Answered step by step

Verified Expert Solution

Question

1 Approved Answer

needed ASAP!! thanks in advance Pollution Busters Inc. is considering a purchase of 10 additional carbon sequesters for $113,000 apiece. The sequesters last for only

needed ASAP!! thanks in advance

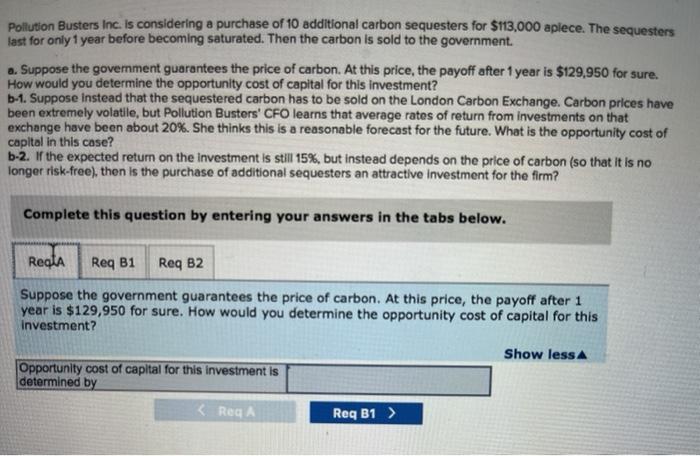

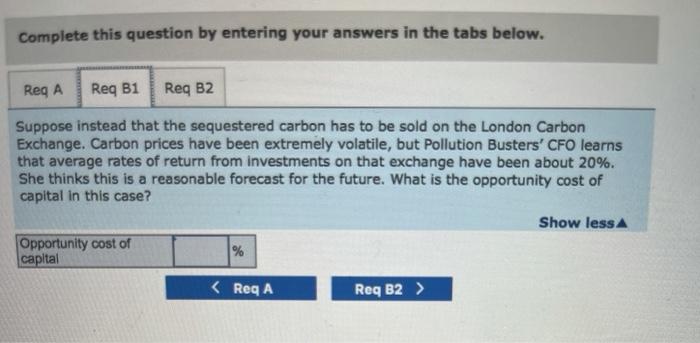

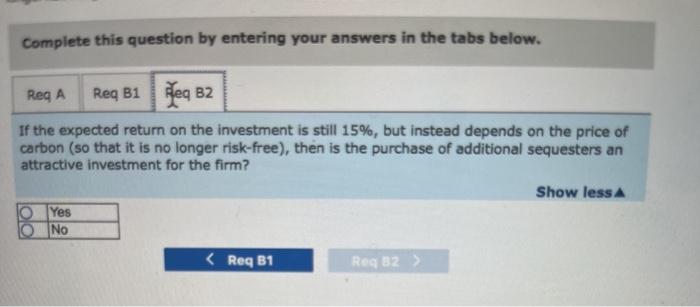

Pollution Busters Inc. is considering a purchase of 10 additional carbon sequesters for $113,000 apiece. The sequesters last for only 1 year before becoming saturated. Then the carbon is sold to the government. . Suppose the government guarantees the price of carbon. At this price, the payoff after 1 year is $129,950 for sure. How would you determine the opportunity cost of capital for this investment? b-1. Suppose Instead that the sequestered carbon has to be sold on the London Carbon Exchange. Carbon prices have been extremely volatile, but Pollution Busters' CFO learns that average rates of return from investments on that exchange have been about 20%. She thinks this is a reasonable forecast for the future. What is the opportunity cost of capital in this case? b-2. If the expected return on the investment is still 15%, but instead depends on the price of carbon (so that it is no longer risk-free), then is the purchase of additional sequesters an attractive Investment for the firm? Complete this question by entering your answers in the tabs below. Regla Req B1 Req B2 Suppose the government guarantees the price of carbon. At this price, the payoff after 1 year is $129,950 for sure. How would you determine the opportunity cost of capital for this investment? Show less Opportunity cost of capital for this investment is determined by Complete this question by entering your answers in the tabs below. Reg A Req B1 Req B2 Suppose instead that the sequestered carbon has to be sold on the London Carbon Exchange. Carbon prices have been extremely volatile, but Pollution Busters' CFO learns that average rates of return from investments on that exchange have been about 20%. She thinks this is a reasonable forecast for the future. What is the opportunity cost of capital in this case? Show less A Opportunity cost of % capital Complete this question by entering your answers in the tabs below. Reg A Req B1 Req B2 If the expected return on the investment is still 15%, but instead depends on the price of carbon (so that it is no longer risk-free), then is the purchase of additional sequesters an attractive investment for the firm? Show less Yes No Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started