Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need last two questions b and c for part 11. Need question b from part 1. Part 1 Maple Company had the following export and

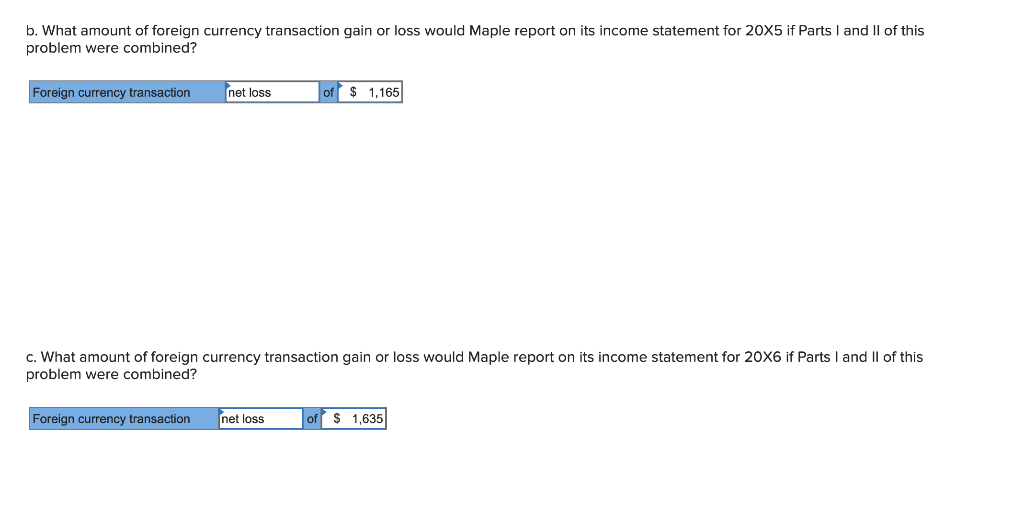

Need last two questions b and c for part 11.

Need question b from part 1.

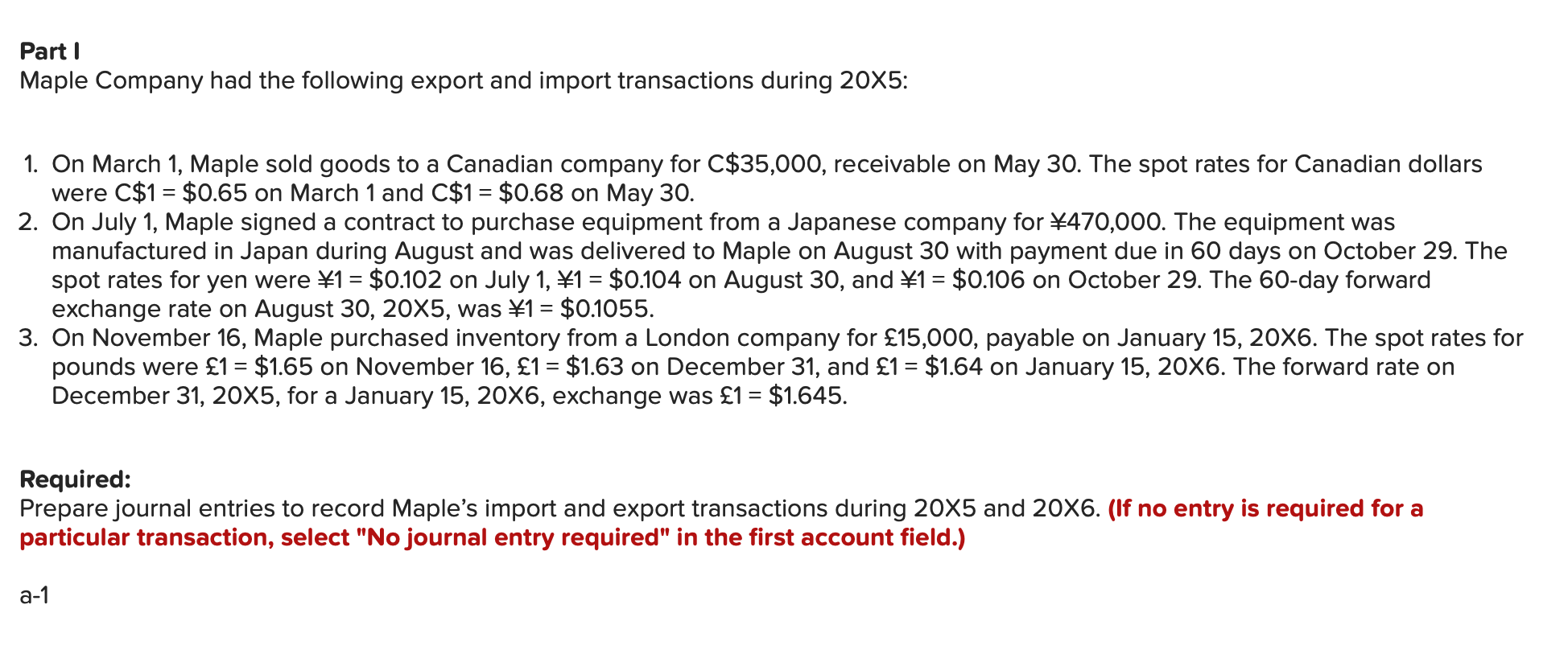

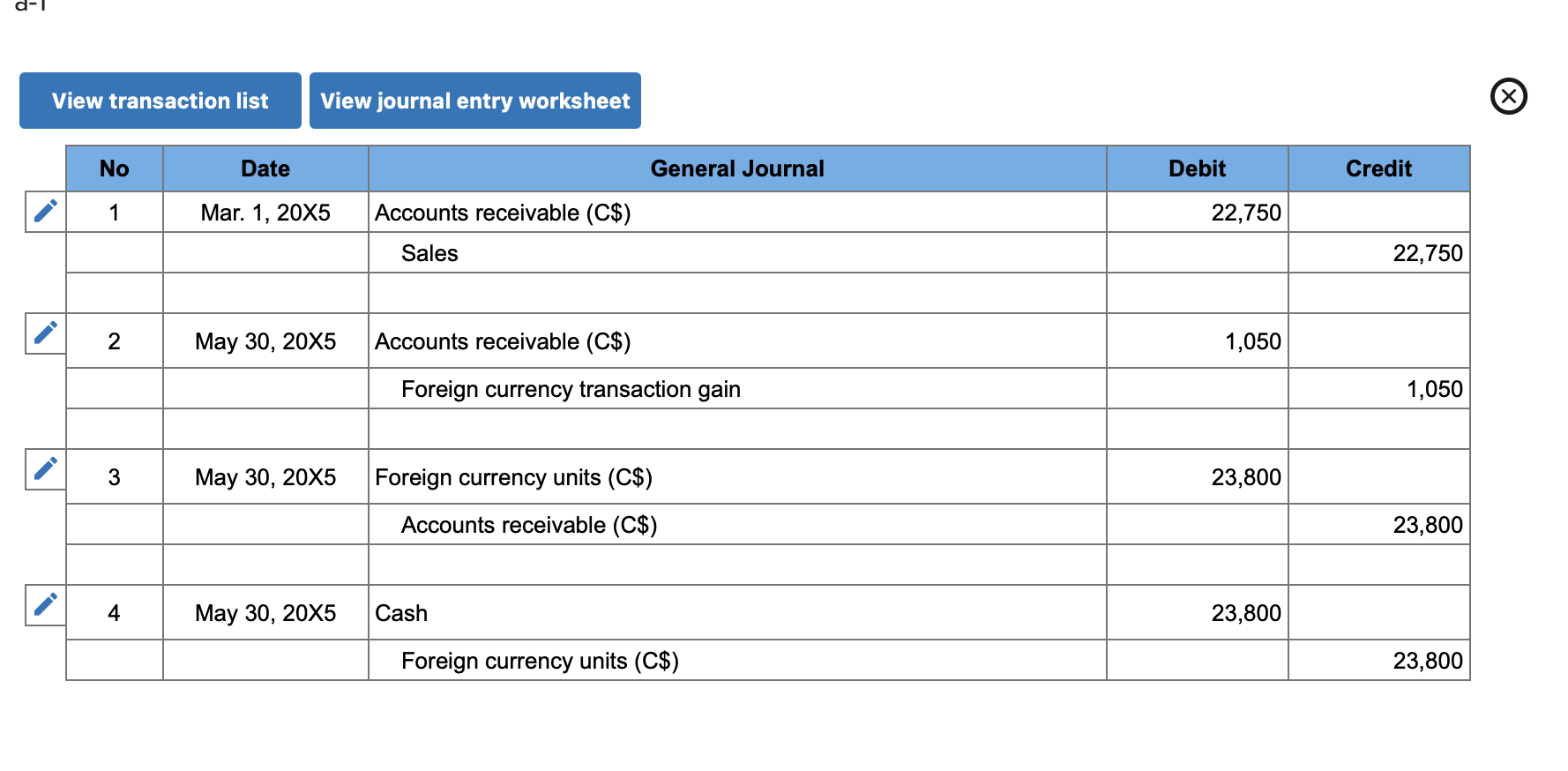

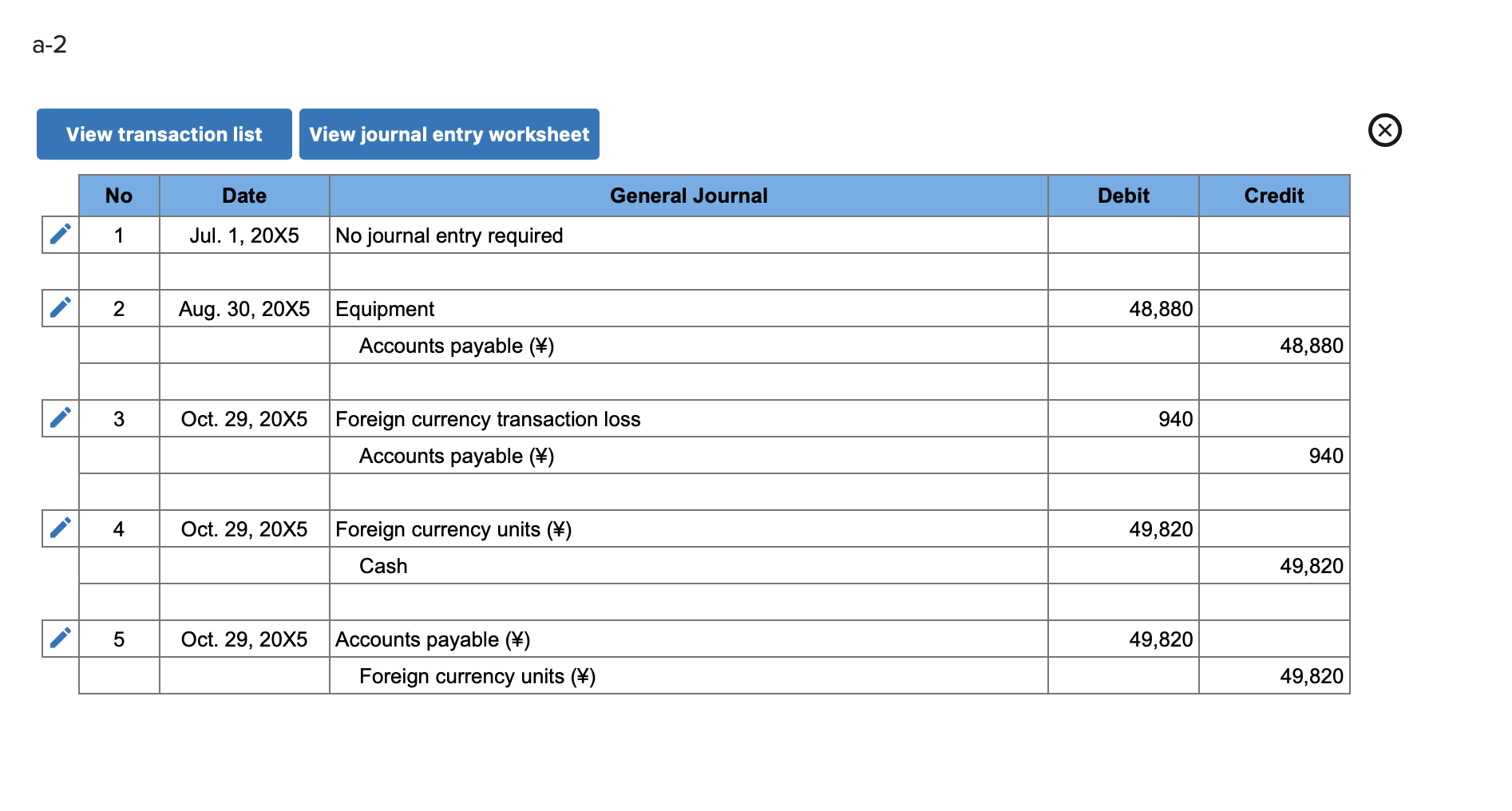

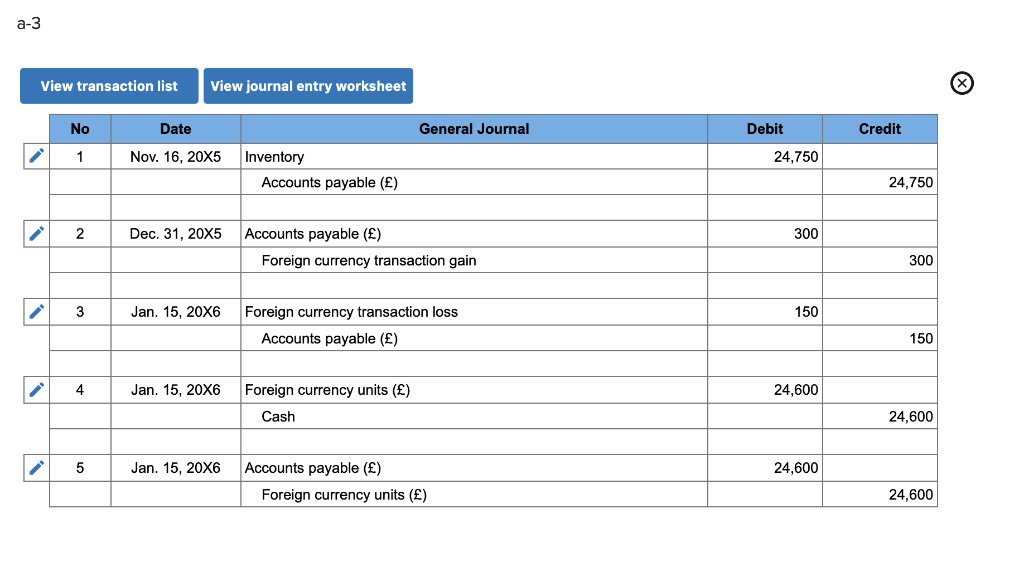

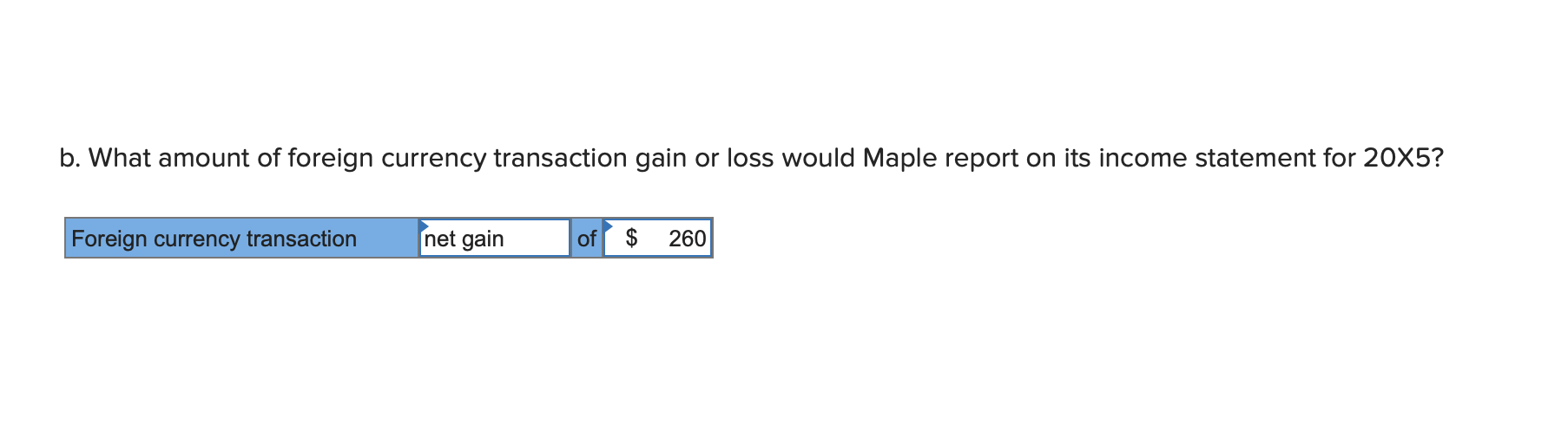

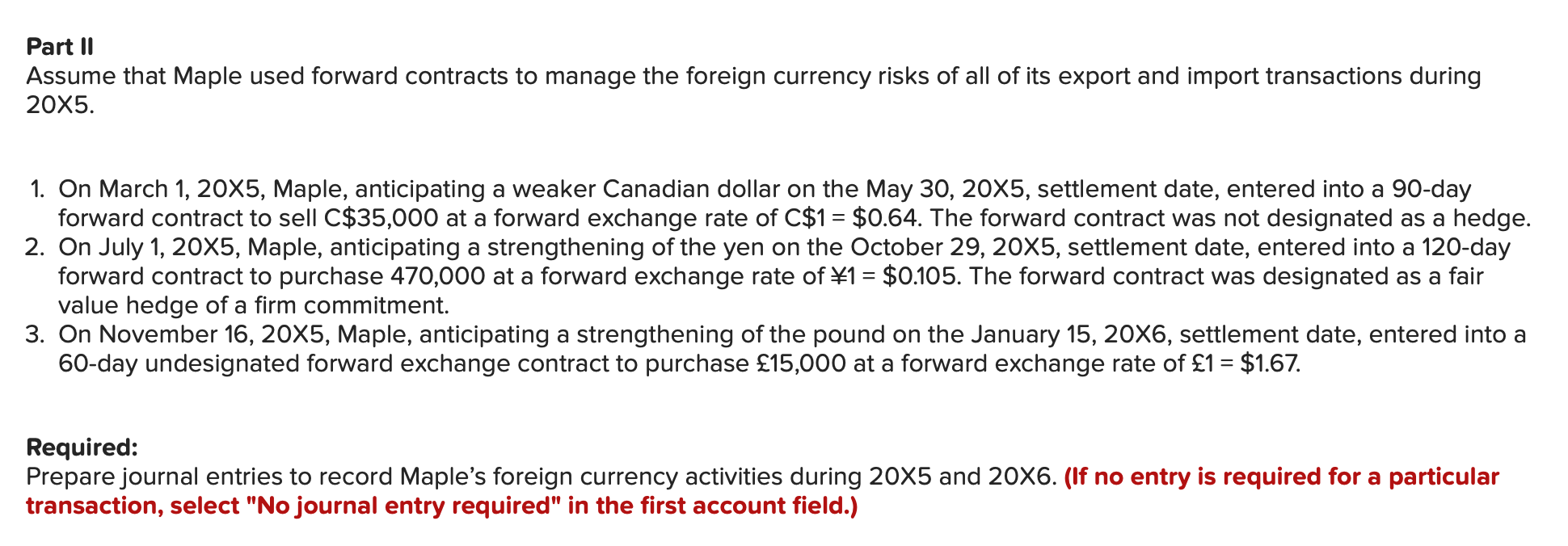

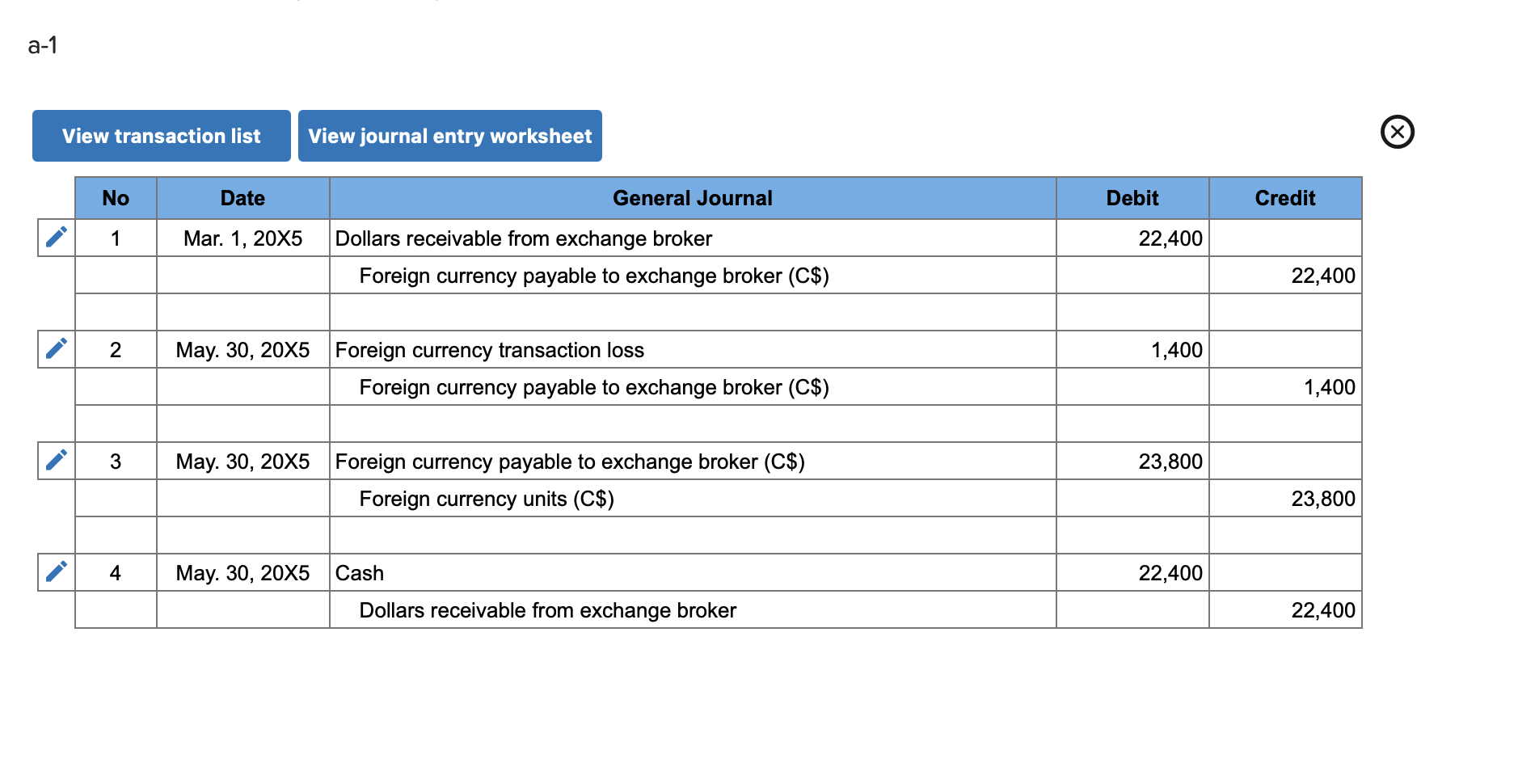

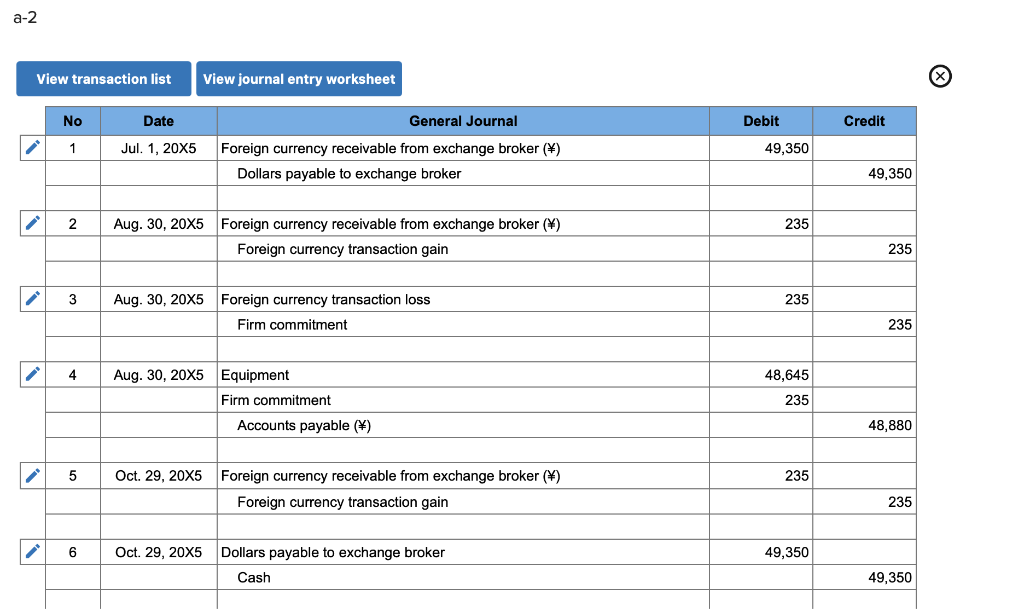

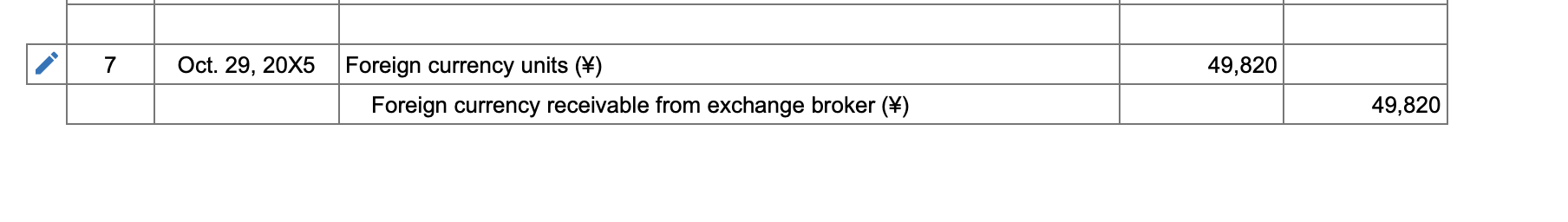

