Need Step By Step Anwsers For Each Question.

Questions 3&4, Please Show Your Work.

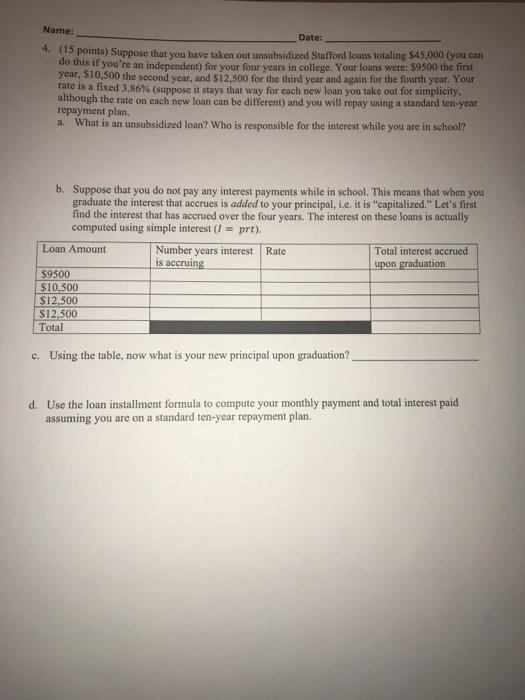

Name: Date: 2. (5 points) A couple completely owns one bome but is purchasing a second home for $120,000 They will put down 20% and will take out a 15-year FRM with 3% APR for the money they need to borrow. They plan on renting out the home for $1200 a month. They are planning on pocketing the extra money made over the mortgage payment. 1) How much money will they be pocketing a month? (Hint: First, determine the monthly mortgage payment, then subtract it from $1200). 2) How much interest would they save if they instead put that extra money toward the mortgage each month (Hint: Determine the total interest paid originally and the total interest paid if you made the extra payment, then subtract the two). 3) How many years does that cut off of the loan? For simplicity we'll ignore taxes and insurance. 3. (5 points) Suppose that you have taken out subsidized Stafford loans totaling $20,000 over your four years in college. Your rate is a fixed 3.86% and you will repay using a standard ten-year repayment plan. Find your after-graduation monthly payment & explain why your principal is still $20,000 (as opposed to $20,000 plus accrued interest) when you graduate, assuming you haven't paid anything toward the principal of the loan during school. (Use loan installment formula.) Name: Date: 4. (15 points) Suppose that you have taken out unsubsidized Stafford loans totaling $45,000 (you can do this if you're an independent) for your four years in college. Your loans were: $9500 the first year, $10.500 the second year, and $12.500 for the third year and again for the fourth year. Your rate is a fixed 3.86% (suppose it stays that way for each new loan you take out for simplicity although the rate on each new loan can be different) and you will repay using a standard ten-year repayment plan. 1. What is an unsubsidized loan? Who is responsible for the interest while you are in school? b. Suppose that you do not pay any interest payments while in school. This means that when you graduate the interest that accrues is added to your principal, i.e. it is "capitalized." Let's first find the interest that has accrued over the four years. The interest on these loans is actually computed using simple interest (1 = prt). Loan Amount Number years interest Rate Total interest accrued is aceruing upon graduation S9500 $10,500 $12.500 $12,500 Total e. Using the table, now what is your new principal upon graduation? d. Use the loan installment formula to compute your monthly payment and total interest paid assuming you are on a standard ten-year repayment plan