Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need the standart deduction for the first one and taxable income for the second Julianne, a single taxpayer, has adjusted gross income of $75,000, medical

need the standart deduction for the first one

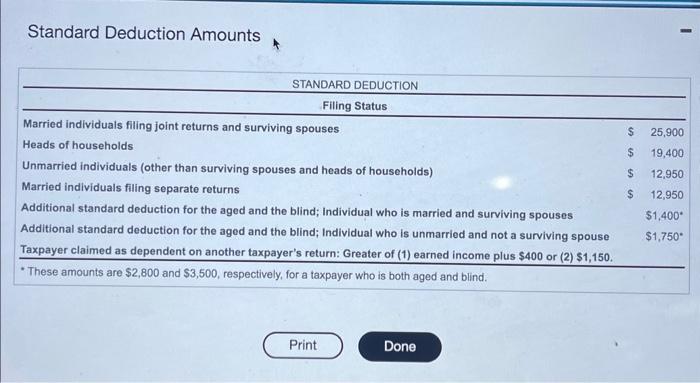

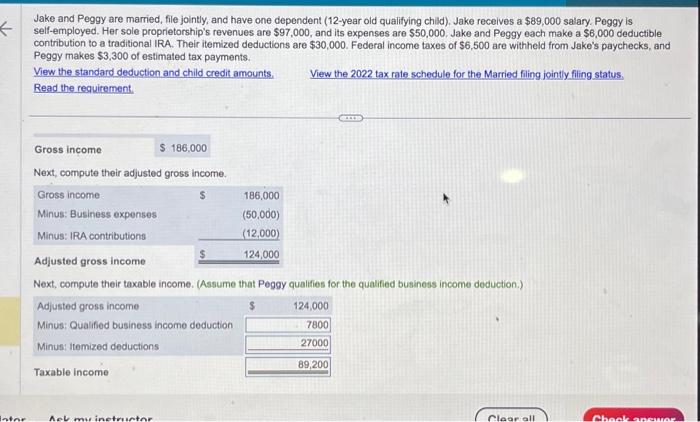

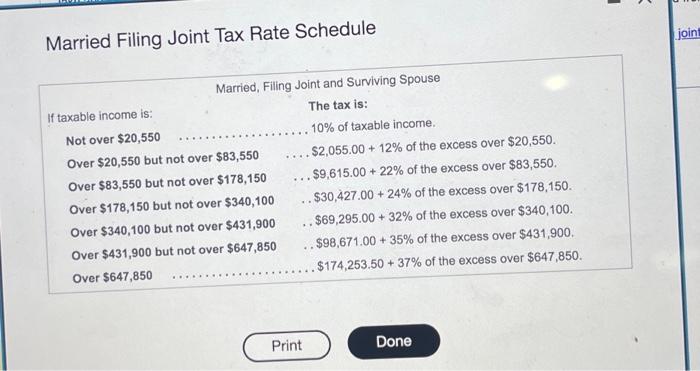

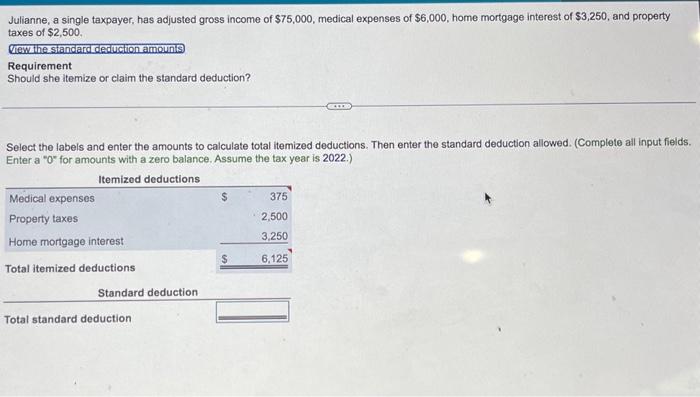

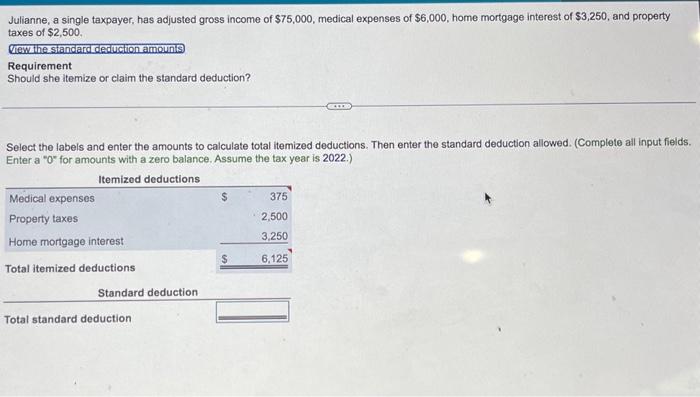

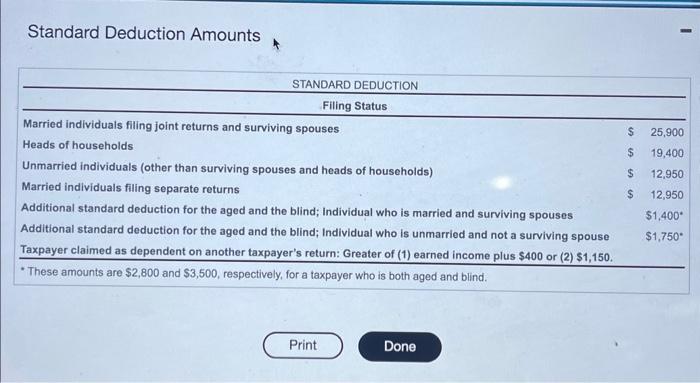

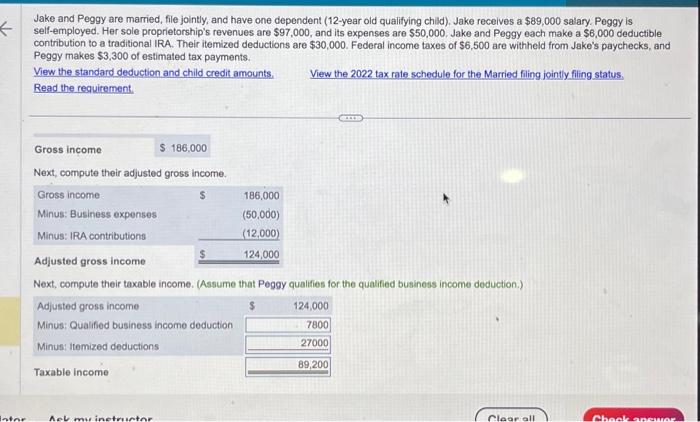

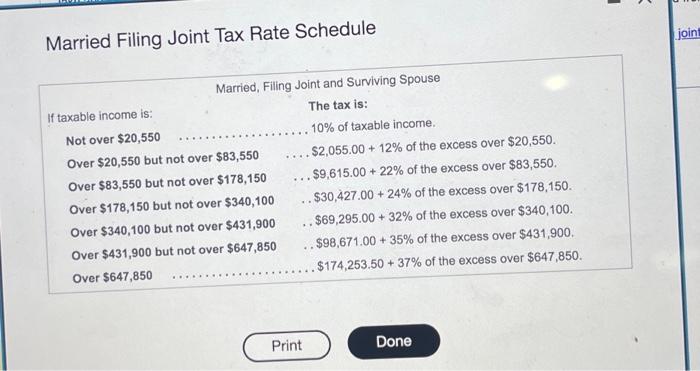

Julianne, a single taxpayer, has adjusted gross income of $75,000, medical expenses of $6,000, home mortgage interest of $3,250, and property taxes of $2,500. Requirement Should she itemize or claim the standard deduction? Select the labels and enter the amounts to calculate total itemized deductions. Then enter the standard deduction allowed. (Complete all input fields. Enter a 0 for amounts with a zero balance. Assume the tax year is 2022.) Standard Deduction Amounts Jake and Peggy are married, file jointly; and have one dependent (12-year old qualifying child). Jake receives a $89,000 salary. Peggy is self-employed. Her sole proprietorship's revenues are $97,000, and its expenses are $50,000. Jake and Peggy each make a $6,000 deductible contribution to a traditional IRA. Their itemized deductions are $30,000. Federal income taxes of $6,500 are withheld from Jake's paychecks, and Peggy makes $3,300 of estimated tax payments. View the standard deduction and child credit amounts. View the 2022 tax rate schedule for the Married filing jointly filing status. Read the requirement. Gross income Next, compute their adjusted gross income. Next, compute their taxable income. (Assume that Peggy qualifies for the qualifed business income deduction.) Married Filing Joint Tax Rate Schedule and taxable income for the second

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started