Part 1 Maple Company had the following export and import transactions during 20X5: = 1. On March 1, Maple sold goods to a Canadian company for C$35,000, receivable on May 30. The spot rates for Canadian dollars were C$1 = $0.65 on March 1 and C$1 = $0.68 on May 30. 2. On July 1, Maple signed a contract to purchase equipment from a Japanese company for #470,000. The equipment was manufactured in Japan during August and was delivered to Maple on August 30 with payment due in 60 days on October 29. The spot rates for yen were #1 = $0.102 on July 1, #1 = $0.104 on August 30, and \1 = $0.106 on October 29. The 60-day forward exchange rate on August 30, 20X5, was #1 = $0.1055. 3. On November 16, Maple purchased inventory from a London company for 15,000, payable on January 15, 20X6. The spot rates for pounds were 1 = $1.65 on November 16, 1 = $1.63 on December 31, and 1 = $1.64 on January 15, 20X6. The forward rate on December 31, 20X5, for a January 15, 20X6, exchange was 1 = $1.645. = - = = = Required: Prepare journal entries to record Maple's import and export transactions during 20X5 and 20X6. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) a-1 d- View transaction list View journal entry worksheet X No Date General Journal Debit Credit 1 Mar. 1, 20X5 Accounts receivable (C$) 22,750 Sales 22,750 2 May 30, 20X5 Accounts receivable (C$) 1,050 Foreign currency transaction gain 1,050 3 May 30, 20X5 Foreign currency units (C$) 23,800 Accounts receivable (C$) 23,800 4 May 30, 20X5 Cash 23,800 Foreign currency units (C$) 23,800 a-2 