need urget please 10minuate

need urget please 10minuate

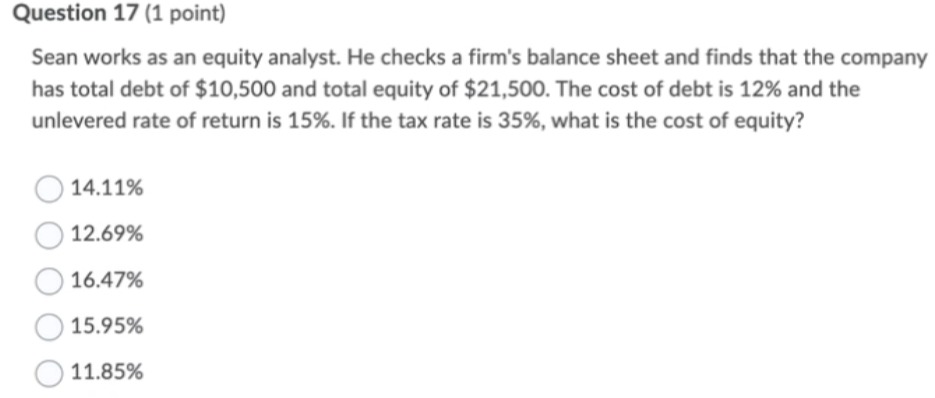

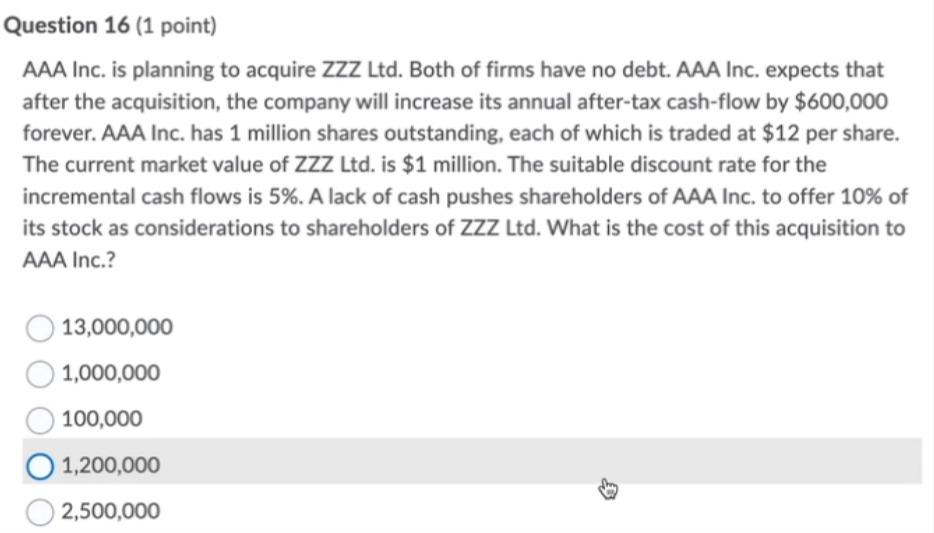

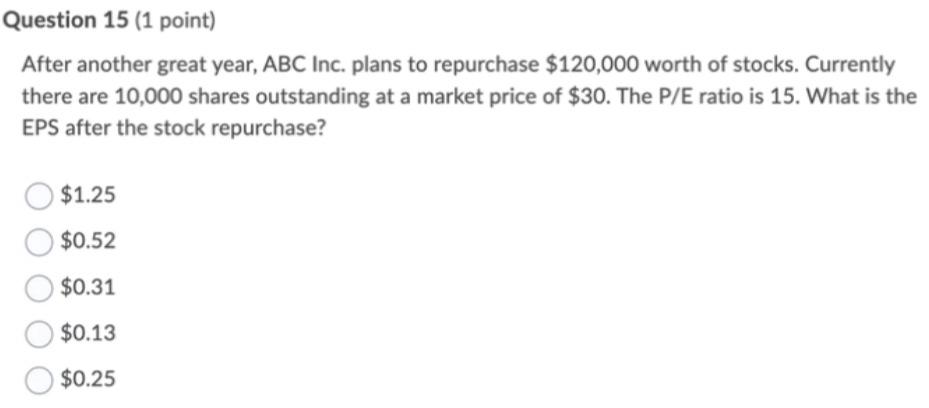

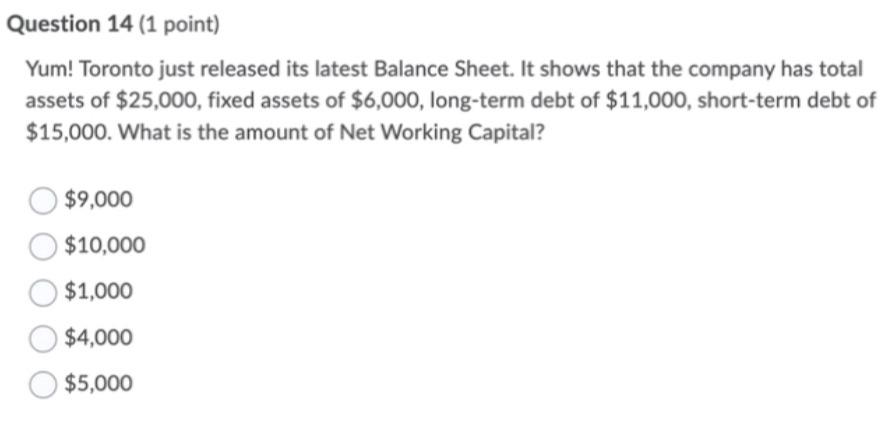

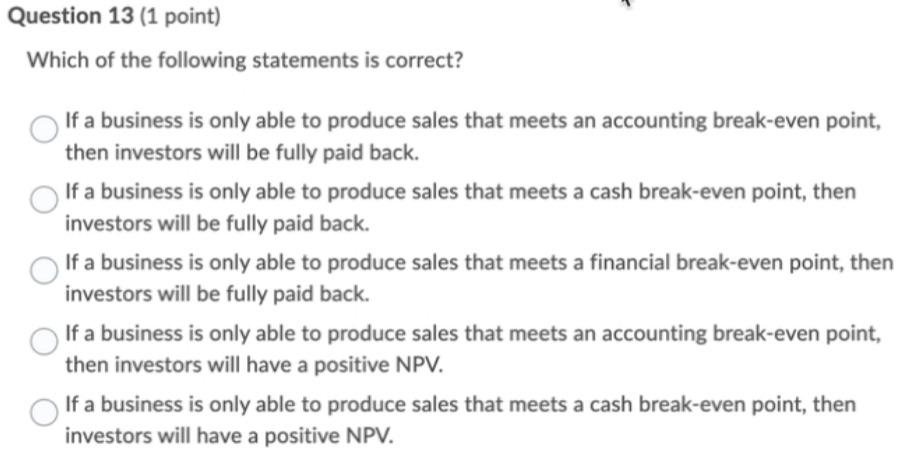

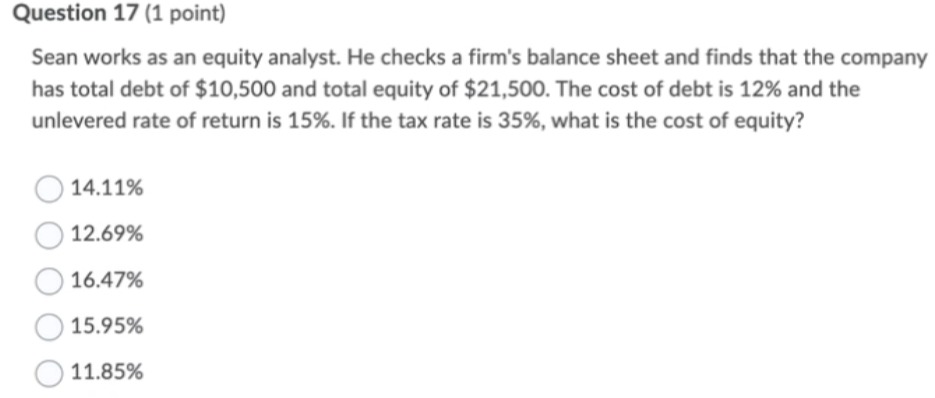

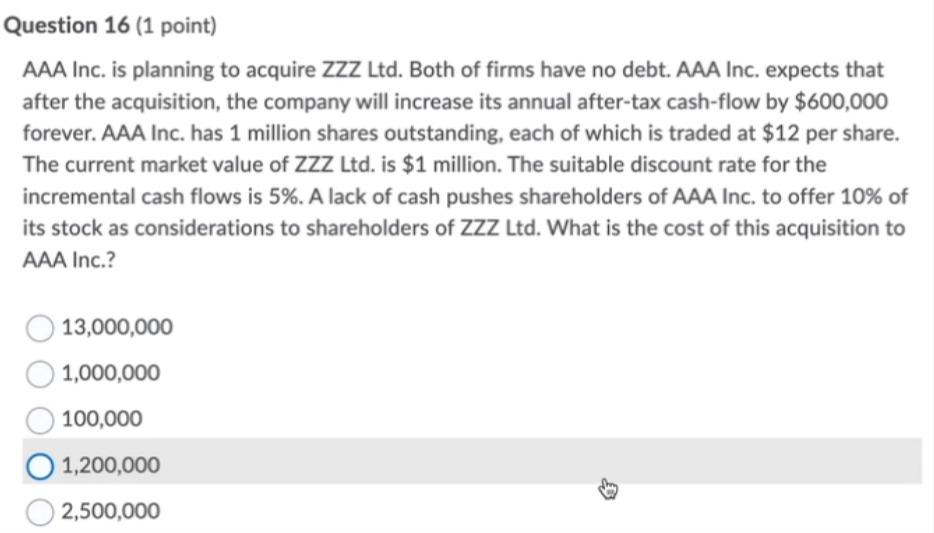

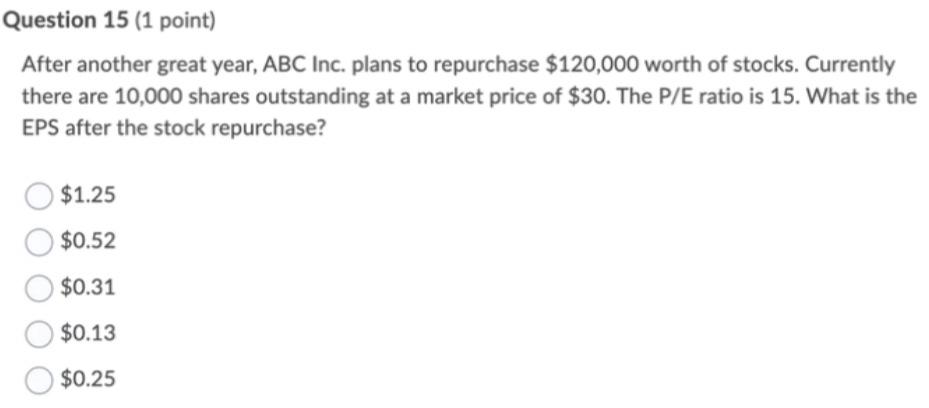

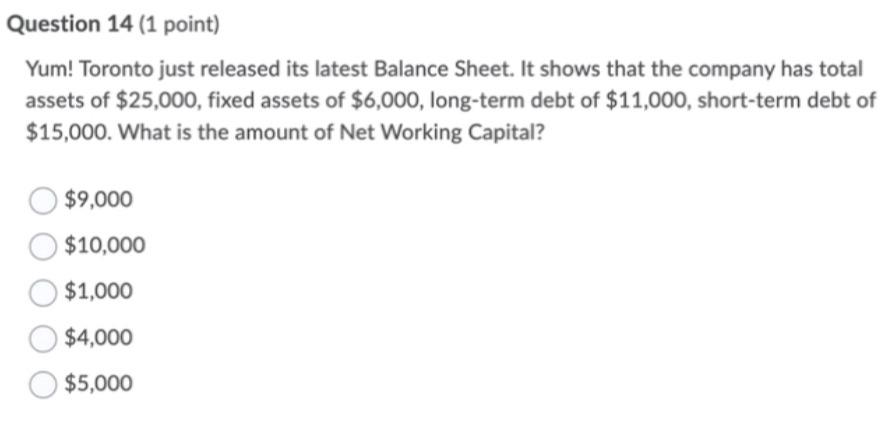

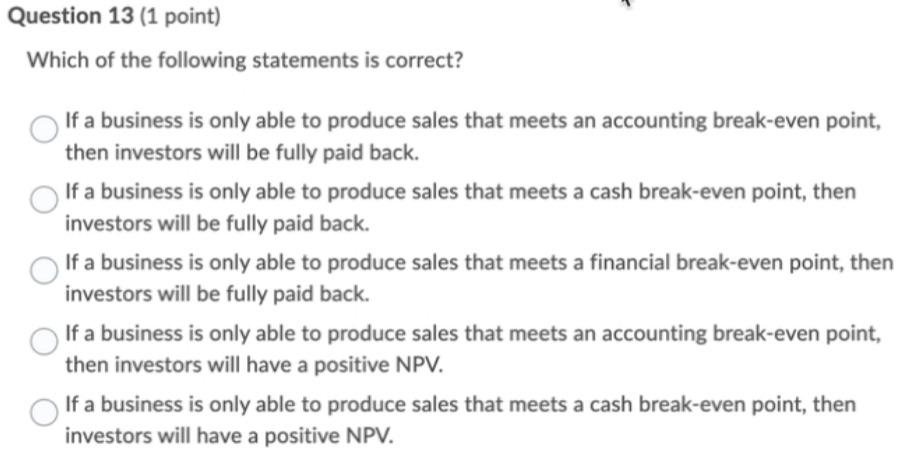

Question 17 (1 point) Sean works as an equity analyst. He checks a firm's balance sheet and finds that the company has total debt of $10,500 and total equity of $21,500. The cost of debt is 12% and the unlevered rate of return is 15%. If the tax rate is 35%, what is the cost of equity? 