Need some help with these questions on my math homework due at midnight.

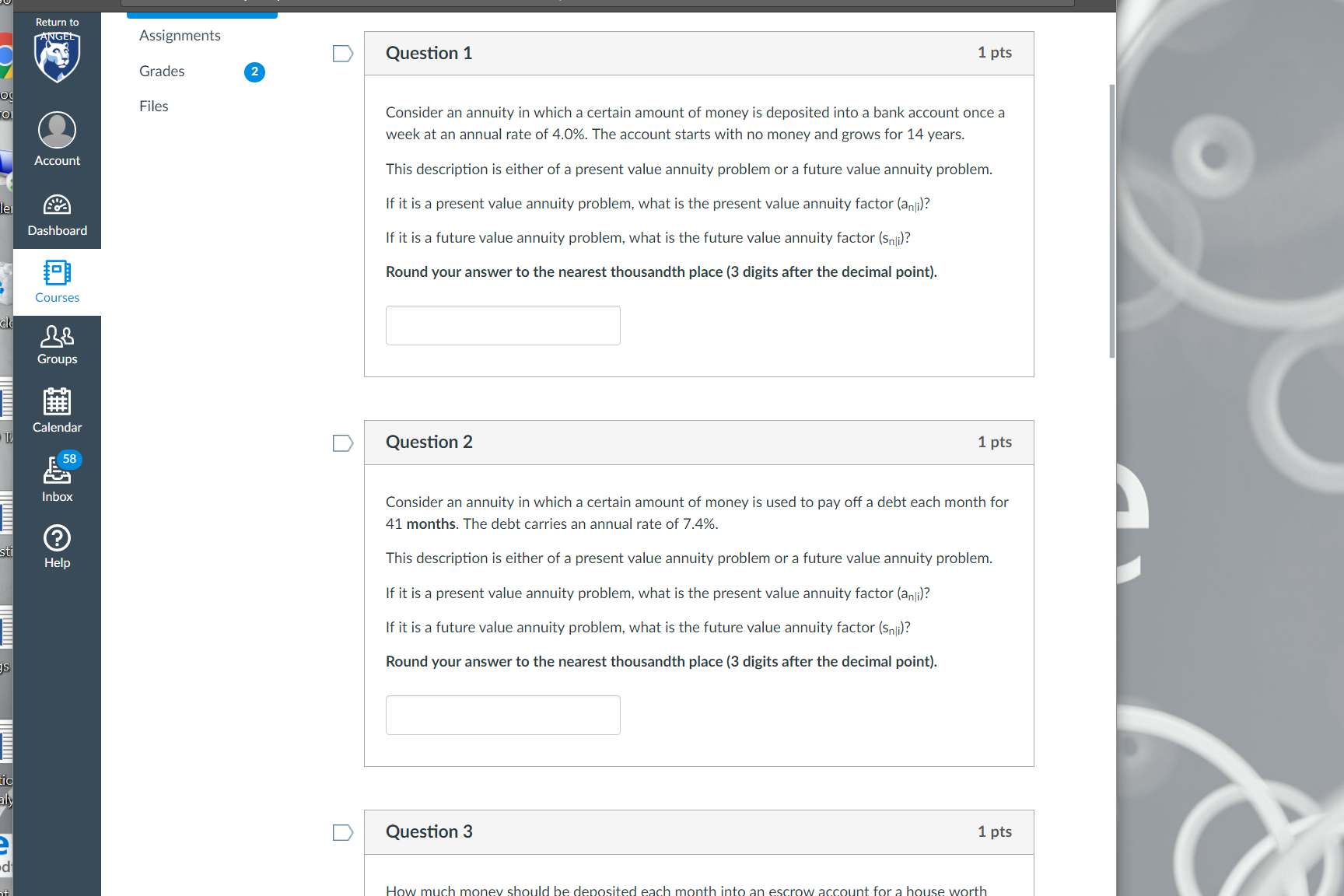

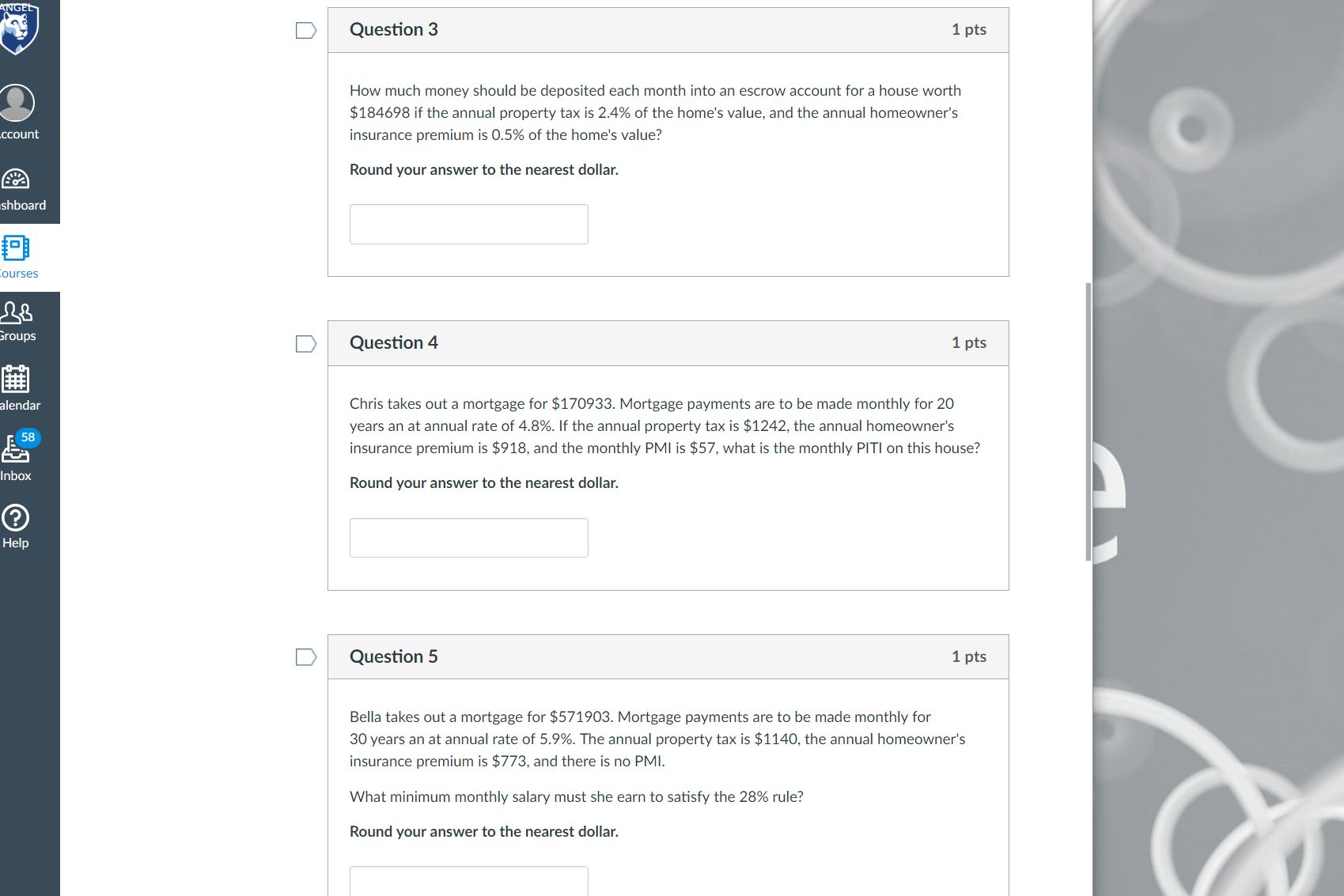

Assignments Grades Files Question 1 1 pts Consider an annuity in which a certain amount of money is deposited into a bank account once a week at an annual rate of 4.0%. The account starts with no money and grows for 14 years. This description is either of a present value annuity problem or a future value annuity problem. If it is a present value annuity problem, what is the present value annuity factor (anli)? If it is a future value annuity problem. what is the future value annuity factor (Snii)? Round your answer to the nearest thousandth place (3 digits after the decimal point). Question 2 1 pts Consider an annuity in which a certain amount of money is used to pay off a debt each month for 41 months. The debt carries an annual rate of 7.4%. This description is either of a present value annuity problem or a future value annuity problem. If it is a present value annuity problem, what is the present value annuity factor (anli)? If it is a future value annuity problem, what is the future value annuity factor (sn'i)? Round your answer to the nearest thousandth place (3 digits after the decimal point). Question 3 1 pts How much money should be deposited each mnnth into an escrow account for a house worth Question 3 1 pts How much money should be deposited each month into an escrow account for a house worth $184698 if the annual property tax is 2.4% of the home's value, and the annual homeowner's insurance premium is 0.5% of the home's value? Round your answer to the nearest dollar. Question 4 1 pts Chris takes out a mortgage for $170933. Mortgage payments are to be made monthly for 20 years an at annual rate of 4.8%. If the annual property tax is $1242, the annual homeowner's insurance premium is $918. and the monthly PMI is $57, what is the monthly PITI on this house? Round your answer to the nearest dollar. Question 5 1 pts Bella takes out a mortgage for $571903. Mortgage payments are to be made monthly for 30 years an at annual rate of 5.9%. The annual property tax is $1140, the annual homeowner's insurance premium is $773, and there is no PM |. What minimum monthly salary must she earn to satisfy the 28% rule? Round your answer to the nearest dollar. \f