Answered step by step

Verified Expert Solution

Question

1 Approved Answer

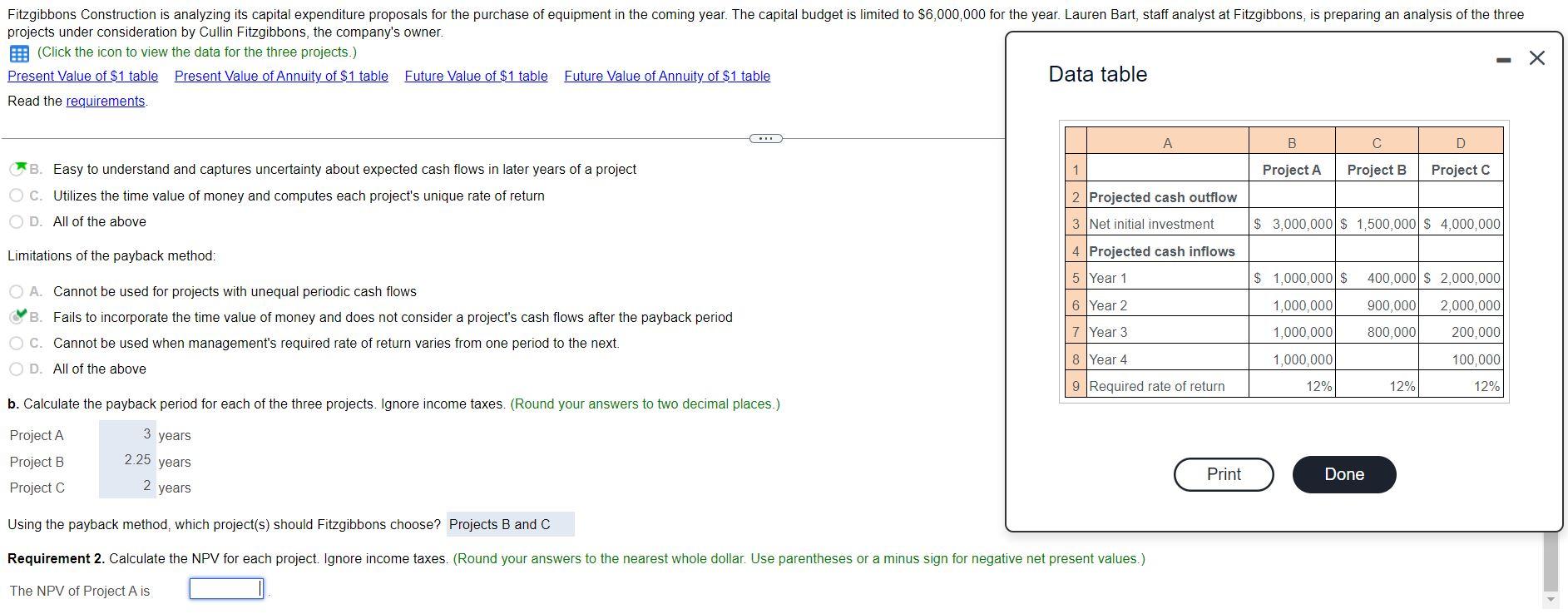

Need the NVP for project A, B, and C. Thank you Fitzgibbons Construction is analyzing its capital expenditure proposals for the purchase of equipment in

