Need to do the adjusting entry

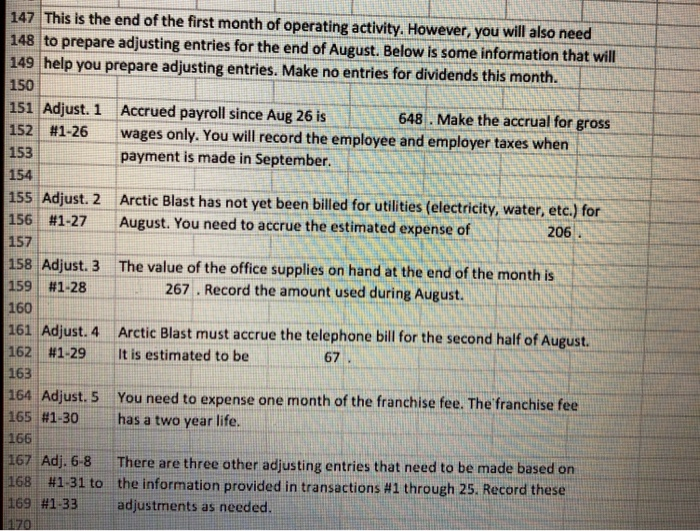

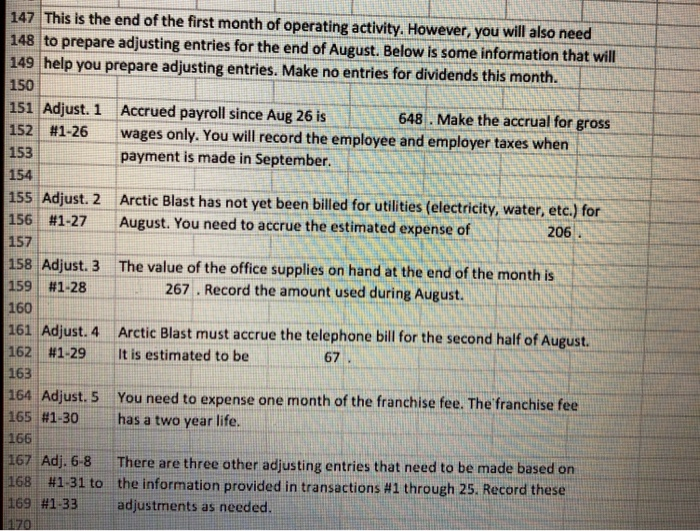

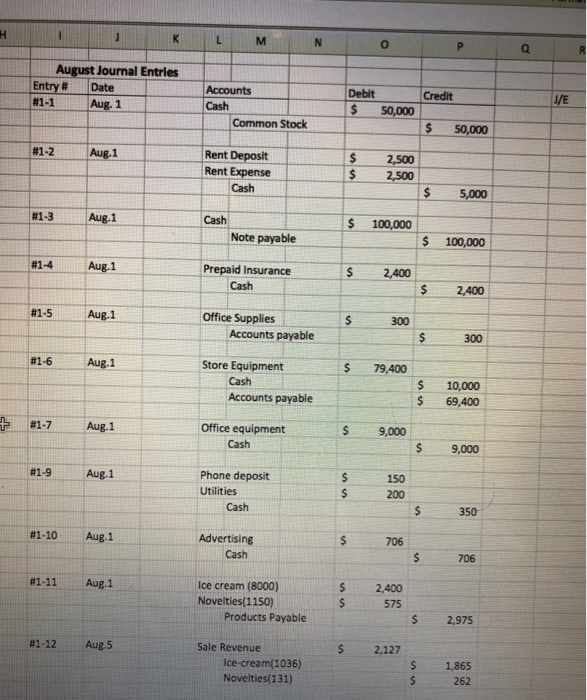

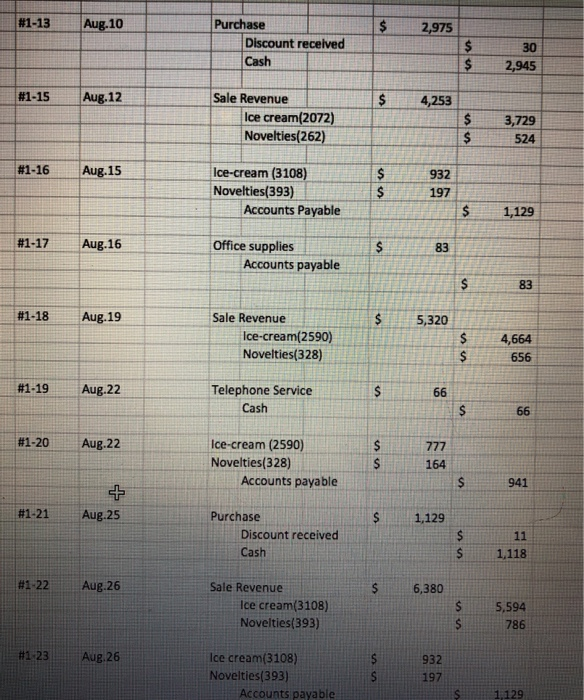

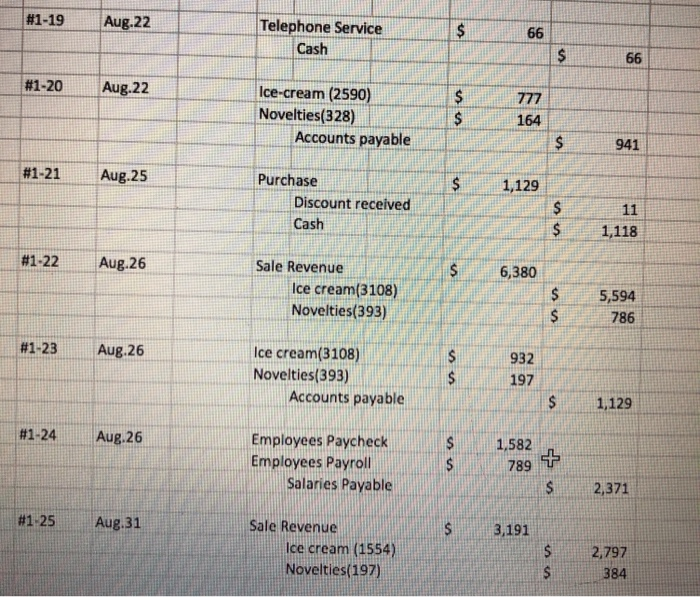

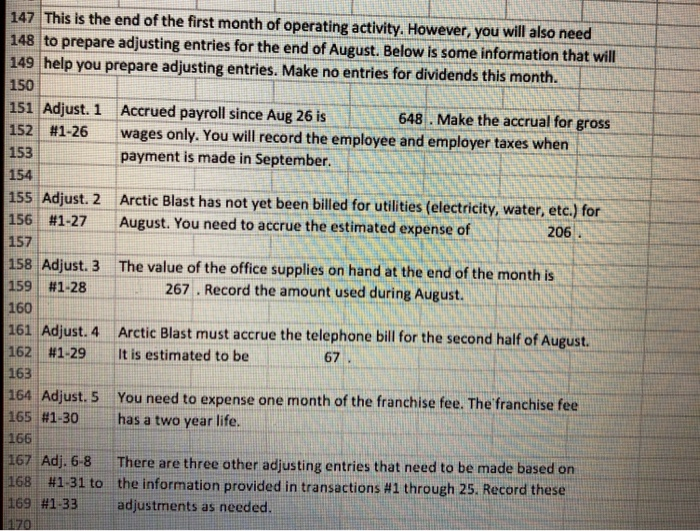

147 This is the end of the first month of operating activity. However, you will also need 148 to prepare adjusting entries for the end of August. Below is some information that will 149 help you prepare adjusting entries. Make no entries for dividends this month 150 151 Adjust. 1 Accrued payroll since Aug 26 is 152/ #1-26 wages only. You will record the employee and employer taxes when 153 154 648. Make the accrual for gross payment is made in September. 155 Adjust. 2 Arctic Blast has not yet been billed for utilities (electricity, water, ete) for 156 #1-27 August. You need to accrue the estimated expense of 157 158 Adjust. 3 The value of the office supplies on hand at the end of the month is 159: #1-28 160 161 Adjust. 4 Arctic Blast must accrue the telephone bill for the second half of August. 162 : #1-29 It is estimated to be 163 164 Adjust. 5 You need to expense one month of the franchise fee. The franchise fee 165 #1-30 has a two year life. 166 167 Adj. 6-8 There are three other adjusting entries that need to be made based on 168 #1-31 to the information provided in transactions #1 through 25, Record these 169 #1-33 adjustments as needed. 206. 267. Record the amount used during August. 67 0 August Journal Entries EntryDateAccountsDebit Credit #1-1 Aug. 1 Cash s50,000 - Common Stock 50,000 #1-2 Rent Deposit Rent Expense Cash 2,500 $2,500 $ 5,000 en-3- Aug.1 100,000 . Note payable S 100,000 #1-4 Aug.1 $ 2,400 Prepaid Insurance Cash 2,400 #1-5 Aug.1 Office Supplies 300 Accounts payable 300 #1-6 Aug.1 Store Equipment S79,400 Cash Accounts payable S10,000 S 69,400 #1-7 Aug.1 Office equipment 9,000 S 9,000 #1-9 Aug.1 Phone deposit Utilities 150 350 #1-10 Aug.1 Advertising 706 Cash 706 Ice cream (8000) Novelties(1150) $ 2,400 575 #1-11 Aug.1 Products Payable s 2,975 #1-12 Aug,5 Sale Revenue s 