Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need some assistance please. Stoll Company's long-term avallable-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions

need some assistance please.

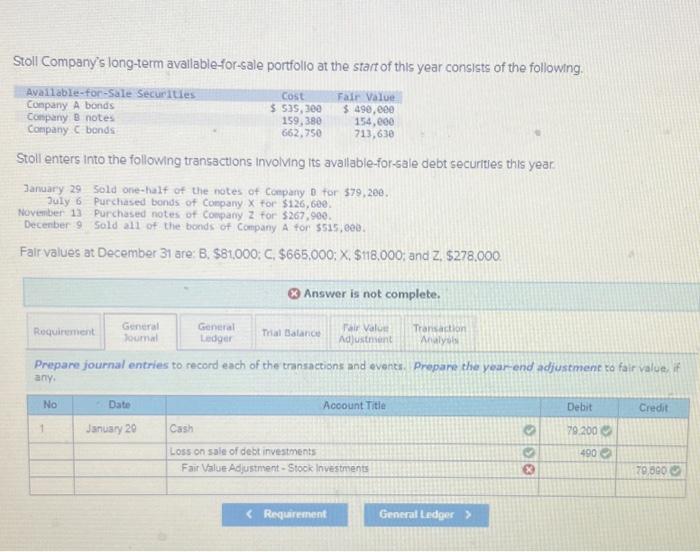

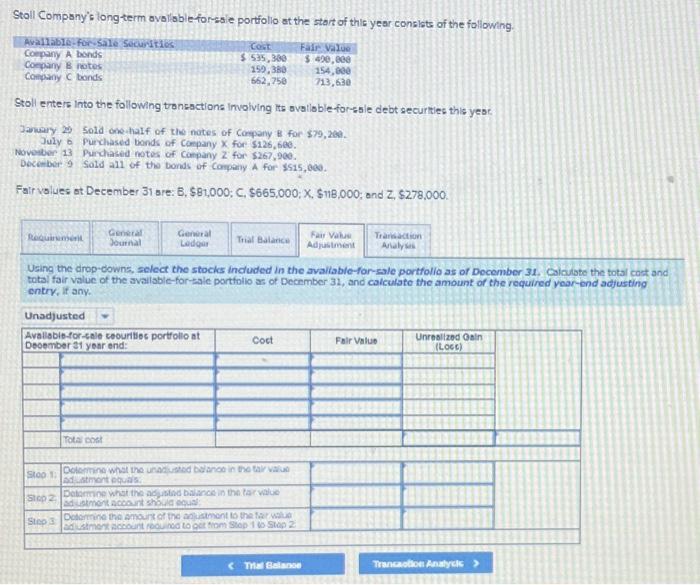

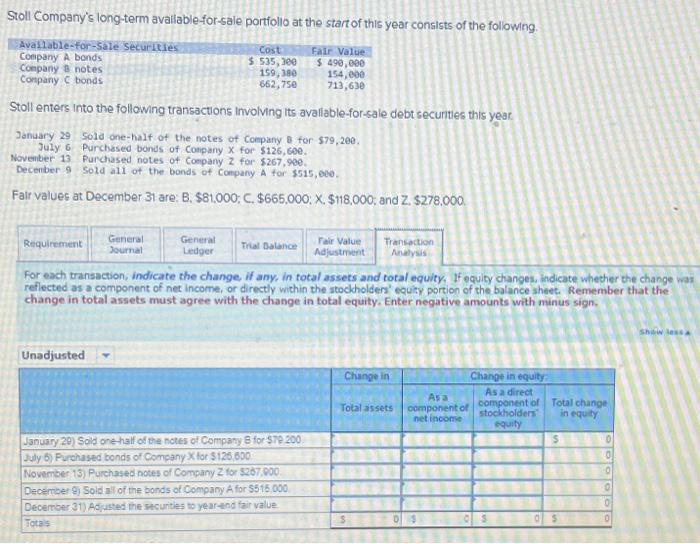

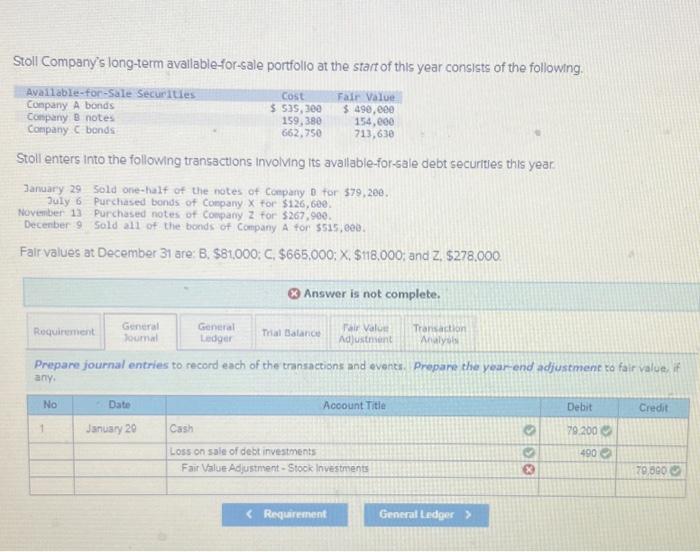

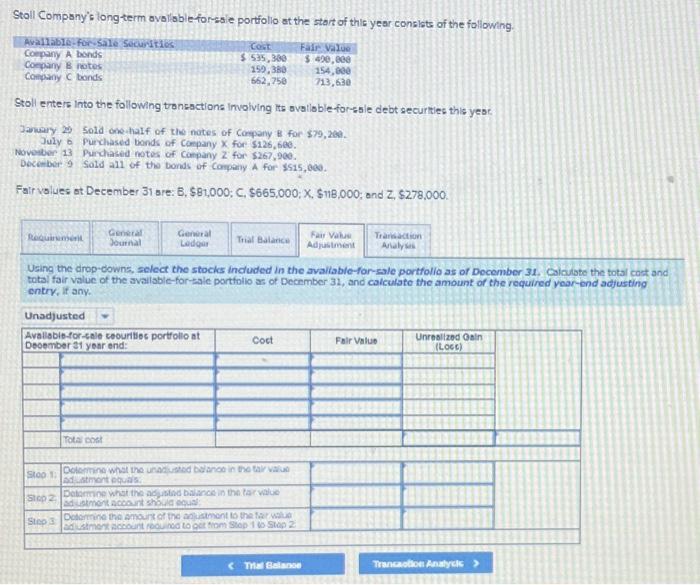

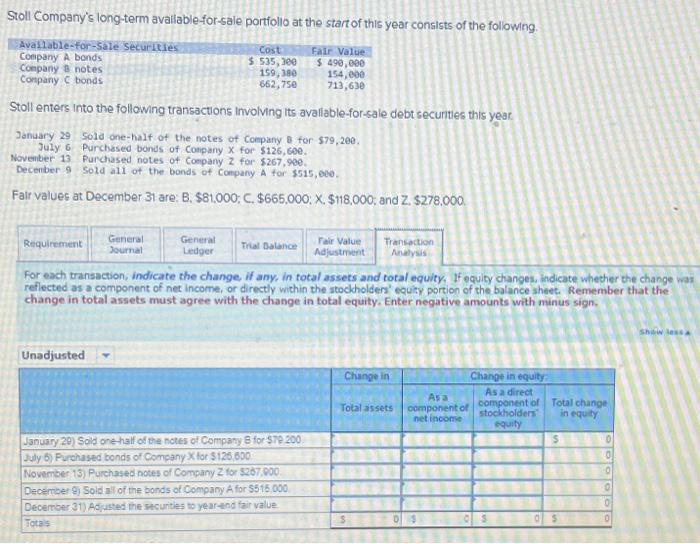

Stoll Company's long-term avallable-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its avallable-for sale debt securitles this year- January 29 Sold one-hulf of the notes of comphy o for $79,260. 3 wy 6 Purchased bonds of Company X for $126,600. November 13 Purchased notes of Company z for $267,900. Decenber 9 sold all of the bonds of Company A for $515, eea. Fairvalues at December 31 are : B, \$8r,000; C, \$665,000; X, \$118,000; and Z, \$278,000. Answer is not complete. Prepare journal entries to record each of the transactions and events. Prepare the year-end adjustment to fair value, if any. Stoll Company's long term avoliable forssie portiolio at the start of thle year consists of the following. Stoll enters into the following tronsactiona involving its ovalioble foresie debt securties this yese Janwery 28 sold one-half of the notes of Company is for $79,260. July 6 Pirchased bonds of Company x for $126,600. novelter 13 Prchased notos of Company z for $267,200. December 9 Sold all of the bonds of Company A for $15,0e0. Fair values ot December 31 sie: B, \$81,000; C, \$665,000; X, \$118,000; and Z, \$278,000. Uaing the drop-downs, select the stocks induded in the avaliable-for-sale portfolio as of Docember 31 . Calculate the fotal cast and total fair value of the available-for-alale portfolio as of Decrmber 32, and calculste the amount of the required vaor-end adjusting sentry, it any. Stoll Company's long-term avallable-for-sale portiollo at the start of this year consists of the following. Stoll enters into the following transactions involving its avaliable-for-sale debt securities this year. Jahuary 29 Sold one-halt of the notes of Company 0 for $79,200. July 6 Purchesed bonds of Conpany X for $126,600. November 13 Purchased notes of Company z for $267,990. Decenber 9 Sold all of the bonds of Company A for \$515, 060. Falr values at December 31 are: B,$81,000,C,$665,000;X,$118,000; and Z, $278,000. For each transaction, indicate the change, if any, in fotal assets and total equity, If equity changes, indicate whecher the change was reflected as a component of net income, or directly within the stockdholder's' equity portion of the balance sheec. Remember that the change in total assets must agree with the change in total equity. Enter negative amounts with minus sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started