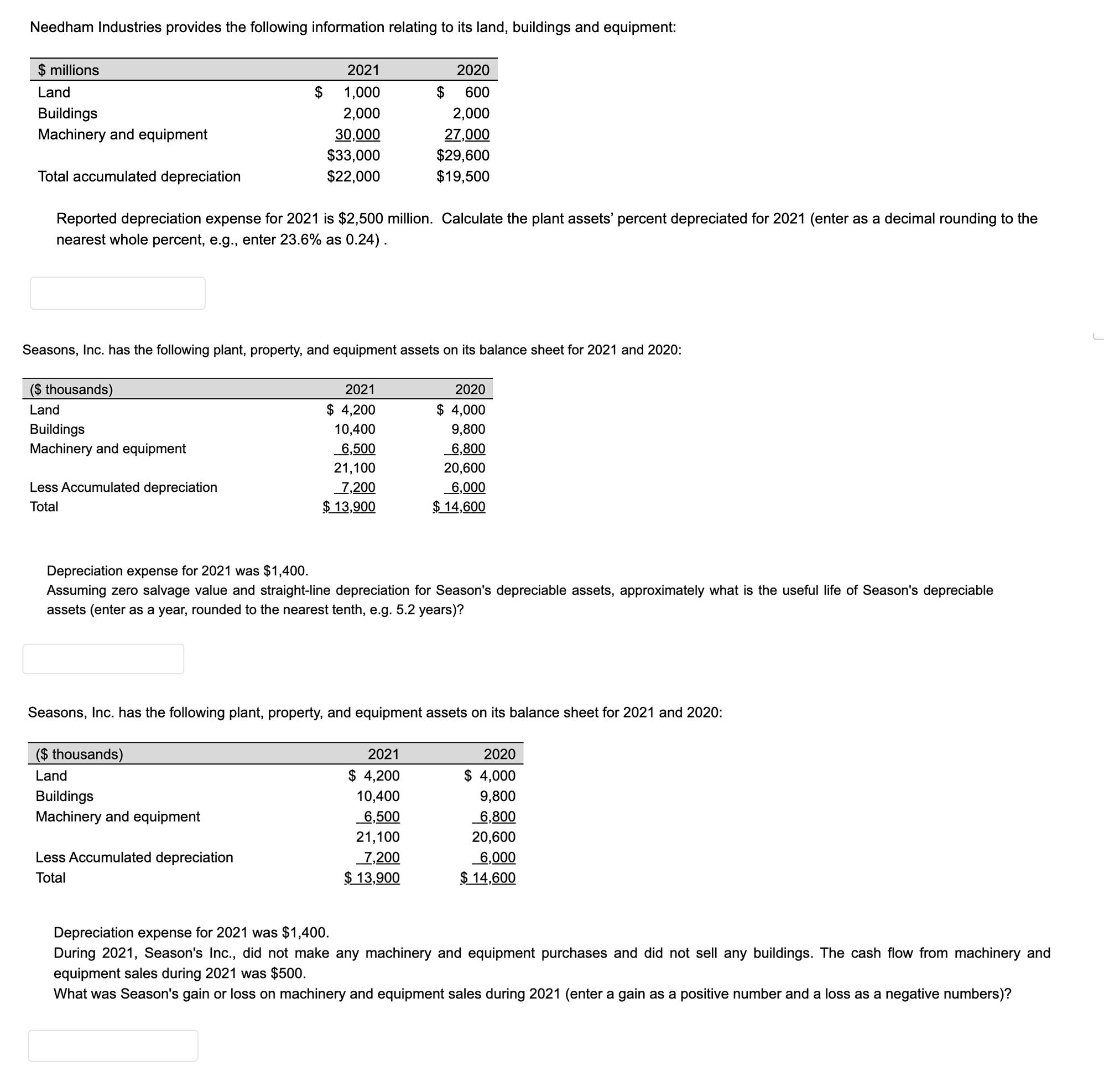

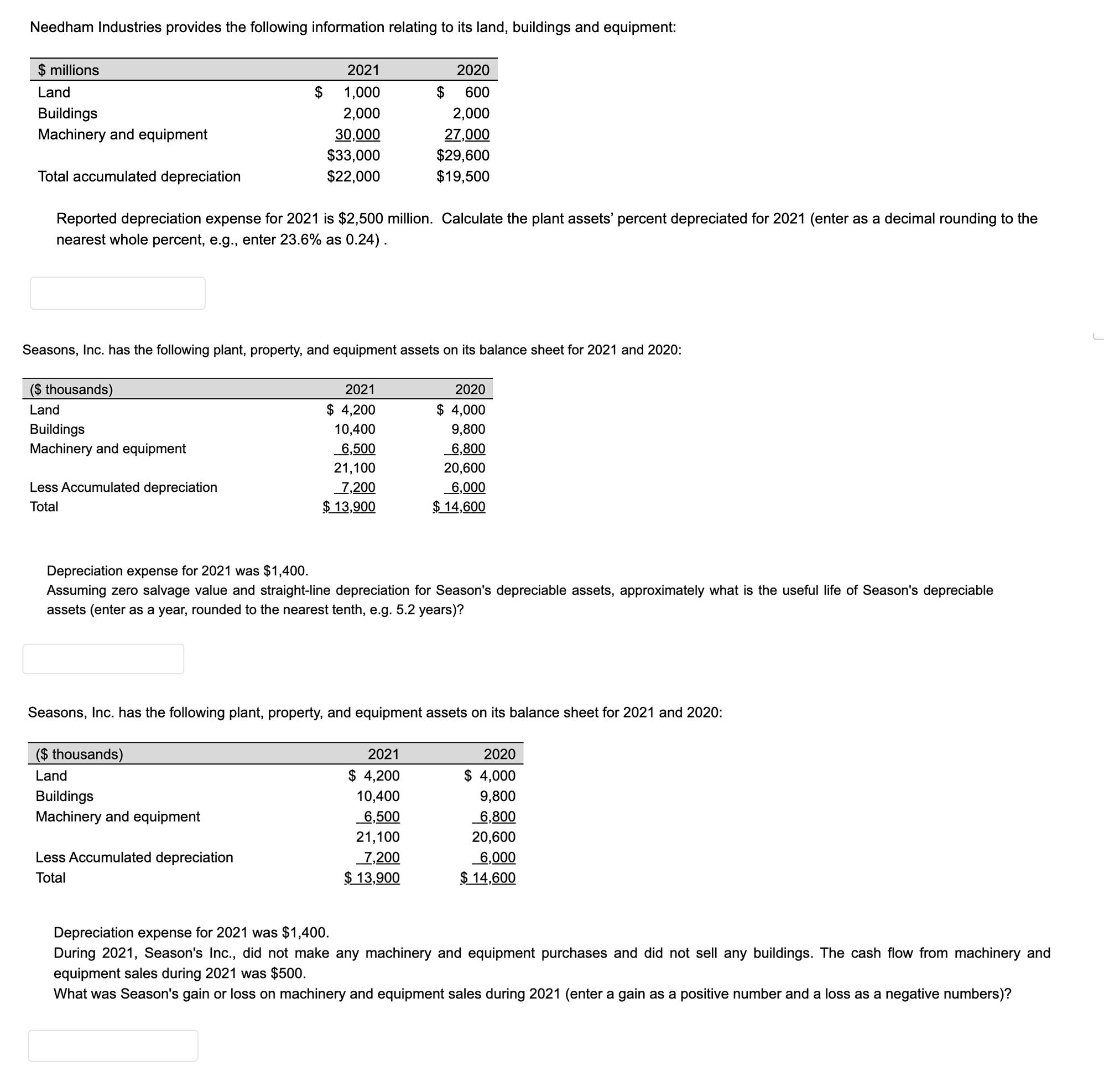

Needham Industries provides the following information relating to its land, buildings and equipment: $ millions Land Buildings Machinery and equipment 2021 $ 1,000 2,000 30,000 $33,000 $22,000 2020 $ 600 2,000 27,000 $29,600 $19,500 Total accumulated depreciation Reported depreciation expense for 2021 is $2,500 million. Calculate the plant assets' percent depreciated for 2021 (enter as a decimal rounding to the nearest whole percent, e.g., enter 23.6% as 0.24). Seasons, Inc. has the following plant, property, and equipment assets on its balance sheet for 2021 and 2020: ($ thousands) Land Buildings Machinery and equipment 2021 $ 4,200 10,400 6,500 21,100 7,200 $ 13,900 2020 4,000 9,800 6,800 20,600 Less Accumulated depreciation Total 6,000 $ 14,600 Depreciation expense for 2021 was $1,400. Assuming zero salvage value and straight-line depreciation for Season's depreciable assets, approximately what is the useful life of Season's depreciable assets (enter as a year, rounded to the nearest tenth, e.g. 5.2 years)? Seasons, Inc. has the following plant, property, and equipment assets on its balance sheet for 20 2020: ($ thousands) Land Buildings Machinery and equipment 2021 $ 4,200 10,400 6,500 21,100 7,200 $ 13,900 2020 $ 4,000 9,800 6,800 20,600 6,000 $ 14,600 Less Accumulated depreciation Total Depreciation expense for 2021 was $1,400. During 2021, Season's Inc., did not make any machinery and equipment purchases and did not sell any buildings. The cash flow from machinery and equipment sales during 2021 was $500. What was Season's gain or loss on machinery and equipment sales during 2021 (enter a gain as a positive