need help with those! thanks you

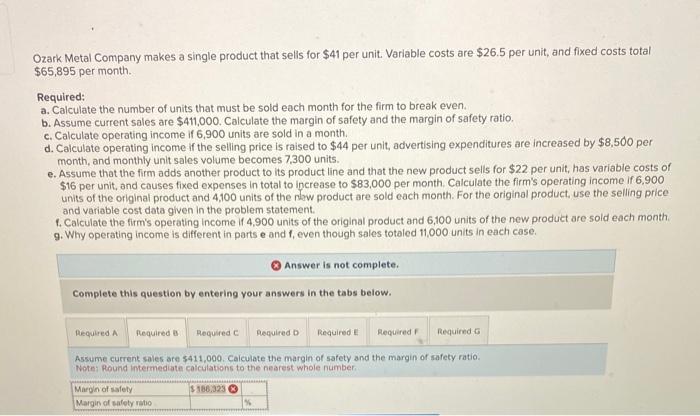

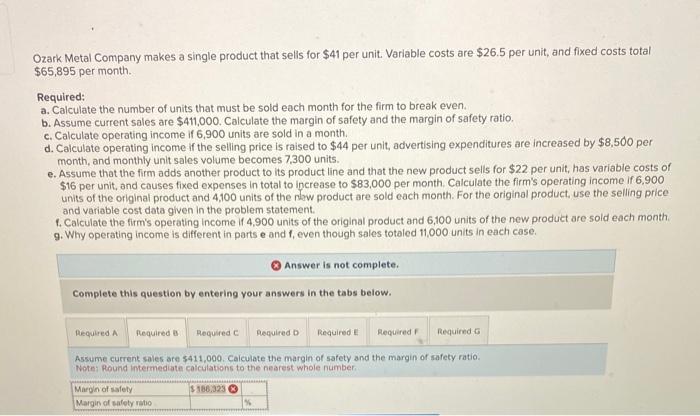

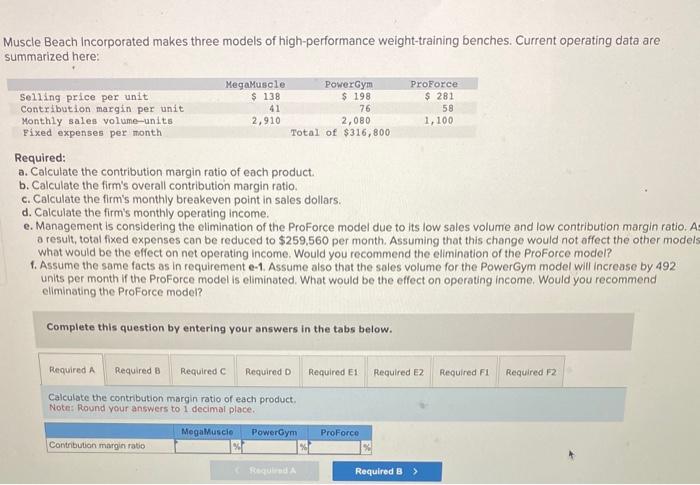

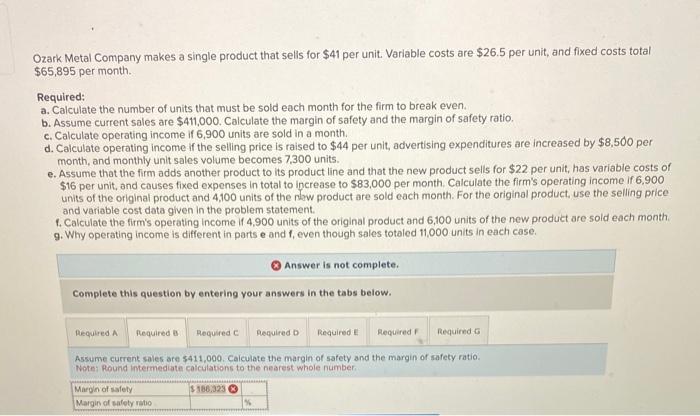

Ozark Metal Company makes a single product that sells for $41 per unit. Variable costs are $26.5 per unit, and fixed costs total $65,895 per month. Required: a. Calculate the number of units that must be sold each month for the firm to break even. b. Assume current sales are $411,000. Calculate the margin of safety and the margin of safety ratio. c. Calculate operating income if 6,900 units are sold in a month. d. Calculate operating income if the selling price is raised to $44 per unit, advertising expenditures are increased by $8,500 per month, and monthly unit sales volume becomes 7,300 units. e. Assume that the firm adds another product to its product line and that the new product sells for $22 per unit, has variable costs of $16 per unit, and causes fixed expenses in total to increase to $83,000 per month. Calculate the firm's operating income if 6,900 units of the original product and 4,100 units of the new product are sold each month. For the original product, use the selling price and variable cost data given in the problem statement. f. Calculate the firm's operating income if 4,900 units of the original product and 6,100 units of the new product are soid each month. 9. Why operating income is different in parts e and f, even though sales totaled 11,000 units in each case. Answer is not complete. Complete this question by entering your answers in the tabs below. Assume current sales are $411,000. Calculate the margin of safety and the margin of safety ratio. Notes Poond intermediate calculations to the nearest whole number. Muscle Beach Incorporated makes three models of high-performance weight-training benches. Current operating data are summarized here: Required: a. Calculate the contribution margin ratio of each product. b. Calculate the firm's overall contribution margin ratio. c. Calculate the firm's monthly breakeven point in sales dollars. d. Calculate the firm's monthly operating income. e. Management is considering the elimination of the Proforce model due to its low sales volume and low contribution margin ratio. a result, total fixed expenses can be reduced to $259,560 per month. Assuming that this change would not affect the other model what would be the effect on net operating income. Would you recommend the elimination of the Proforce mociel? f. Assume the same facts as in requirement e-1. Assume also that the sales volume for the PowerGym model will increase by 492 units per month if the ProForce model is eliminated. What would be the effect on operating income. Would you recommend eliminating the ProForce model? Complete this question by entering your answers in the tabs below. Calculate the contribution margin ratio of each product. Notes Pround your answers to 1 decimal place