Answered step by step

Verified Expert Solution

Question

1 Approved Answer

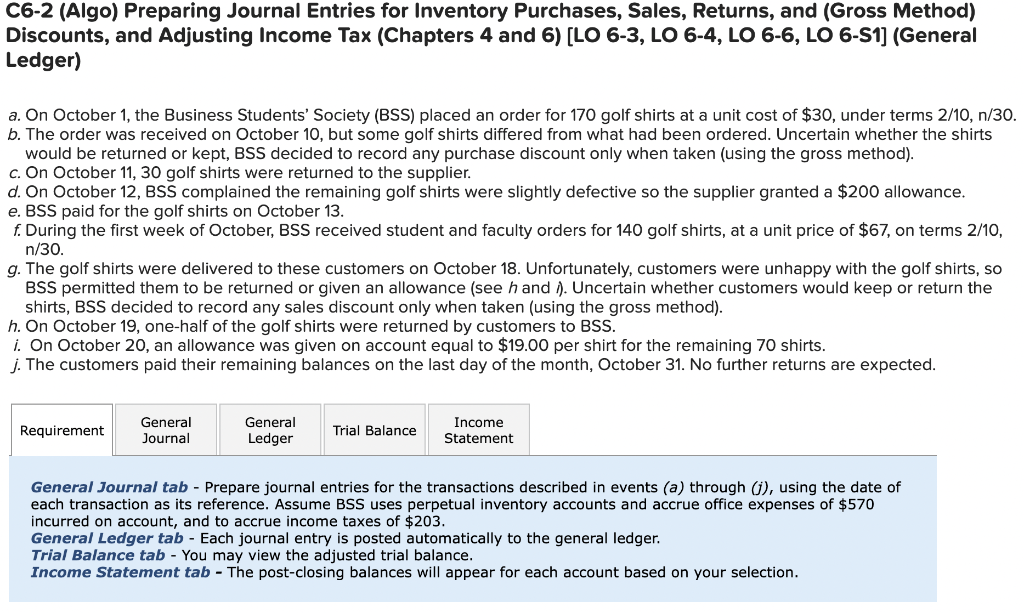

Need the Journal Entries, Ledger, Trial Balance, and Income Statement C6-2 (Algo) Preparing Journal Entries for Inventory Purchases, Sales, Returns, and (Gross Method) Discounts, and

Need the Journal Entries, Ledger, Trial Balance, and Income Statement

C6-2 (Algo) Preparing Journal Entries for Inventory Purchases, Sales, Returns, and (Gross Method) Discounts, and Adjusting Income Tax (Chapters 4 and 6) [LO 6-3, LO 6-4, LO 6-6, LO 6-S1] (General Ledger) a. On October 1 , the Business Students' Society (BSS) placed an order for 170 golf shirts at a unit cost of $30, under terms 2/10, n/30. would be returned or kept, BSS decided to record any purchase discount only when taken (using the gross method). c. On October 11, 30 golf shirts were returned to the supplier. d. On October 12, BSS complained the remaining golf shirts were slightly defective so the supplier granted a $200 allowance. e. BSS paid for the golf shirts on October 13. f During the first week of October, BSS received student and faculty orders for 140 golf shirts, at a unit price of $67, on terms 2/10, n/30. g. The golf shirts were delivered to these customers on October 18 . Unfortunately, customers were unhappy with the golf shirts, so BSS permitted them to be returned or given an allowance (see h and i ). Uncertain whether customers would keep or return the shirts, BSS decided to record any sales discount only when taken (using the gross method). h. On October 19, one-half of the golf shirts were returned by customers to BSS. i. On October 20, an allowance was given on account equal to $19.00 per shirt for the remaining 70 shirts. General Journal tab - Prepare journal entries for the transactions described in events (a) through (j), using the date of each transaction as its reference. Assume BSS uses perpetual inventory accounts and accrue office expenses of $570 incurred on account, and to accrue income taxes of $203. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - You may view the adjusted trial balance. Income Statement tab - The post-closing balances will appear for each account based on your selection. C6-2 (Algo) Preparing Journal Entries for Inventory Purchases, Sales, Returns, and (Gross Method) Discounts, and Adjusting Income Tax (Chapters 4 and 6) [LO 6-3, LO 6-4, LO 6-6, LO 6-S1] (General Ledger) a. On October 1 , the Business Students' Society (BSS) placed an order for 170 golf shirts at a unit cost of $30, under terms 2/10, n/30. would be returned or kept, BSS decided to record any purchase discount only when taken (using the gross method). c. On October 11, 30 golf shirts were returned to the supplier. d. On October 12, BSS complained the remaining golf shirts were slightly defective so the supplier granted a $200 allowance. e. BSS paid for the golf shirts on October 13. f During the first week of October, BSS received student and faculty orders for 140 golf shirts, at a unit price of $67, on terms 2/10, n/30. g. The golf shirts were delivered to these customers on October 18 . Unfortunately, customers were unhappy with the golf shirts, so BSS permitted them to be returned or given an allowance (see h and i ). Uncertain whether customers would keep or return the shirts, BSS decided to record any sales discount only when taken (using the gross method). h. On October 19, one-half of the golf shirts were returned by customers to BSS. i. On October 20, an allowance was given on account equal to $19.00 per shirt for the remaining 70 shirts. General Journal tab - Prepare journal entries for the transactions described in events (a) through (j), using the date of each transaction as its reference. Assume BSS uses perpetual inventory accounts and accrue office expenses of $570 incurred on account, and to accrue income taxes of $203. General Ledger tab - Each journal entry is posted automatically to the general ledger. Trial Balance tab - You may view the adjusted trial balance. Income Statement tab - The post-closing balances will appear for each account based on your selectionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started