number and a loss as a negative numbers)? Needham Industries provides the following information relating to its land, buildings and equipment: $ millions Land Buildings Machinery and equipment 2021 $ 1,000 2,000 30,000 $33,000 $22,000 2020 $ 600 2,000 27,000 $29,600 $19,500 Total accumulated depreciation Reported depreciation expense for 2021 is $2,500 million. Calculate the plant assets' percent depreciated for 2021 (enter as a decimal rounding to the nearest whole percent, e.g., enter 23.6% as 0.24). Seasons, Inc. has the following plant, property, and equipment assets on its balance sheet for 2021 and 2020: ($ thousands) Land Buildings Machinery and equipment 2021 $ 4,200 10,400 6,500 21,100 7,200 $ 13,900 2020 4,000 9,800 6,800 20,600 Less Accumulated depreciation Total 6,000 $ 14,600 Depreciation expense for 2021 was $1,400. Assuming zero salvage value and straight-line depreciation for Season's depreciable assets, approximately what is the useful life of Season's depreciable assets (enter as a year, rounded to the nearest tenth, e.g. 5.2 years)? Seasons, Inc. has the following plant, property, and equipment assets on its balance sheet for 20 2020: ($ thousands) Land Buildings Machinery and equipment 2021 $ 4,200 10,400 6,500 21,100 7,200 $ 13,900 2020 $ 4,000 9,800 6,800 20,600 6,000 $ 14,600 Less Accumulated depreciation Total Depreciation expense for 2021 was $1,400. During 2021, Season's Inc., did not make any machinery and equipment purchases and did not sell any buildings. The cash flow from machinery and equipment sales during 2021 was $500. What was Season's gain or loss on machinery and equipment sales during 2021 (enter a gain as a positive number and a loss as a negative numbers)