Answered step by step

Verified Expert Solution

Question

1 Approved Answer

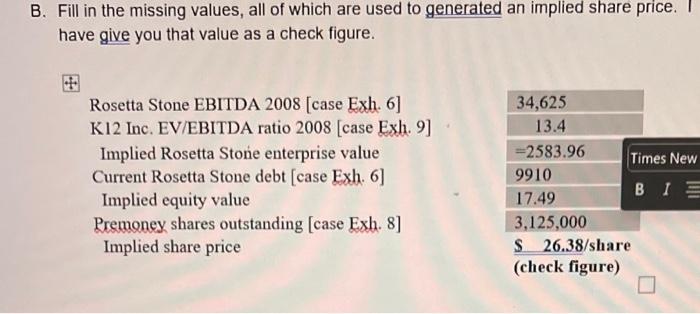

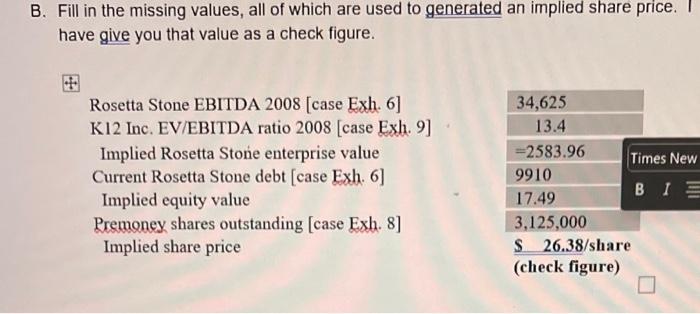

need the highlighted numbers. all exhibits are given B. Fill in the missing values, all of which are used to generated an implied share price.