View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Jul. 1, 20X5 No journal entry required 2 48,880 Aug. 30, 20X5 Equipment Accounts payable () 48,880 3 Oct. 29, 20X5 940 Foreign currency transaction loss Accounts payable () 940 4 Oct. 29, 20X5 49,820 Foreign currency units () Cash 49,820 5 Oct. 29, 20X5 49,820 Accounts payable () Foreign currency units () 49,820 a-3 View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Nov. 16, 20X5 24,750 Inventory Accounts payable () 24,750 2 Dec. 31, 20X5 300 Accounts payable () Foreign currency transaction gain 300 3 3 Jan. 15, 20X6 150 Foreign currency transaction loss Accounts payable () 150 4 Jan. 15, 20X6 24,600 Foreign currency units () Cash 24,600 5 Jan. 15, 20X6 24,600 Accounts payable () Foreign currency units () 24,600 b. What amount of foreign currency transaction gain or loss would Maple report on its income statement for 20X5? Foreign currency transaction net gain of $ 260 Part II Assume that Maple used forward contracts to manage the foreign currency risks of all of its export and import transactions during 20X5. 1. On March 1, 20X5, Maple, anticipating a weaker Canadian dollar on the May 30, 20X5, settlement date, entered into a 90-day forward contract to sell C$35,000 at a forward exchange rate of C$1 = $0.64. The forward contract was not designated as a hedge. 2. On July 1, 20X5, Maple, anticipating a strengthening of the yen on the October 29, 20X5, settlement date, entered into a 120-day forward contract to purchase 