Answered step by step

Verified Expert Solution

Question

1 Approved Answer

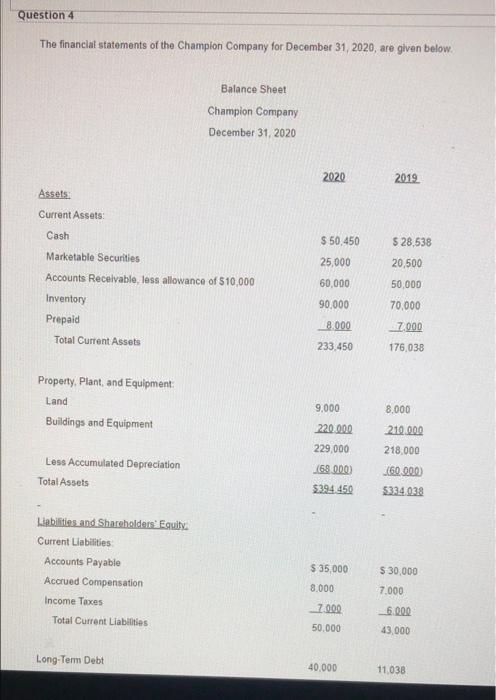

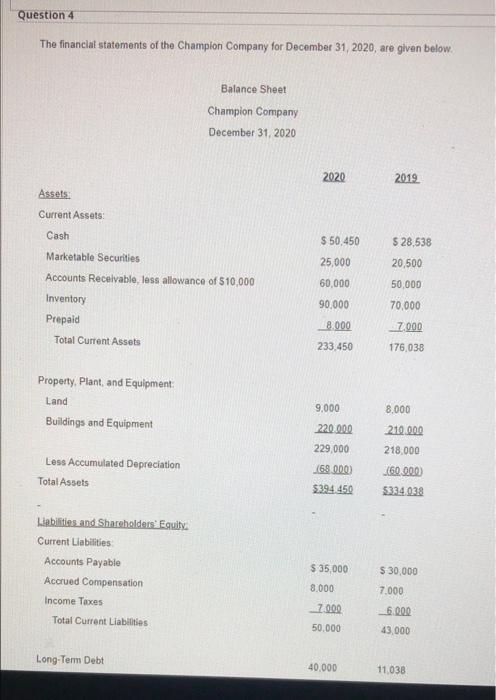

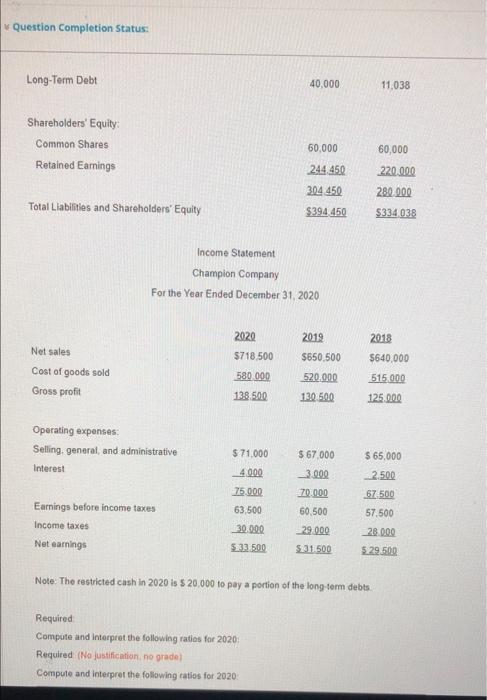

need the answer fast pls Question 4 The financial statements of the Champion Company for December 31, 2020, are given below. Balance Sheet Champion Company