need the highlighted numbers. all exhibits are given

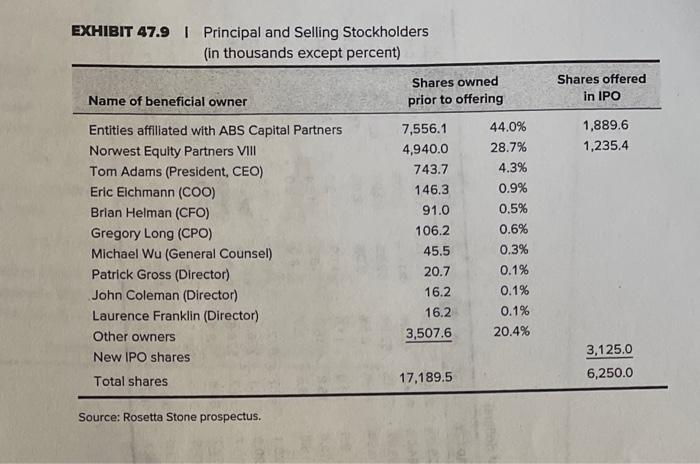

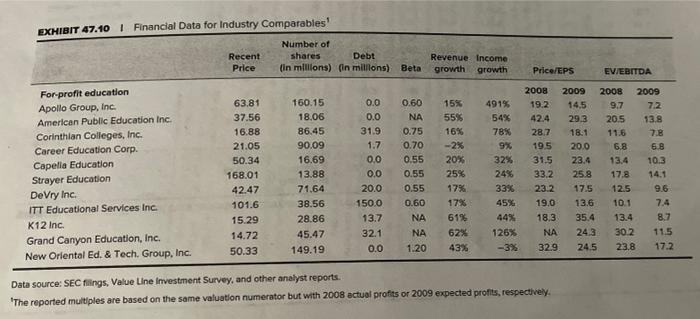

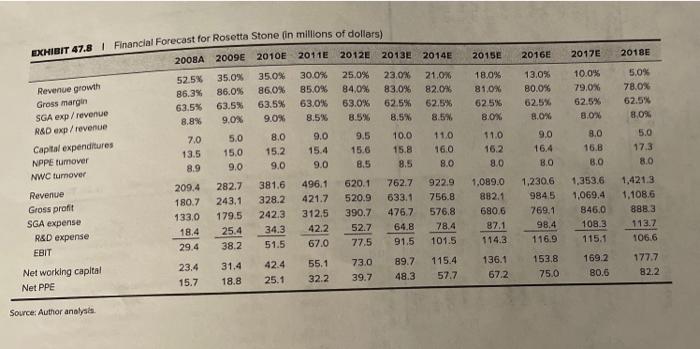

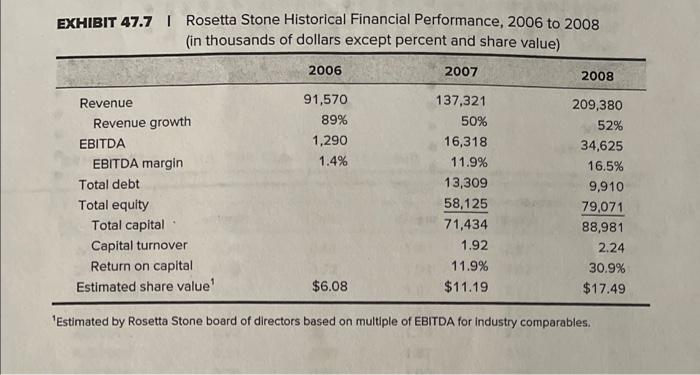

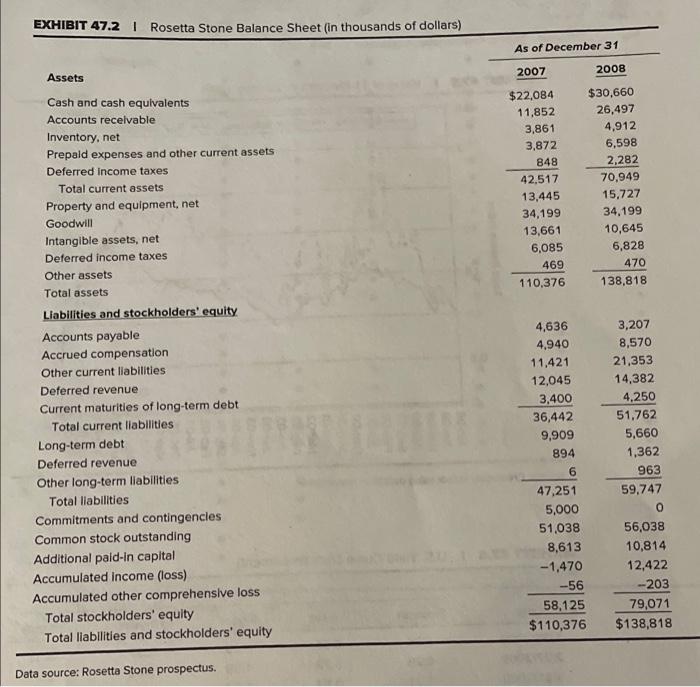

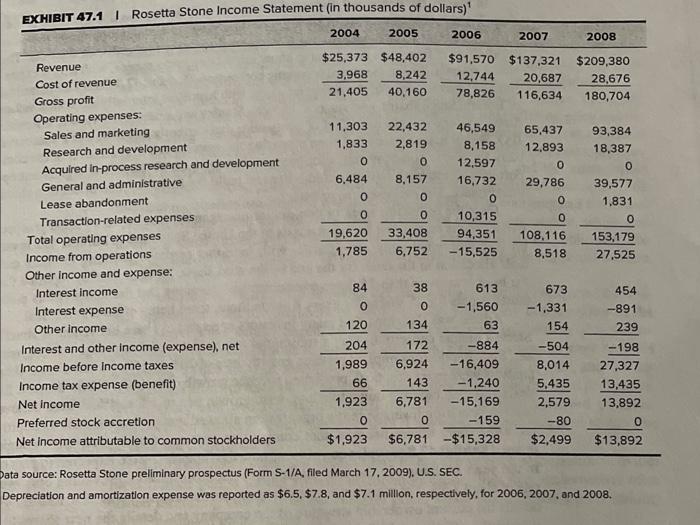

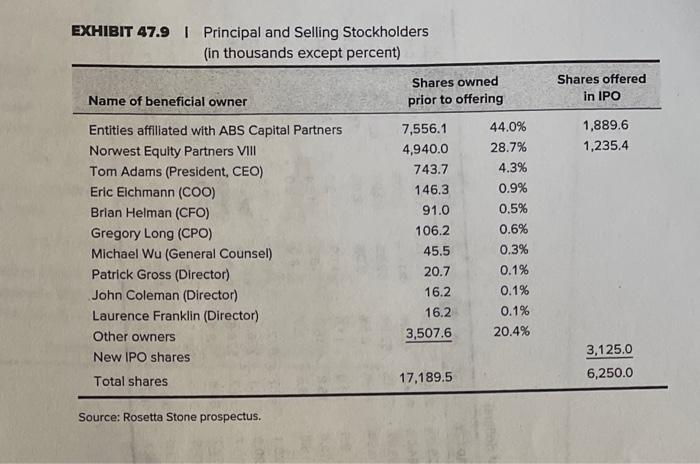

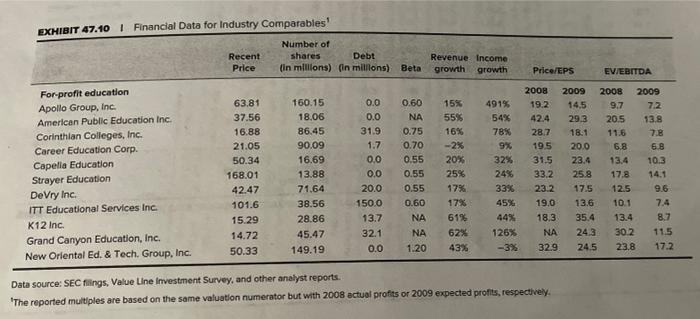

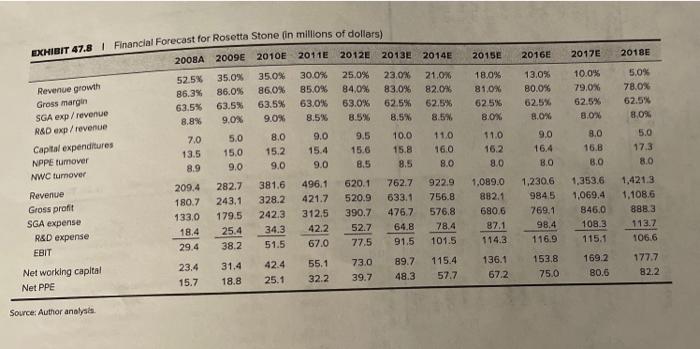

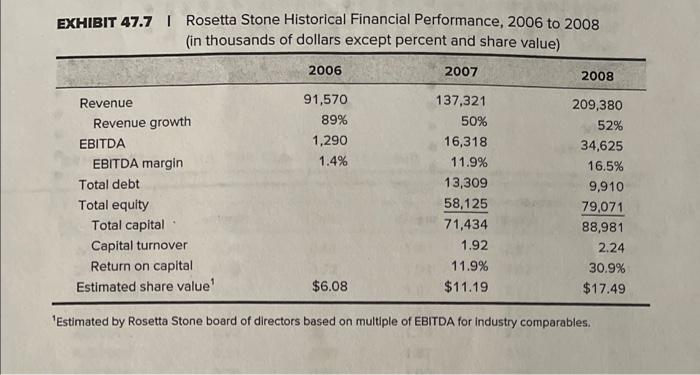

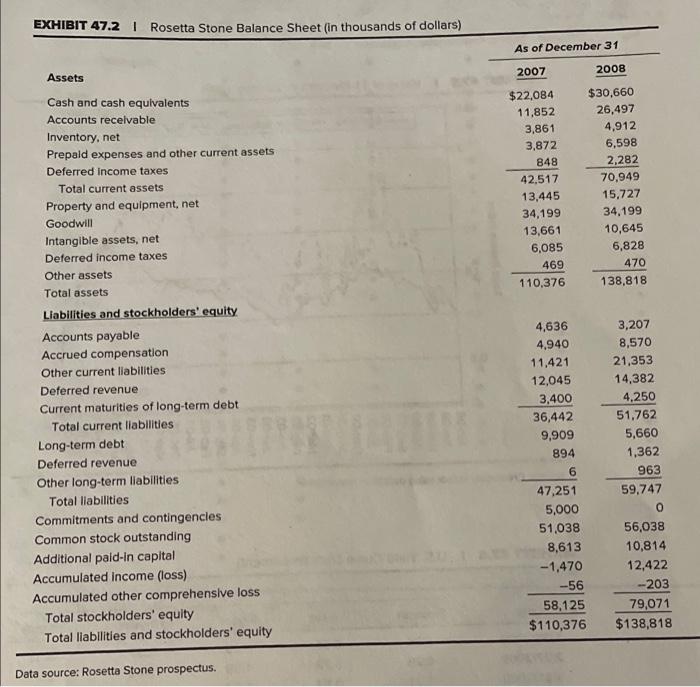

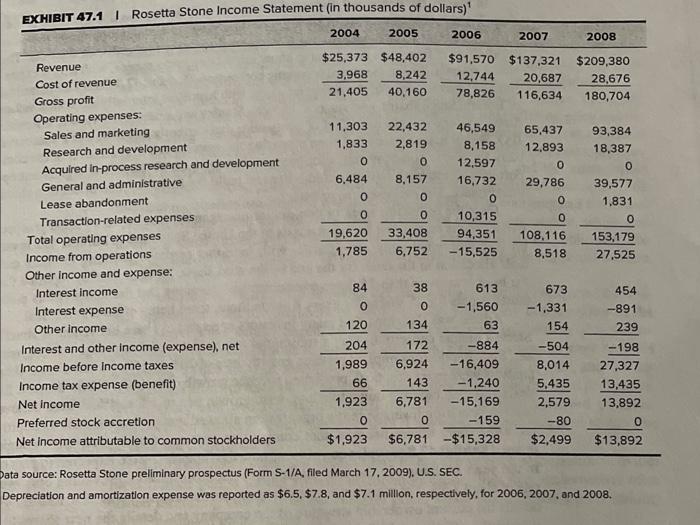

B. Fill in the missing values, all of which are used to generated an implied share price. have give you that value as a check figure. EXHIBIT 47.9 I Principal and Selling Stockholders (in thousands except percent) Source: Rosetta Stone prospectus. Data source: SEC filings, Value Une imvestment Survey, and other analyst reports. 