Question

Need the answer to a and b of the question below please! Thank you so much! During 2016, Jeff Smallwood worked for two different employers.

Need the answer to a and b of the question below please! Thank you so much!

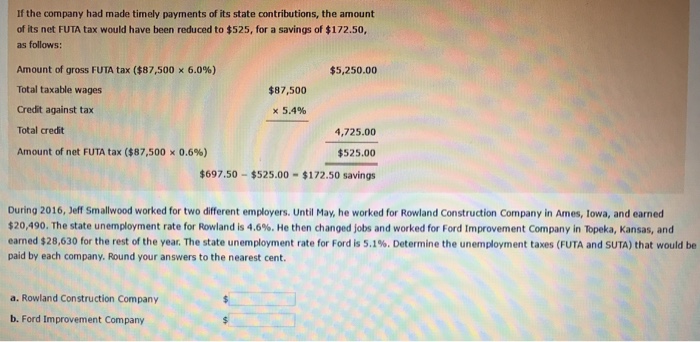

During 2016, Jeff Smallwood worked for two different employers. Until May, he worked for Rowland Construction Company in Ames, Iowa, and earned $20,490. The state unemployment rate for Rowland is 4.6%. He then changed jobs and worked for Ford Improvement Company in Topeka, Kansas, and earned $28,630 for the rest of the year. The state unemployment rate for Ford is 5.1%. Determine the unemployment taxes (FUTA and SUTA) that would be paid by each company. Round your answers to the nearest cent.

a. Rowland Construction Company $______________

b. Ford Improvement Company $______________

Please note, the 2015 rates for for FUTA and SUTA need to be used for this problem.

Also, please note, for the textbook in this class, the rate 0.6% was used for the FUTA tax rate for employers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started