Answered step by step

Verified Expert Solution

Question

1 Approved Answer

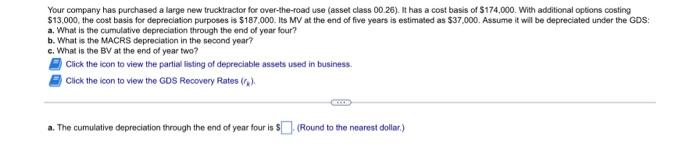

need some help Your company has purchased a large new trucktractor for over-the-foad use (asset class 00.26). It has a cost basis of $174,000. With

need some help

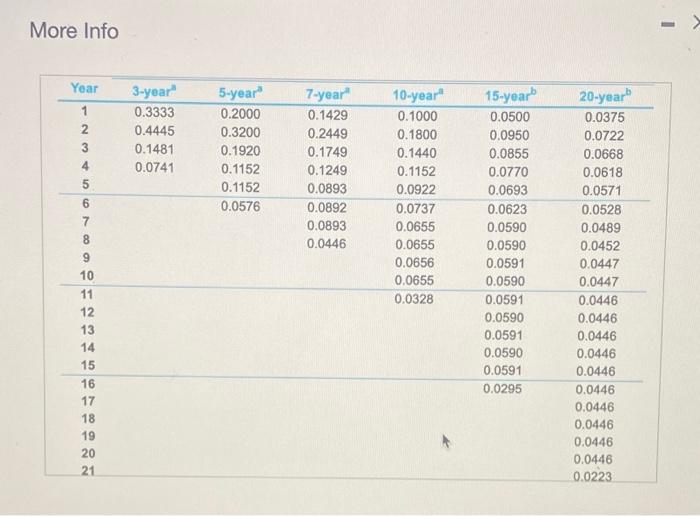

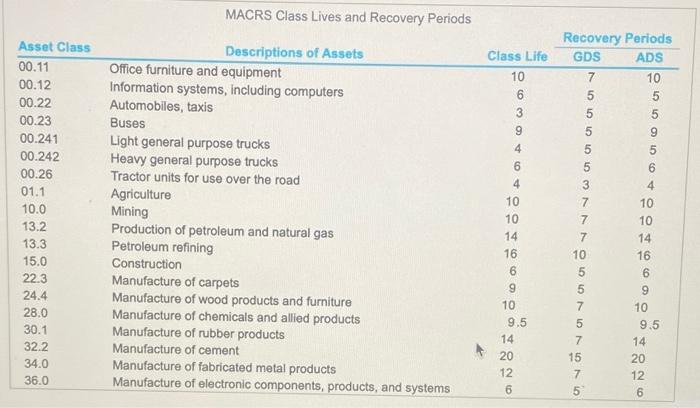

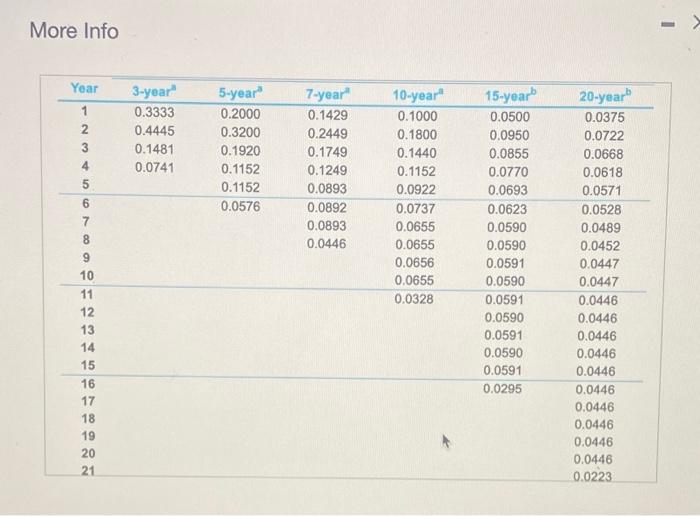

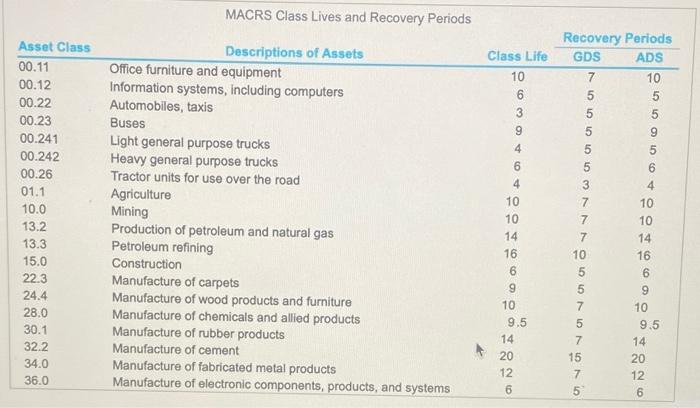

Your company has purchased a large new trucktractor for over-the-foad use (asset class 00.26). It has a cost basis of $174,000. With additional options costing $13,000, the oost basis for depreciation purposes is $187,000. Its MV at the end of five years is estimated as $37,000. Assume it will be depreciated under the GDS: a. What is the cumulative depreciation through the end of yoar four? b. What is the MACRS depreciation in the second year? c. What is the BY at the end of year two? Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the G0S Recovery Rates (rk). a. The cumulative depreciation through the end of year four is \& (Round to the nearest dollar.) More Info MACRS Class Lives and Recovery Periods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started