and problem. a. Provide a definition for the Average Collection Period Ratio that explains: 1- The main purpose of the Average Collection Period Ratio. (35 words 1.25 pts) 2- When does the Average Collection Period Ratio indicate a company is doing well or doing poorly? ( 30 words - 1pt ) 3- What are the benefits of comparing a company's results for the Average Collection Period Ratio to its main competitor, to the prior year company results, and to its industry? (35 words 1.25 pts) b. For Notes Payable: 1- Explain how to compute interest for a $20,000 loan at 7% interest for 5 months. ( 50 words 1.5 pts) 2- Upload and attach your completed Journal Entry Problem spreadsheet file to your posting. (Total 2 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started