'The reported multples are based on the same valuation numerator but with 2008 actual profts or 2009 expected profits, respectively. Source: Author anolysis. EXHIBIT 47.7 I Rosetta Stone Historical Financial Performance, 2006 to 2008 (in thousands of dollars except percent and share value) ' Estimated by Rosetta Stone board of directors based on multiple of EBITDA for industry comparables, EXRHIRIT A7 1 lata source: Rosetta Stone preliminary prospectus (Form S-1/A, filed March 17, 2009), U.S. SEC. Depreciation and amortization expense was reported as $6.5,$7.8, and $7.1 million, respectively, for 2006, 2007 , and 2008 . B. Fill in the missing values, all of which are used to generated an implied share price. have give you that value as a check figure. EXHIBIT 47.9 I Principal and Selling Stockholders (in thousands except percent) Source: Rosetta Stone prospectus. Data source: SEC filings, Value Une imvestment Survey, and other analyst reports. 'The reported multples are based on the same valuation numerator but with 2008 actual profts or 2009 expected profits, respectively. Source: Author anolysis. EXHIBIT 47.7 I Rosetta Stone Historical Financial Performance, 2006 to 2008 (in thousands of dollars except percent and share value) ' Estimated by Rosetta Stone board of directors based on multiple of EBITDA for industry comparables, EXRHIRIT A7 1 lata source: Rosetta Stone preliminary prospectus (Form S-1/A, filed March 17, 2009), U.S. SEC. Depreciation and amortization expense was reported as $6.5,$7.8, and $7.1 million, respectively, for 2006, 2007 , and 2008

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started