Need the NVP for project A, B, and C. Thank you

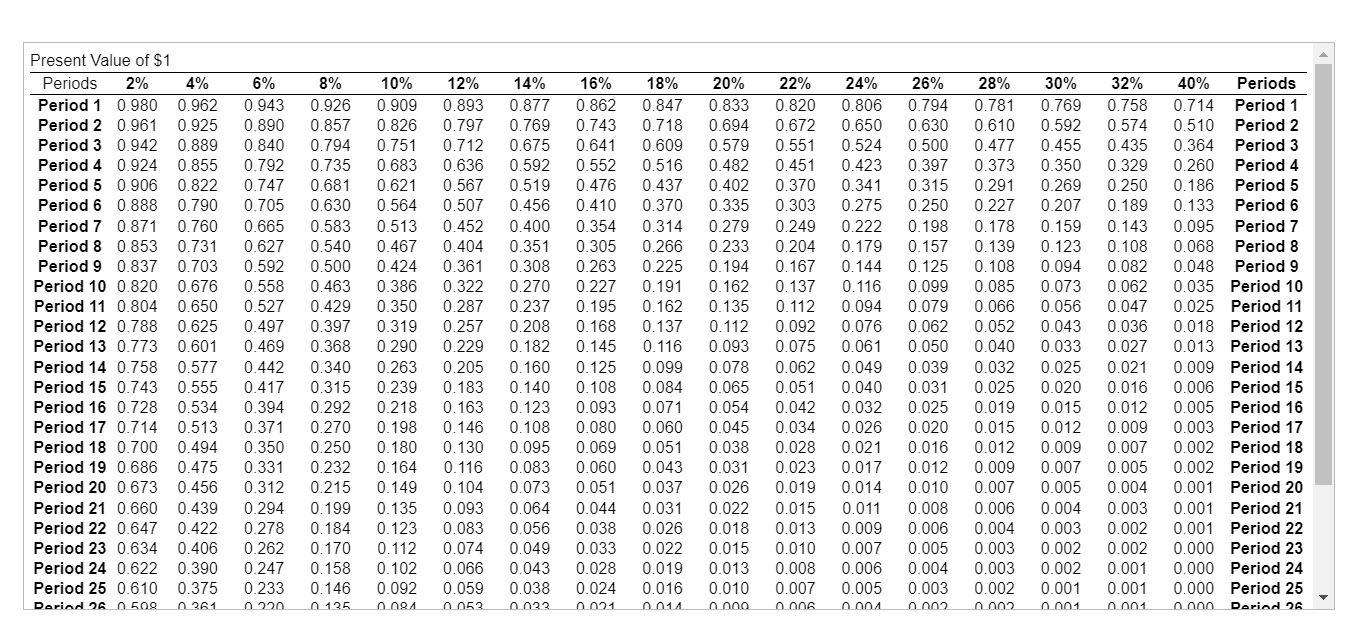

Fitzgibbons Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $6,000,000 for the year. Lauren Bart, staff analyst at Fitzgibbons, is preparing an analysis of the three projects under consideration by Cullin Fitzgibbons, the company's owner. (Click the icon to view the data for the three projects.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Data table Read the requirements I. B B D 1 Project A Project B Project C B. Easy to understand and captures uncertainty about expected cash flows in later years of a project OC. Utilizes the time value of money and computes each project's unique rate of return O D. All of the above 2 Projected cash outflow 3 Net initial investment $ 3,000,000 $ 1,500,000 $ 4,000,000 Limitations of the payback method: 4 Projected cash inflows 5 Year 1 6 Year 2 O A. Cannot be used for projects with unequal periodic cash flows B. Fails to incorporate the time value of money and does not consider a project's cash flows after the payback period O C. Cannot be used when management's required rate of return varies from one period to the next. OD. All of the above $ 1,000,000 $ 400,000 $ 2,000,000 1,000,000 900,000 2,000,000 1,000,000 800,000 200,000 7 Year 3 8 Year 4 1,000,000 100,000 12% 9 Required rate of return 12% 12% b. Calculate the payback period for each of the three projects. Ignore income taxes. (Round your answers to two decimal places.) 3 years Project A Project B Project C 2.25 years 2 years Print Done Using the payback method, which project(s) should Fitzgibbons choose? Projects B and C Requirement 2. Calculate the NPV for each project. Ignore income taxes. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) The NPV of Project A is Present Value of $1 Periods 2% 4% Period 1 0.980 0.962 Period 2 0.961 0.925 Period 3 0.942 0.889 Period 4 0.924 0.855 Period 5 0.906 0.822 Period 6 0.888 0.790 Period 7 0.871 0.760 Period 8 0.853 0.731 Period 9 0.837 0.703 Period 10 0.820 0.676 Period 11 0.804 0.650 Period 12 0.788 0.625 Period 13 0.773 0.601 Period 14 0.758 0.577 Period 15 0.743 0.555 Period 16 0.728 0.534 Period 17 0.714 0.513 Period 18 0.700 0.494 Period 19 0.686 0.475 Period 20 0.673 0.456 Period 21 0.660 0.439 Period 22 0.647 0.422 Period 23 0.634 0.406 Period 24 0.622 0.390 Period 25 0.610 0.375 Deriod 26 0.500 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.294 