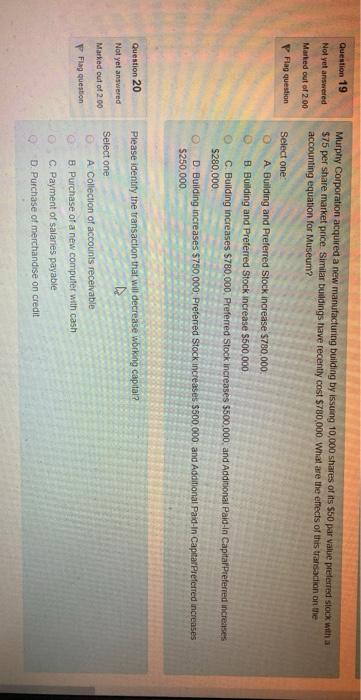

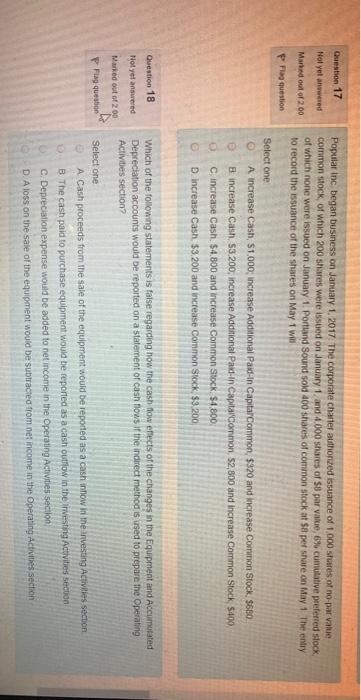

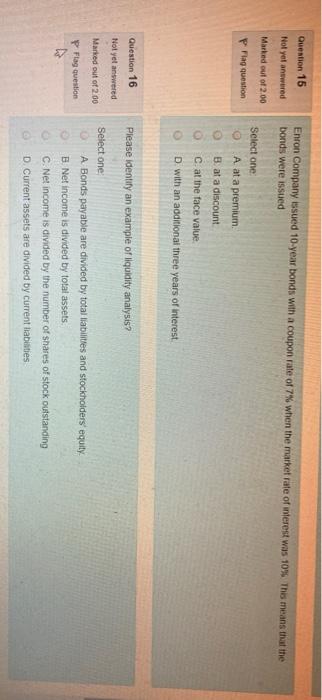

Question 19 Not yet answered Murphy Corporation acquired a new manufacturing building by issuing 10,000 shares of its $50 par value preferred stock with a $75 per share market price. Similar buildings have recently cost $780,000 What are the effects of this transaction on the accounting equation for Museum? Marked out of 2 00 Flag question Select one A Building and Preferred Stock increase $780,000 B Building and Preferred Stock Increase $500,000 C Building increases $780.000. Preferred Stock increases $500,000 and Additional Paid In Capital Preferred increases $280,000 D. Building increases $750,000: Preferred Stock Increases $500,000 and Additional Paid-in Capital Preferred increases $250.000 Please identify the transaction that will decrease working capital? Question 20 Not yet answered Marked out of 2.00 Select one A Collection of accounts receivable B. Purchase of a new computer with cash P Flag question C. Payment of salaries payable D. Purchase of merchandise on credit Question 17 Not yet anwered Popular Inc began business on January 1, 2017. The corporate charter authorized issuance of 1000 suites of no parvane common stock, of which 200 shares were issued on January 1, and 4,000 shares of S8 par value, 6% cumulative preferred stock, of which one were issued on January 1. Portland Sound sold 400 shares of common stock at sa per share on May 1 The entry to record the issuance of the shares on May 1 will Mand out of 200 P Fla question Select one A. Increase Cash, S1000, increase Additional Paid in Capital Common, $320 and increase Corrunon stock. $600 8 increase Cash, 53200, increase Additional Park in Capital Common 52,800 and increase Common Stock $100 Cincrease Cash $4.800 and increase Common Stock $4.800 D. Increase Cash $3,200 and increase Common Stock $3.200 Question 18 Not yet answered Which of the following statements is false regarding how the cash flow effects of the changes in the Equipment and Accumulated Depreciation accounts would be reported on a statement of cash flows if the indirect method is used to prepare the operating Activities section Marked out of 200 P Flag question Select one A Cash proceeds from the sale of the equipment would be reported as a cash intlow in the investing Activities section B. The cash paid to purchase equipment would be reported as a cash outflow in the investing Activities section C. Depreciation expense would be added to net income in the Operating Activities Section D. A loss on the sale of the equipment would be subtracted from net income in the Operating Activities section Question 15 Enron Company issued 10-year bonds with a coupon rate of 7% when the market rate of interest was 10% This means that the bonds were issued Not yet answered Marked out of 2.00 p Flag question Select one A at a premium B at a discount C at the face value D. with an additional three years of interest. Question 16 Please identity an example of liquidity analysis? Not yet answered Marked out of 2.00 Flag question Select one A Bonds payable are divided by total liabilities and stockholders equity B. Net income is divided by total assets C. Net income is divided by the number of shares of stock outstanding D. Current assets are divided by current liabilities