Answered step by step

Verified Expert Solution

Question

1 Approved Answer

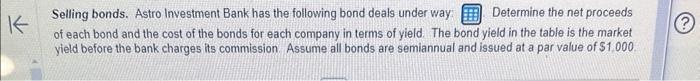

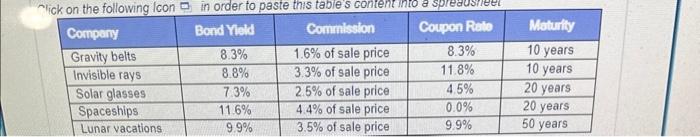

Need the market price, net price, and yield to maturity for EACH of the FIVE bonds. Thank you. Selling bonds. Astro Investment Bank has the

Need the market price, net price, and yield to maturity for EACH of the FIVE bonds. Thank you.

Selling bonds. Astro Investment Bank has the following bond deals under way: Determine the net proceeds of each bond and the cost of the bonds for each company in terms of yield. The bond yield in the table is the market yield before the bank charges its commission. Assume all bonds are semiannual and issued at a par value of $1,000 Sick on the following Icon in order to paste this table's conrent into a spreausieel \begin{tabular}{|l|c|c|c|c|} \hline Compony & Bond Yeid & Commlsion & Coupon Rale & Moturity \\ \hline Gravity belts & 8.3% & 1.6% of sale price & 8.3% & 10 years \\ \hline Invisible rays & 8.8% & 3.3% of sale price & 11.8% & 10 years \\ \hline Solar glasses & 7.3% & 2.5% of sale price & 4.5% & 20 years \\ \hline Spaceships & 11.6% & 4.4% of sale price & 0.0% & 20 years \\ \hline Lunar vacations & 9.9% & 3.5% of sale price & 9.9% & 50 years \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started