0.278 0.262 0.247 0.233 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.199 0.184 0.170 0.158 0.146 n 125 10% 12% 14% 0.909 0.893 0.877 0.826 0.797 0.769 0.751 0.712 0.675 0.683 0.636 0.592 0.621 0.567 0.519 0.564 0.507 0.456 0.513 0.452 0.400 0.467 0.404 0.351 0.424 0.361 0.308 0.386 0.322 0.270 0.350 0.287 0.237 0.319 0.257 0.208 0.290 0.229 0.182 0.263 0.205 0.160 0.239 0.183 0.140 0.218 0.163 0.123 0.198 0.146 0.108 0.180 0.130 0.095 0.164 0.116 0.083 0.149 0.104 0.073 0.135 0.093 0.064 0.123 0.083 0.056 0.112 0.074 0.049 0.102 0.066 0.043 0.092 0.059 0.038 ANA 0052 0022 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.044 0.038 0.033 0.028 0.024 021 18% 20% 22% 0.847 0.833 0.820 0.718 0.694 0.672 0.609 0.579 0.551 0.516 0.482 0.451 0.437 0.402 0.370 0.370 0.335 0.303 0.314 0.279 0.249 0.266 0.233 0.204 0.225 0.194 0.167 0.191 0.162 0.137 0.162 0.135 0.112 0.137 0.112 0.092 0.116 0.093 0.075 0.099 0.078 0.062 0.084 0.065 0.051 0.071 0.054 0.042 0.060 0.045 0.034 0.051 0.038 0.028 0.043 0.031 0.023 0.037 0.026 0.019 0.031 0.022 0.015 0.026 0.018 0.013 0.022 0.015 0.010 0.019 0.013 0.008 0.016 0.010 0.007 0014 nang 0.006 24% 26% 28% 30% 32% 40% Periods 0.806 0.794 0.781 0.769 0.758 0.714 Period 1 0.650 0.630 0.610 0.592 0.574 0.510 Period 2 0.524 0.500 0.477 0.455 0.435 0.364 Period 3 0.423 0.397 0.373 0.350 0.329 0.260 Period 4 0.341 0.315 0.291 0.269 0.250 0.186 Period 5 0.275 0.250 0.227 0.207 0.189 0.133 Period 6 0.222 0.198 0.178 0.159 0.143 0.095 Period 7 0.179 0.157 0.139 0.123 0.108 0.068 Period 8 0.144 0.125 0.108 0.094 0.082 0.048 Period 9 0.116 0.099 0.085 0.073 0.062 0.035 Period 10 0.094 0.079 0.066 0.056 0.047 0.025 Period 11 0.076 0.062 0.052 0.043 0.036 0.018 Period 12 0.061 0.050 0.040 0.033 0.027 0.013 Period 13 0.049 0.039 0.032 0.025 0.021 0.009 Period 14 0.040 0.031 0.025 0.020 0.016 0.006 Period 15 0.032 0.025 0.019 0.015 0.012 0.005 Period 16 0.026 0.020 0.015 0.012 0.009 0.003 Period 17 0.021 0.016 0.012 0.009 0.007 0.002 Period 18 0.017 0.012 0.009 0.007 0.005 0.002 Period 19 0.014 0.010 0.007 0.005 0.004 0.001 Period 20 0.011 0.008 0.006 0.004 0.003 0.001 Period 21 0.009 0.006 0.004 0.003 0.002 0.001 Period 22 0.007 0.005 0.003 0.002 0.002 0.000 Period 23 0.006 0.004 0.003 0.002 0.001 0.000 Period 24 0.005 0.003 0.002 0.001 0.001 0.000 Period 25 an 0.002 non2 nnn1 n01 nnnn Dariad 2A 0 261

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started