need the answer fast pls

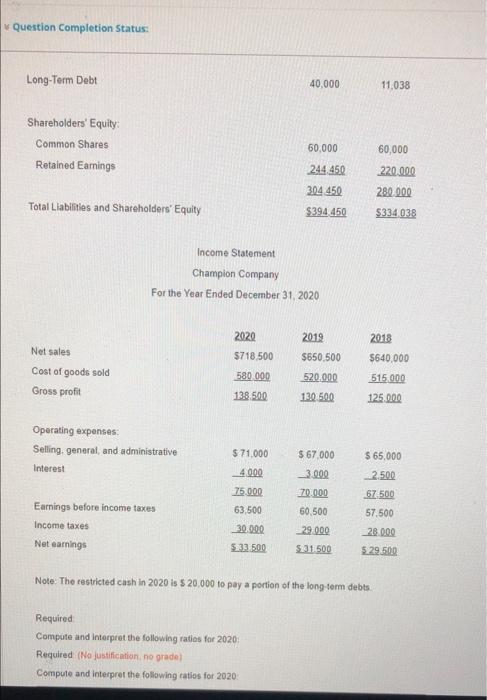

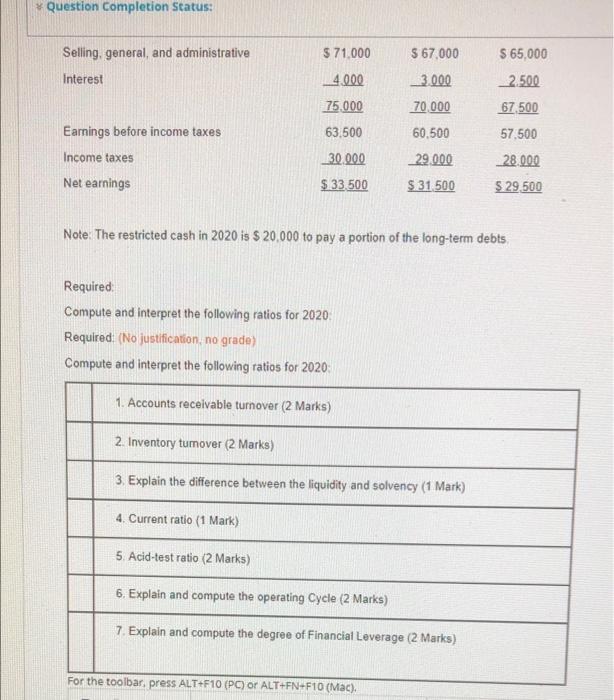

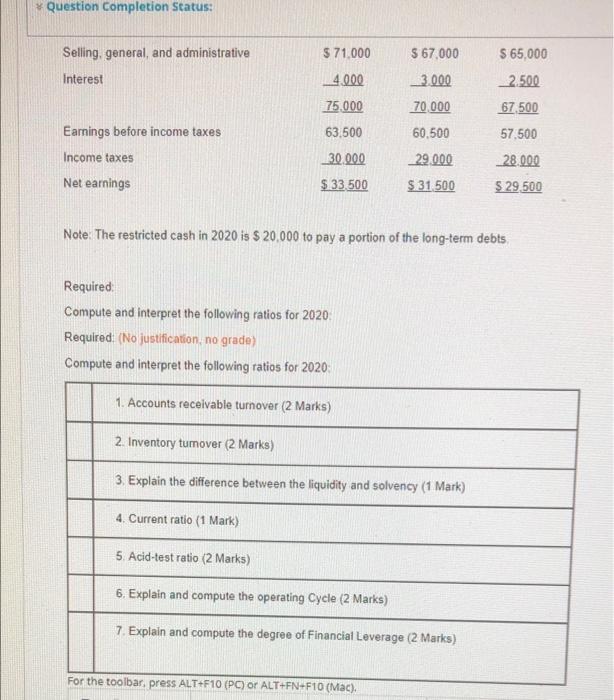

Question 4 The financial statements of the Champion Company for December 31, 2020, are given below. Balance Sheet Champion Company December 31, 2020 2020 2019 Assets. Current Assets Cash $ 50,450 $ 28,538 25,000 20,500 60,000 50,000 Marketable Securities Accounts Receivable, less allowance of $10,000 Inventory Prepaid Total Current Assets 90,000 70,000 8.000 7000 233.450 176,038 Property. Plant, and Equipment Land 9,000 8.000 Buildings and Equipment 220.000 229,000 Less Accumulated Depreciation Total Assets 210.000 218,000 (60.000) 5334,038 (69000) $394.450 Liabilities and Shareholders' Equity Current Liabilities Accounts Payable Accrued Compensation Income Taxes Total Current Liabilities $ 35,000 $ 30,000 8.000 7.000 - 7.000 __6.000 50.000 43,000 Long-Term Debt 40,000 11.038 Question Completion Status: Long-Term Debt 40.000 11,038 Shareholders' Equity Common Shares Retained Eamings 60.000 60,000 244, 450 220.000 304 450 280 000 Total Liabilities and Shareholders' Equity $394 450 $334038 Income Statement Champion Company For the Year Ended December 31, 2020 2020 2019 2018 Net sales $718 500 $650,500 S640.000 580 000 Cost of goods sold Gross profit 520.000 13.0.5.00 515.000 125.000 138.500 Operating expenses Selling general, and administrative Interest $71.000 $ 67 000 -4.000 Earnings before income taxes Income taxes Net earnings 75.000 63 500 30.000 _3.000 20.000 60,500 - 29.000 $31.500 $ 65.000 2.500 67.500 57,500 26.000 5.29.500 5.33 500 Note: The restricted cash in 2020 is $ 20,000 to pay a portion of the long-term debts. Required Compute and interpret the following ratios for 2020 Required (No justification, no grade Compute and interpret the following ratios for 2020 Question Completion Status: Seling, general and administrative $ 67,000 S 65,000 $ 71.000 4.000 Interest 2.500 75.000 67 500 63.500 Earnings before income taxes Income taxes Net earnings 3.000 70,000 60,500 29.000 $ 31 500 57,500 28.000 30.000 $ 33,500 $ 29,500 Note: The restricted cash in 2020 is $ 20,000 to pay a portion of the long-term debts Required Compute and interpret the following ratios for 2020 Required: (No justification, no grade) Compute and interpret the following ratios for 2020 1. Accounts receivable turnover (2 Marks) 2. Inventory tumover (2 Marks) 3. Explain the difference between the liquidity and solvency (1 Mark) 4. Current ratio (1 Mark) 5. Acid-test ratio (2 Marks) 6. Explain and compute the operating Cycle (2 Marks) 7. Explain and compute the degree of Financial Leverage (2 Marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started