need this asap please!

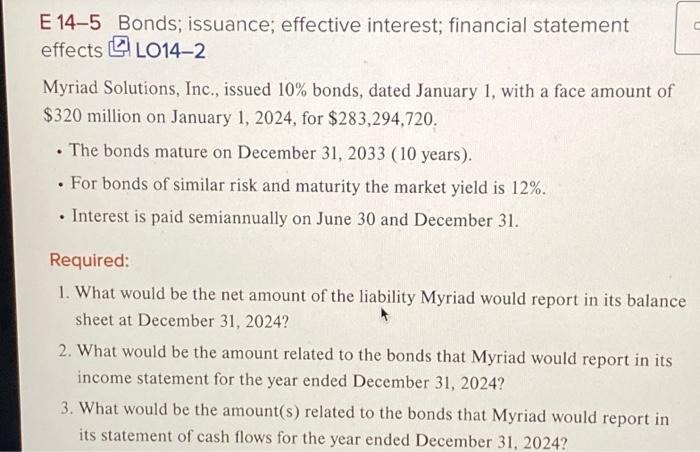

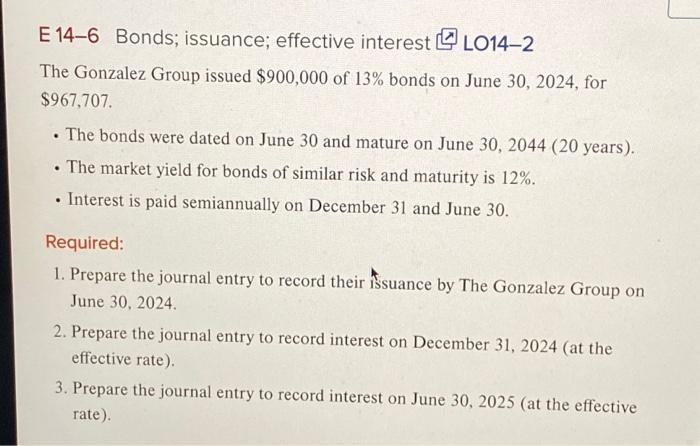

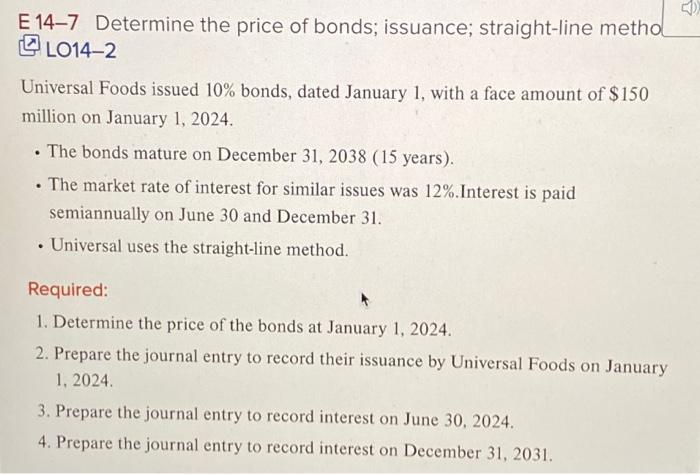

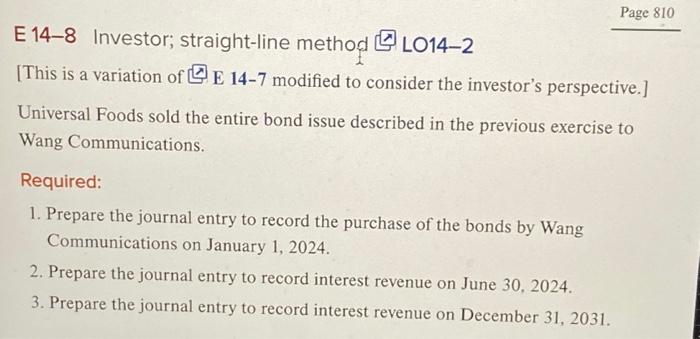

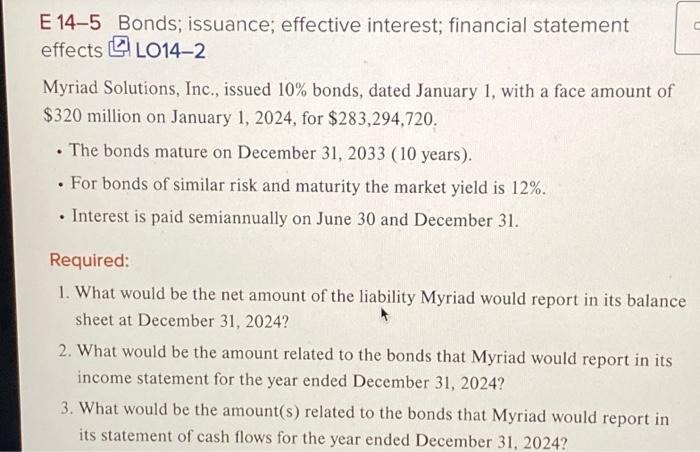

E 14-5 Bonds; issuance; effective interest; financial statement effects LO14-2 Myriad Solutions, Inc., issued 10\% bonds, dated January 1, with a face amount of $320 million on January 1, 2024, for $283,294,720. - The bonds mature on December 31, 2033 (10 years). - For bonds of similar risk and maturity the market yield is 12%. - Interest is paid semiannually on June 30 and December 31 . Required: 1. What would be the net amount of the liability Myriad would report in its balance sheet at December 31, 2024? 2. What would be the amount related to the bonds that Myriad would report in its income statement for the year ended December 31, 2024? 3. What would be the amount(s) related to the bonds that Myriad would report in its statement of cash flows for the year ended December 31.2024 ? E 14-6 Bonds; issuance; effective interest [ LO14-2 The Gonzalez Group issued $900,000 of 13% bonds on June 30,2024 , for $967,707. - The bonds were dated on June 30 and mature on June 30, 2044 (20 years). - The market yield for bonds of similar risk and maturity is 12%. - Interest is paid semiannually on December 31 and June 30. Required: 1. Prepare the journal entry to record their issuance by The Gonzalez Group on June 30, 2024. 2. Prepare the journal entry to record interest on December 31, 2024 (at the effective rate). 3. Prepare the journal entry to record interest on June 30, 2025 (at the effective rate). E 14-7 Determine the price of bonds; issuance; straight-line metho LO14-2 Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1, 2024. - The bonds mature on December 31, 2038 (15 years). - The market rate of interest for similar issues was 12%.Interest is paid semiannually on June 30 and December 31. - Universal uses the straight-line method. Required: 1. Determine the price of the bonds at January 1,2024. 2. Prepare the journal entry to record their issuance by Universal Foods on January 1, 2024. 3. Prepare the journal entry to record interest on June 30, 2024. 4. Prepare the journal entry to record interest on December 31, 2031. E 14-8 Investor; straight-line method LO14-2 [This is a variation of [[E 14-7 modified to consider the investor's perspective.] Universal Foods sold the entire bond issue described in the previous exercise to Wang Communications. Required: 1. Prepare the journal entry to record the purchase of the bonds by Wang Communications on January 1, 2024. 2. Prepare the journal entry to record interest revenue on June 30, 2024. 3. Prepare the journal entry to record interest revenue on December 31, 2031