Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need to do a SWOT analysis for a debt investor Paul Smith, COO (10% shareholder): COO of Kitchens&Co since graduating in 2017; Ben Hughes, Head

Need to do a SWOT analysis for a debt investor

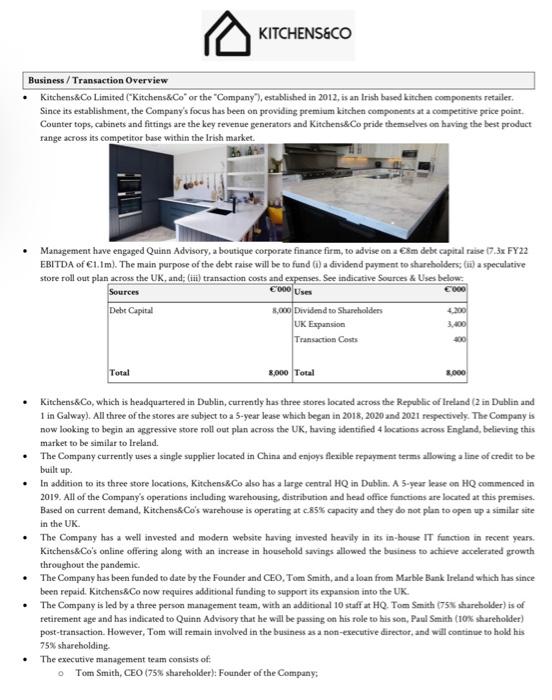

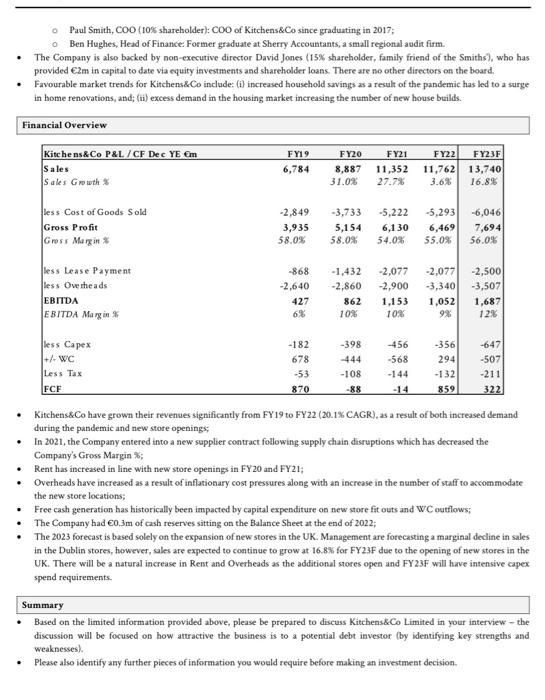

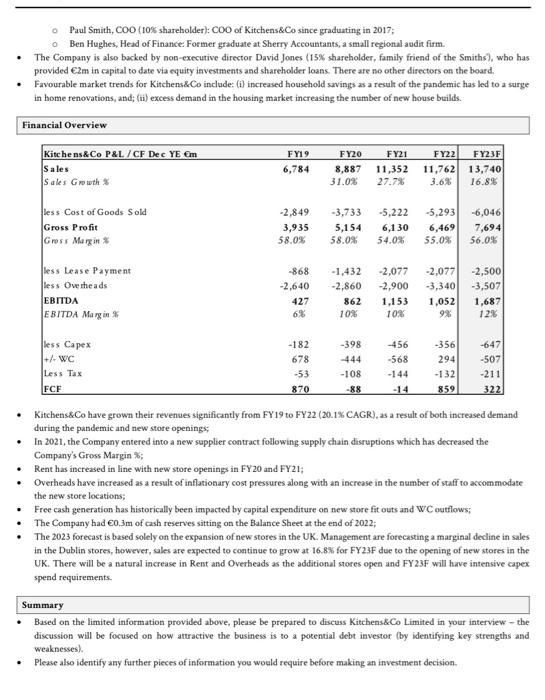

Paul Smith, COO (10\% shareholder): COO of Kitchens\&Co since graduating in 2017; Ben Hughes, Head of Finance. Former graduate at Sherry Accountants, a small regional avdit firm. - The Company is also backed by non-executive director David Jones (15\% shareholder, family friend of the Smiths), who has provided 62m in capiral to date via equity investments and shareholder loans. There are no other directors on the board, - Favourable market trends for Kitchens\&Co include: (i) increased household savings as a result of the pandemic has led to a surge in home renovations, and; (ii) excess demand in the housing market increasing the number of new house builds. - Kitchens\&Co have grown their revenues significantly from FY19 to FY22 (20.1\% CAGR), as a restalt of both increased demand during the pandemic and new store openings; - In 2021, the Company entered into a new supplier contract following supply chain disruptions which has decreased the Company's Gross Margia \%; - Rent has increased in line with new store openings in FY20 and FY21; - Overheads have increased as a result of inflationary cost pressures along with an increase in the number of staff to accommodate the new store locations; - Free cash generation has historically been impacted by capital expenditure on new store fit outs and WC outflows; - The Company had 0,3m of cash reserves sitting on the Balance Sheet at the end of 2022; - The 2023 forecast is based solely on the expansion of new stores in the UK. Management are forecasting a marginal decline in sales in the Dublin stores, however, sales are expected to continue to grow at 16.8% for FY23F due to the opening of new stores in the UK. There will be a natural increase in Rent and Overheads as the additional soores open and FY23F will have intensive capex spend requirements. Summary - Based on the limited information provided above, please be prepared to discuss Kitchens\&Co Limited in your interview - the discussion will be focused on how attractive the business is to a potential debt investor (by identifying key strengths and weaknesses). - Please also identify any further pieces of information you would require before making an investment decision. - Kitchens\&Co Limited ("Kitchens\&Co" or the "Company"), establiched in 2012, is an lrish bused kitchen components retailer. Since its establishment, the Company's focus has been on providing premium kitchen components at a competitive price point. Counter tops, cabinets and fittings are the key revenue generators and Kitchens\&Co pride themselves on baving the best product range across ins competitor base within the lrish market. - Management have engaged Quinn Advisory, a boutique corporate finance firm, to advise on a 68m debe capital nise (7.3x FY22 EBITDA of 1.1m ). The main purpose of the debt raise will be to fund (i) a dividend payment to shareholders, (ii) a speculative store roll out plan across the UK, and: (iii) transaction costs and expenses. See indicative Sources \& Uses below: - Kitchens\&Co, which is headquartered in Dublin, currently has three stores