Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need solution to the last 3 questions(ii, iii,iv) please if you are writing the answers on a paper and you scan it after I would

need solution to the last 3 questions(ii, iii,iv) please if you are writing the answers on a paper and you scan it after I would really appreciate it if the handwriting is clear enough to read,give a step by step if possible

if possibleot that necessary but could i have a step by step would really appreciate it, please answer all questions thank you so much

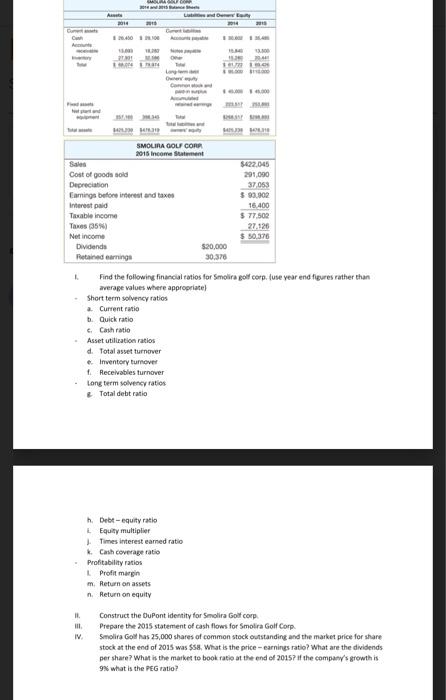

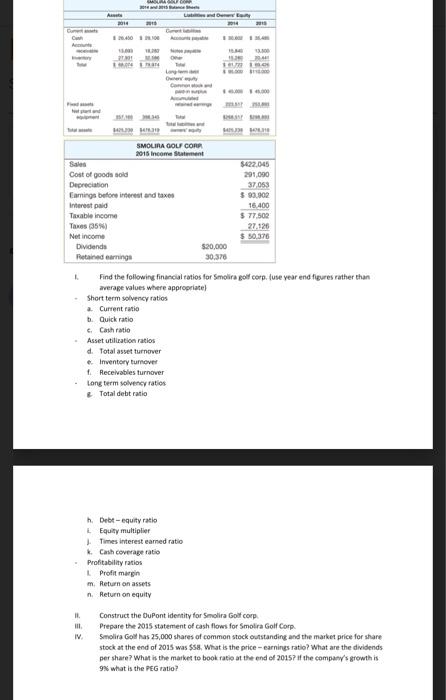

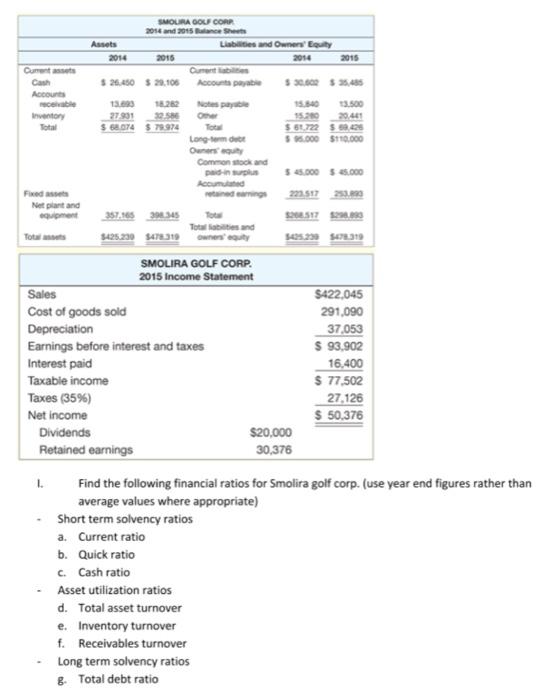

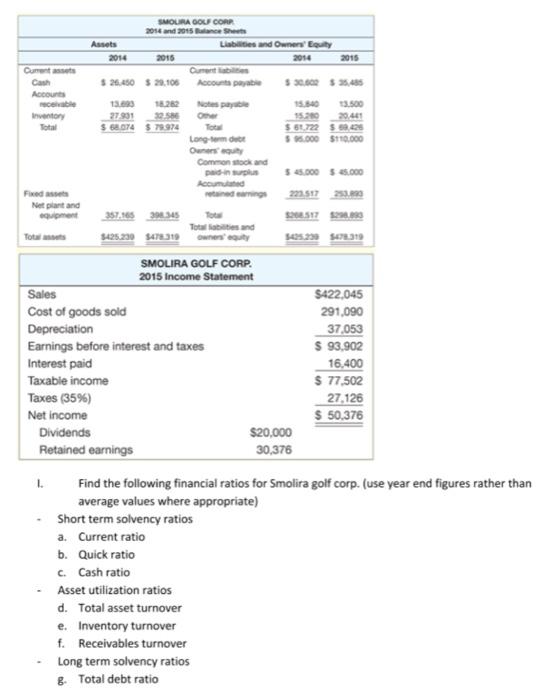

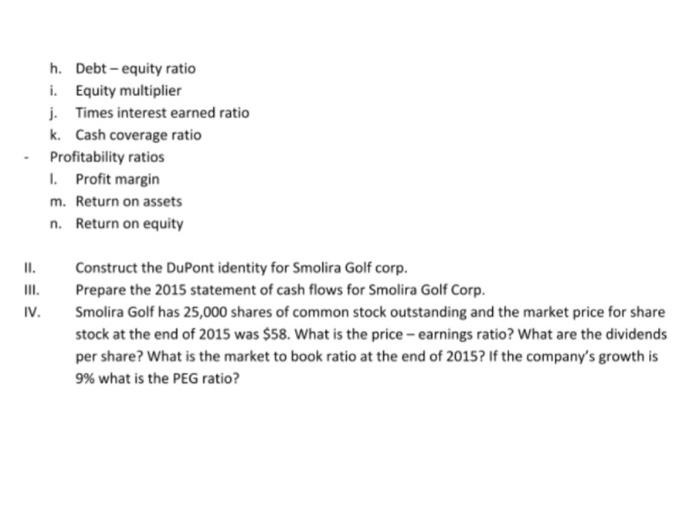

1. Find the following financial tatios for Smolira golf corp. fuse vear end figures rather than average values where appropeiatel - Short term solvency ratios a. Current ratio b. Quick ratio c. Carh ratio - Asset utilieation ratios d. Total asset turnover 6. Inventary turnover f. Receivables turnover - tong term yolvecher ratios 2. Total debt ratio h. Debt-equity ratio i. Equaty multiplier j. Times interest earned ratio k. Cash coverage ratio - Protitability ratios 1. Profit margin m. Return on assets n. Return on equity 11. Construct the DuPont identity for Senolira Golt corp. iii. Prepare the 2015 statement of cash flows for Smolira Golf Corp. W. Serolira Golt has 25,000 shares of common stock outstanding and the market price for share stock at the end of 2015 was $58, What is the price - earnings ratio? What are the dividends per share? What is the market to book ratie at the end of 2015 ? If the compacy's growth is 92 what is the PEG ratio? 1. Find the following financial ratios for Smolira golf corp. (use year end figures rather than average values where appropriate) - Short term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio - Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover - Long term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity II. Construct the DuPont identity for Smolira Golf corp. III. Prepare the 2015 statement of cash flows for Smolira Golf Corp. IV. Smolira Golf has 25,000 shares of common stock outstanding and the market price for share stock at the end of 2015 was $58. What is the price - earnings ratio? What are the dividends per share? What is the market to book ratio at the end of 2015? If the company's growth is 9% what is the PEG ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started