2,127 Ice-cream(1036) Novelties(133) S 1.865 S 262 |#1-13 Aug.10 | $2,979 Purchase Discount received Cash 30 $2,945 #1-15 Aug.12 Sale Revenue s4,253 -- Ice cream(2072) Novelties(262) 3,729 524 Ice-cream (3108) Novelties(393) 932 197 #1-16 Aug.15 Accounts Payable s 1,129 | #1-17 Aug.16 Office supplies 83 Accounts payable 83 #1-18 Aug.19 Sale Revenue 5,320 Ice-cream(2590) Novelties(328) 4,664 656 #1-19 Aug.22 Telephone Service Cash Ice-cream (2590) Novelties(328) #1-20 Aug.22 s164 Accounts payable 941 #1-21 Aug.25 Purchase $1,129 Discount received Cash S1,118 #1-22 Aug.26 Sale Revenue 6,380 Ice cream(3108) Novelties(393) $ 5,594 786 Ice cream(3108) Novelties(393) 932 197 #123 Aug.26 Accounts payable 1,129 #1-19 Aug.22 | Telephone Service Cash #1-20 Aug.22 Ice-cream (2590) Novelties(328) 164 Accounts payable 941 #1-21 Aug.25 Purchase $1,129 Discount received Cash 1,118 #1-22 Aug.26 Sale Revenue $ 6,380 Ice cream(3108) Novelties(393) $ 5,594 786 #1-23 Aug.26 Ice cream(3108) Novelties(393) 932 197 Accounts payable S 1,129 #1-24 Aug.26 Employees Paycheck s 1.582 Employees PayrollS789 t Salaries Payable s2,371 #1-25 Aug.31 Sale Revenue S3,191 Ice cream (1554) Novelties(197) $2,797 384 147 This is the end of the first month of operating activity. However, you will also need 148 to prepare adjusting entries for the end of August. Below is some information that will 149 help you prepare adjusting entries. Make no entries for dividends this month 150 151 Adjust. 1 Accrued payroll since Aug 26 is 152/ #1-26 wages only. You will record the employee and employer taxes when 153 154 648. Make the accrual for gross payment is made in September. 155 Adjust. 2 Arctic Blast has not yet been billed for utilities (electricity, water, ete) for 156 #1-27 August. You need to accrue the estimated expense of 157 158 Adjust. 3 The value of the office supplies on hand at the end of the month is 159: #1-28 160 161 Adjust. 4 Arctic Blast must accrue the telephone bill for the second half of August. 162 : #1-29 It is estimated to be 163 164 Adjust. 