located across the Republic of Ireland ( 2 in Dublin and 1 in Galwayl. All three of the stores are subject to a 5-year lease which began in 2018, 2020 and 2021 ropectivily. The Compuny is now looking to begin an ageressive store roll out plan across the UK, huving identified 4 locations acrons England, believing this market to be similar to Ireland. - The Company currently uses a single supplier located in China and enjoys flexible repayment terms allowing a line of credit to be bailt up. - In addition to its three store locations, Kitchens\&Co also bas a large central HQ in Dublin A 5-year lease on HQ commenced in 2019. All of the Company's operations including warehousing, distribution and head office functions are located at this premises. Based on current demand, Kitchens\&Co's warehouse is operating at c.85\% capacity and they do not plan to open up a similar site in the UK. - The Company has a well invested and modern website having invested heavily in its in-hoese IT function in recent years. Kitchens\&Co's ontine offering along with an increase in household savings allowed the business to achieve acceierated growth throughout the pandemic. - The Company has been funded to date by the Founder and CEO, Tom Smith, and a loan from Marble Bank lreland which has since been repuid. Kitchens\&Co now requires additional funding to support its expansion into the UK. - The Company is led by a three person manugement team, with an additional 10 staff at HQ. Tom Smith (75 K sharcholder) is of retirement age and has indicated to Quinn Advisory that he will be passing on his role to his son, Puul Smith (10s shareholder) post-transaction. However, Tom will remain involved in the business as a non-executive director, and will continue to hold his 75% shareholding. - The executive management team consists of: - Tom Smith, CEO (75\% shareholder): Founder of the Company; - Kitchens\&Co Limited ("Kitchens\&Co" or the "Company"), establiched in 2012, is an lrish bused kitchen components retailer. Since its establishment, the Company's focus has been on providing premium kitchen components at a competitive price point. Counter tops, cabinets and fittings are the key revenue generators and Kitchens\&Co pride themselves on baving the best product range across ins competitor base within the lrish market. - Management have engaged Quinn Advisory, a boutique corporate finance firm, to advise on a 68m debe capital nise (7.3x FY22 EBITDA of 1.1m ). The main purpose of the debt raise will be to fund (i) a dividend payment to shareholders, (ii) a speculative store roll out plan across the UK, and: (iii) transaction costs and expenses. See indicative Sources \& Uses below: - Kitchens\&Co, which is headquartered in Dublin, currently has three stores located across the Republic of Ireland ( 2 in Dublin and 1 in Galwayl. All three of the stores are subject to a 5-year lease which began in 2018, 2020 and 2021 ropectivily. The Compuny is now looking to begin an ageressive store roll out plan across the UK, huving identified 4 locations acrons England, believing this market to be similar to Ireland. - The Company currently uses a single supplier located in China and enjoys flexible repayment terms allowing a line of credit to be bailt up. - In addition to its three store locations, Kitchens\&Co also bas a large central HQ in Dublin A 5-year lease on HQ commenced in 2019. All of the Company's operations including warehousing, distribution