470,000 at a forward exchange rate of 1 = $0.105. The forward contract was designated as a fair value hedge of a firm commitment. 3. On November 16, 20X5, Maple, anticipating a strengthening of the pound on the January 15, 20X6, settlement date, entered into a 60-day undesignated forward exchange contract to purchase 15,000 at a forward exchange rate of 1 = $1.67. = - Required: Prepare journal entries to record Maple's foreign currency activities during 2005 and 20X6. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) a-1 View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Mar. 1, 20X5 22,400 Dollars receivable from exchange broker Foreign currency payable to exchange broker (C$) 22,400 2 1,400 May 30, 20X5 Foreign currency transaction loss Foreign currency payable to exchange broker (C$) 1,400 3 23,800 May 30, 20X5 Foreign currency payable to exchange broker (C$) Foreign currency units (C$) 23,800 4 May. 30, 20X5 Cash 22,400 Dollars receivable from exchange broker 22,400 a-2 View transaction list View journal entry worksheet No Date Debit Credit 1 Jul. 1, 20X5 General Journal Foreign currency receivable from exchange broker (4) Dollars payable to exchange broker 49,350 49.350 2 235 Aug. 30, 20X5 Foreign currency receivable from exchange broker (V) Foreign currency transaction gain 235 3 235 Aug. 30, 20X5 Foreign currency transaction loss Firm commitment 235 4 Aug. 30, 20X5 Equipment Firm commitment Accounts payable () 48,645 235 48,880 5 Oct. 29, 20X5 235 Foreign currency receivable from exchange broker () Foreign currency transaction gain 235 6 Oct. 29, 20X5 49,350 Dollars payable to exchange broker Cash 49,350 7 49,820 Oct. 29, 20X5 Foreign currency units () Foreign currency receivable from exchange broker () 49,820 b. What amount of foreign currency transaction gain or loss would Maple report on its income statement for 20x5 if Parts I and Il of this problem were combined? Foreign currency transaction net loss of $ 1,165 c. What amount of foreign currency transaction gain or loss would Maple report on its income statement for 20x6 if Parts I and II of this problem were combined? Foreign currency transaction net loss of $ 1,635Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started