14.11% 12.69% 16.47% 15.95% 11.85% Question 16 (1 point) AAA Inc. is planning to acquire ZZZ Ltd. Both of firms have no debt. AAA Inc. expects that after the acquisition, the company will increase its annual after-tax cash-flow by $600,000 forever. AAA Inc. has 1 million shares outstanding, each of which is traded at $12 per share. The current market value of ZZZ Ltd. is $1 million. The suitable discount rate for the incremental cash flows is 5%. A lack of cash pushes shareholders of AAA Inc. to offer 10% of its stock as considerations to shareholders of ZZZ Ltd. What is the cost of this acquisition to AAA Inc.? 13,000,000 1,000,000 100,000 1,200,000 2,500,000 Question 15 (1 point) After another great year, ABC Inc. plans to repurchase $120,000 worth of stocks. Currently there are 10,000 shares outstanding at a market price of $30. The P/E ratio is 15. What is the EPS after the stock repurchase? $1.25 $0.52 $0.31 $0.13 $0.25 Question 14 (1 point) Yum! Toronto just released its latest Balance Sheet. It shows that the company has total assets of $25,000, fixed assets of $6,000, long-term debt of $11,000, short-term debt of $15,000. What is the amount of Net Working Capital? $9,000 $10,000 $1,000 $4,000 $5,000 Question 13 (1 point) Which of the following statements is correct? If a business is only able to produce sales that meets an accounting break-even point, then investors will be fully paid back. If a business is only able to produce sales that meets a cash break-even point, then investors will be fully paid back. If a business is only able to produce sales that meets a financial break-even point, then investors will be fully paid back. If a business is only able to produce sales that meets an accounting break-even point, then investors will have a positive NPV. O If a business is only able to produce sales that meets a cash break-even point, then investors will have a positive NPV

need urget please 10minuate

need urget please 10minuate