Need some help with tis please anyone.

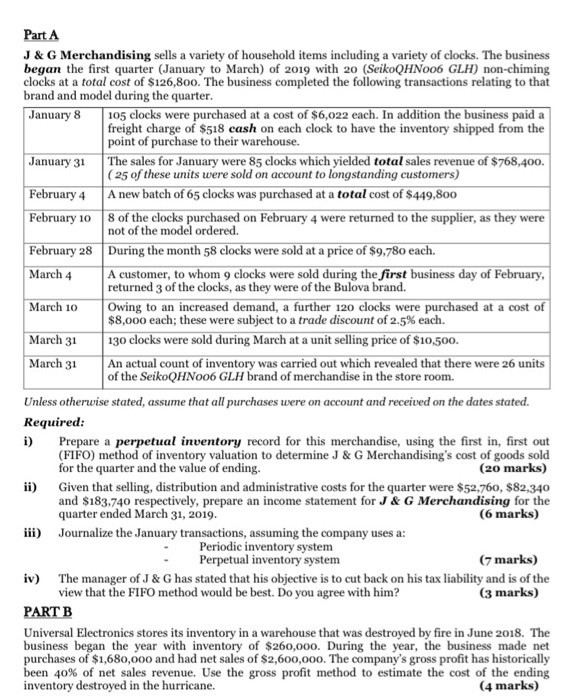

Part A J & G Merchandising sells a variety of household items including a variety of clocks. The business began the first quarter (January to March) of 2019 with 20 (SeikoQHN006 GLH) non-chiming clocks at a total cost of $126,800. The business completed the following transactions relating to that brand and model during the quarter. January 8 105 clocks were purchased at a cost of $6,022 each. In addition the business paid a freight charge of $518 cash on each clock to have the inventory shipped from the point of purchase to their warehouse. January 31 The sales for January were 85 clocks which yielded total sales revenue of $768,400. ( 25 of these units were sold on account to longstanding customers) February 4 A new batch of 65 clocks was purchased at a total cost of $449,800 February 10 8 of the clocks purchased on February 4 were returned to the supplier, as they were not of the model ordered. February 28 During the month 58 clocks were sold at a price of $9.780 each. March 4 A customer, to whom 9 clocks were sold during the first business day of February returned 3 of the clocks, as they were of the Bulova brand. March 10 Owing to an increased demand, a further 120 clocks were purchased at a cost of $8,000 each; these were subject to a trade discount of 2.5% each. March 31 130 clocks were sold during March at a unit selling price of $10,500. March 31 An actual count of inventory was carried out which revealed that there were 26 units of the SeikoQHN006 GLH brand of merchandise in the store room. Unless otherwise stated, assume that all purchases were on account and received on the dates stated. Required: Prepare a perpetual inventory record for this merchandise, using the first in, first out (FIFO) method of inventory valuation to determine J & G Merchandising's cost of goods sold for the quarter and the value of ending. (20 marks) ii) Given that selling, distribution and administrative costs for the quarter were $52,760, $82,340 and $183.740 respectively, prepare an income statement for J & G Merchandising for the quarter ended March 31, 2019. (6 marks) iii) Journalize the January transactions, assuming the company uses a: Periodic inventory system - Perpetual inventory system (7 marks) iv) The manager of J & G has stated that his objective is to cut back on his tax liability and is of the view that the FIFO method would be best. Do you agree with him? (3 marks) PART B Universal Electronics stores its inventory in a warehouse that was destroyed by fire in June 2018. The business began the year with inventory of $260,000. During the year, the business made net purchases of $1,680,000 and had net sales of $2,600,000. The company's gross profit has historically been 40% of net sales revenue. Use the gross profit method to estimate the cost of the ending inventory destroyed in the hurricane. (4 marks)