Need solution As soon as possible. Thank you

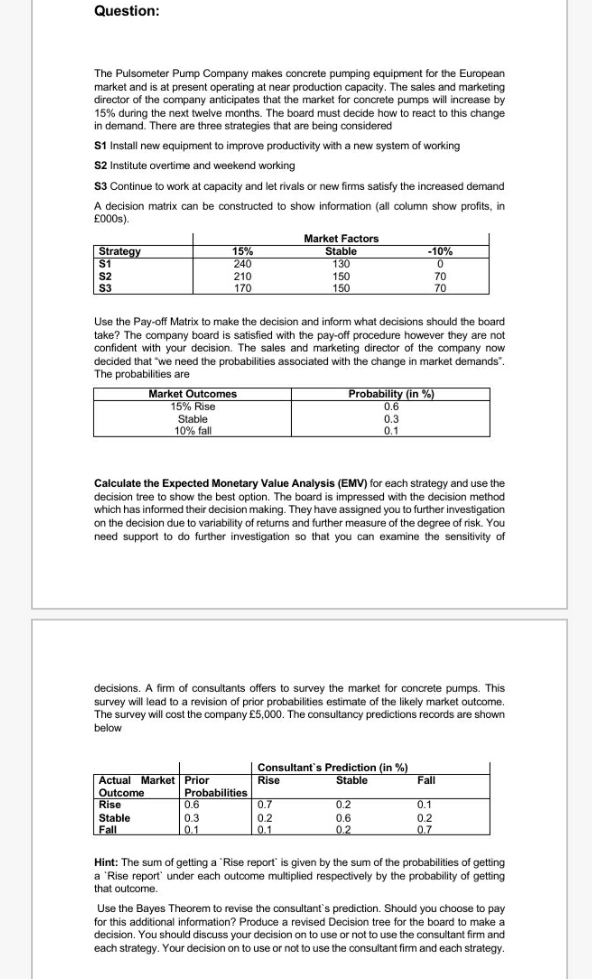

Question: The Pulsometer Pump Company makes concrete pumping equipment for the European market and is at present operating at near production capacity. The sales and marketing director of the company anticipates that the market for concrete pumps will increase by 15% during the next twelve months. The board must decide how to react to this change in demand. There are three strategies that are being considered S1 Install new equipment to improve productivity with a new system of working $2 Institute overtime and weekend working $3 Continue to work at capacity and let rivals or new firms satisfy the increased demand A decision matrix can be constructed to show information (all column show profits, in 6000s). Market Factors Strategy 15% Stable -10% $1 240 130 0 $2 210 150 70 $3 170 150 70 Use the Pay-off Matrix to make the decision and inform what decisions should the board take? The company board is satisfied with the pay-off procedure however they are not confident with your decision. The sales and marketing director of the company now decided that "we need the probabilities associated with the change in market demands". The probabilities are Market Outcomes Probability (in %) 15% Rise 0.6 Stable 0.3 10% fall 0.1 Calculate the Expected Monetary Value Analysis (EMV) for each strategy and use the decision tree to show the best option. The board is impressed with the decision method which has informed their decision making. They have assigned you to further investigation on the decision due to variability of returns and further measure of the degree of risk. You need support to do further investigation so that you can examine the sensitivity of decisions. A firm of consultants offers to survey the market for concrete pumps. This survey will lead to a revision of prior probabilities estimate of the likely market outcome. The survey will cost the company $5,000. The consultancy predictions records are shown below Consultant's Prediction (in %) Actual Market Prior Rise Stable Fall Outcome Probabilities Rise 0.6 0.7 0.2 0.1 Stable 0.3 0.2 0.6 0.2 Fall 0.1 0.1 0.2 0.7 Hint: The sum of getting a "Rise report" is given by the sum of the probabilities of getting a 'Rise report' under each outcome multiplied respectively by the probability of getting that outcome. Use the Bayes Theorem to revise the consultant's prediction. Should you choose to pay for this additional information? Produce a revised Decision tree for the board to make a decision. You should discuss your decision on to use or not to use the consultant firm and each strategy. Your decision on to use or not to use the consultant firm and each strategy