Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need right of my question thank you Illustration 7 Calculation of Interest on Drawings made uniformly at the end of each quarter. On January 1,

need right of my question thank you

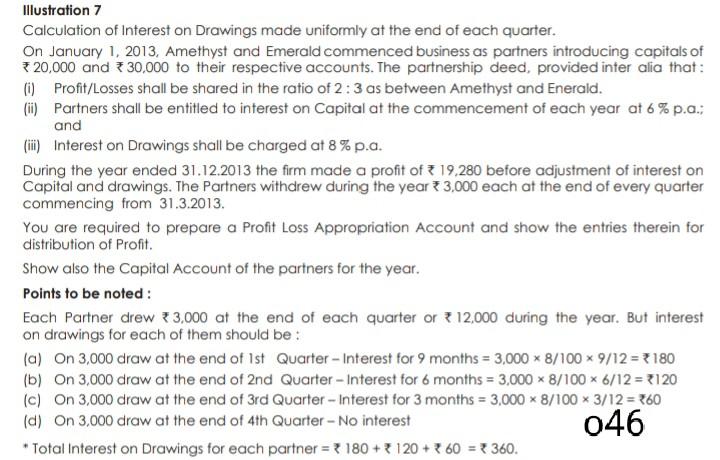

Illustration 7 Calculation of Interest on Drawings made uniformly at the end of each quarter. On January 1, 2013. Amethyst and Emerald commenced business as partners introducing capitals of *20,000 and 30,000 to their respective accounts. The partnership deed, provided inter alia that: (0) Profit/Losses shall be shared in the ratio of 2:3 as between Amethyst and Enerald. (ii) Partners shall be entitled to interest on Capital at the commencement of each year at 6% p.a.; and (ii) Interest on Drawings shall be charged at 8% p.a. During the year ended 31.12.2013 the firm made a profit of 3 19,280 before adjustment of interest on Capital and drawings. The Partners withdrew during the year 3,000 each at the end of every quarter commencing from 31.3.2013. You are required to prepare a Profit Loss Appropriation Account and show the entries therein for distribution of Profit Show also the Capital Account of the partners for the year. Points to be noted: Each Partner drew 3,000 at the end of each quarter or 12,000 during the year. But interest on drawings for each of them should be: la) on 3,000 draw at the end of 1st Quarter - Interest for 9 months = 3,000 * 8/100 9/12 = 180 (b) on 3,000 draw at the end of 2nd Quarter - Interest for 6 months = 3,000 * 8/100 * 6/12 = 3120 (c) On 3,000 draw at the end of 3rd Quarter - Interest for 3 months = 3,000 * 8/100 * 3/12 = 360 (d) On 3,000 draw at the end of 4th Quarter - No interest 046 * Total Interest on Drawings for each partner = ? 180 + + 120 + 360 = 360Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started