5 You need to expense one month of the franchise fee. The franchise fee 165 #1-30 has a two year life. 166 167 Adj. 6-8 There are three other adjusting entries that need to be made based on 168 #1-31 to the information provided in transactions #1 through 25, Record these 169 #1-33 adjustments as needed. 206. 267. Record the amount used during August. 67 0 August Journal Entries EntryDateAccountsDebit Credit #1-1 Aug. 1 Cash s50,000 - Common Stock 50,000 #1-2 Rent Deposit Rent Expense Cash 2,500 $2,500 $ 5,000 en-3- Aug.1 100,000 . Note payable S 100,000 #1-4 Aug.1 $ 2,400 Prepaid Insurance Cash 2,400 #1-5 Aug.1 Office Supplies 300 Accounts payable 300 #1-6 Aug.1 Store Equipment S79,400 Cash Accounts payable S10,000 S 69,400 #1-7 Aug.1 Office equipment 9,000 S 9,000 #1-9 Aug.1 Phone deposit Utilities 150 350 #1-10 Aug.1 Advertising 706 Cash 706 Ice cream (8000) Novelties(1150) $ 2,400 575 #1-11 Aug.1 Products Payable s 2,975 #1-12 Aug,5 Sale Revenue s 2,127 Ice-cream(1036) Novelties(133) S 1.865 S 262 |#1-13 Aug.10 | $2,979 Purchase Discount received Cash 30 $2,945 #1-15 Aug.12 Sale Revenue s4,253 -- Ice cream(2072) Novelties(262) 3,729 524 Ice-cream (3108) Novelties(393) 932 197 #1-16 Aug.15 Accounts Payable s 1,129 | #1-17 Aug.16 Office supplies 83 Accounts payable 83 #1-18 Aug.19 Sale Revenue 5,320 Ice-cream(2590) Novelties(328) 4,664 656 #1-19 Aug.22 Telephone Service Cash Ice-cream (2590) Novelties(328) #1-20 Aug.22 s164 Accounts payable 941 #1-21 Aug.25 Purchase $1,129 Discount received Cash S1,118 #1-22 Aug.26 Sale Revenue 6,380 Ice cream(3108) Novelties(393) $ 5,594 786 Ice cream(3108) Novelties(393) 932 197 #123 Aug.26 Accounts payable 1,129 #1-19 Aug.22 | Telephone Service Cash #1-20 Aug.22 Ice-cream (2590) Novelties(328) 164 Accounts payable 941 #1-21 Aug.25 Purchase $1,129 Discount received Cash 1,118 #1-22 Aug.26 Sale Revenue $ 6,380 Ice cream(3108) Novelties(393) $ 5,594 786 #1-23 Aug.26 Ice cream(3108) Novelties(393) 932 197 Accounts payable S 1,129 #1-24 Aug.26 Employees Paycheck s 1.582 Employees PayrollS789 t Salaries Payable s2,371 #1-25 Aug.31 Sale Revenue S3,191 Ice cream (1554) Novelties(197) $2,797 384