and head office functions are located at this premises. Based on current demand, Kitchens\&Co's warehouse is operating at c.85\% capacity and they do not plan to open up a similar site in the UK. - The Company has a well invested and modern website having invested heavily in its in-hoese IT function in recent years. Kitchens\&Co's ontine offering along with an increase in household savings allowed the business to achieve acceierated growth throughout the pandemic. - The Company has been funded to date by the Founder and CEO, Tom Smith, and a loan from Marble Bank lreland which has since been repuid. Kitchens\&Co now requires additional funding to support its expansion into the UK. - The Company is led by a three person manugement team, with an additional 10 staff at HQ. Tom Smith (75 K sharcholder) is of retirement age and has indicated to Quinn Advisory that he will be passing on his role to his son, Puul Smith (10s shareholder) post-transaction. However, Tom will remain involved in the business as a non-executive director, and will continue to hold his 75% shareholding. - The executive management team consists of: - Tom Smith, CEO (75\% shareholder): Founder of the Company; Paul Smith, COO (10\% shareholder): COO of Kitchens\&Co since graduating in 2017; Ben Hughes, Head of Finance. Former graduate at Sherry Accountants, a small regional avdit firm. - The Company is also backed by non-executive director David Jones (15\% shareholder, family friend of the Smiths), who has provided 62m in capiral to date via equity investments and shareholder loans. There are no other directors on the board, - Favourable market trends for Kitchens\&Co include: (i) increased household savings as a result of the pandemic has led to a surge in home renovations, and; (ii) excess demand in the housing market increasing the number of new house builds. - Kitchens\&Co have grown their revenues significantly from FY19 to FY22 (20.1\% CAGR), as a restalt of both increased demand during the pandemic and new store openings; - In 2021, the Company entered into a new supplier contract following supply chain disruptions which has decreased the Company's Gross Margia \%; - Rent has increased in line with new store openings in FY20 and FY21; - Overheads have increased as a result of inflationary cost pressures along with an increase in the number of staff to accommodate the new store locations; - Free cash generation has historically been impacted by capital expenditure on new store fit outs and WC outflows; - The Company had 0,3m of cash reserves sitting on the Balance Sheet at the end of 2022; - The 2023 forecast is based solely on the expansion of new stores in the UK. Management are forecasting a marginal decline in sales in the Dublin stores, however, sales are expected to continue to grow at 16.8% for FY23F due to the opening of new stores in the UK. There will be a natural increase in Rent and Overheads as the additional soores open and FY23F will have intensive capex spend requirements. Summary - Based on the limited information provided above, please be prepared to discuss Kitchens\&Co Limited in your interview - the discussion will be focused on how attractive the business is to a potential debt investor (by identifying key strengths and weaknesses). - Please also identify any further pieces of information you would require before making an investment decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started