Neee help with these questions

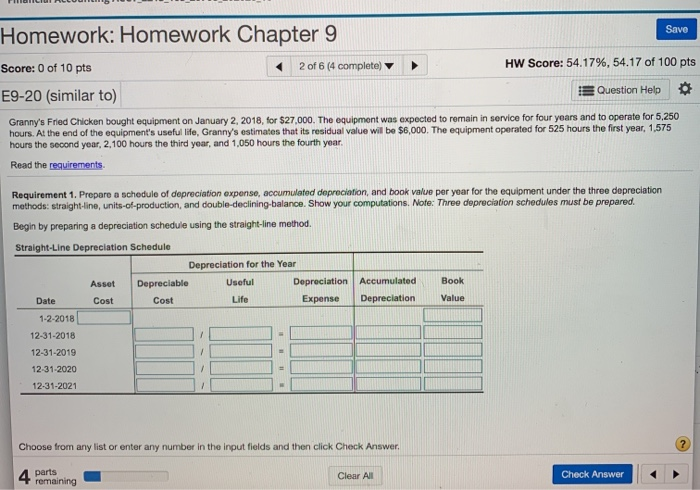

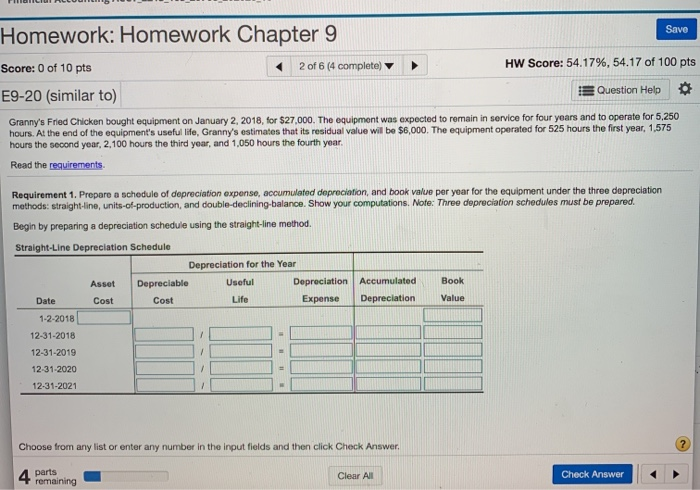

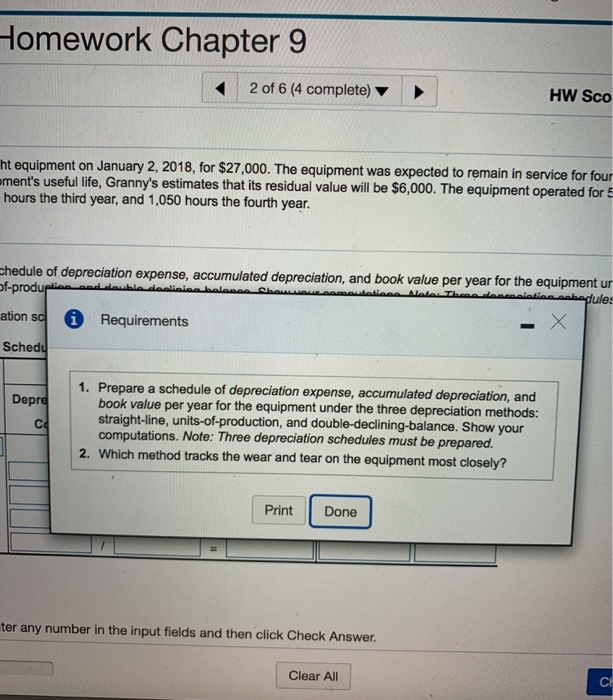

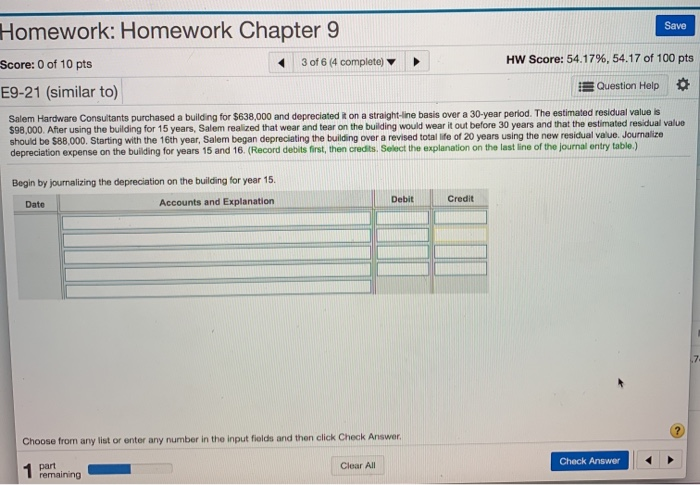

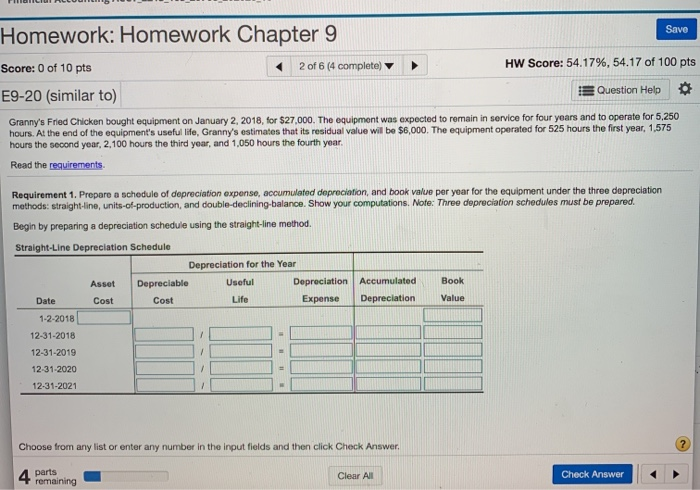

Save Homework: Homework Chapter 9 Score: 0 of 10 pts 2 of 6 (4 complete) E9-20 (similar to) HW Score: 54.17%, 54.17 of 100 pts Question Help Granny's Fried Chicken bought equipment on January 2, 2018, for $27,000. The equipment was expected to remain in service for four years and to operate for 5,250 hours. At the end of the equipment's useful life, Granny's estimates that its residual value will be $6,000. The equipment operated for 525 hours the first year, 1,575 hours the second year, 2,100 hours the third year, and 1,050 hours the fourth year Read the requirements Requirement 1. Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods: straight-line, units-of-production, and double-declining balance. Show your computations. Note: Three depreciation schedules must be prepared. Begin by preparing a depreciation schedule using the straight-line method Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Expense Depreciation Value 1-2-2018 12-31-2018 12-31-2019 12-31-2020 12-31-2021 Life Choose from any list or enter any number in the input fields and then click Check Answer 4 parts 4 remaining Clear All Check Answer Homework Chapter 9 2 of 6 (4 complete) HW Sco nt equipment on January 2, 2018, for $27,000. The equipment was expected to remain in service for four ment's useful life, Granny's estimates that its residual value will be $6,000. The equipment operated for hours the third year, and 1,050 hours the fourth year. chedule of depreciation expense, accumulated depreciation, and book value per year for the equipment ur of-produ A ubin deplinin balan Ch i ne Alaia The desconiation chedule: ation sc Requirements Schedy Depre 1. Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods: straight-line, units-of-production, and double-declining-balance. Show your computations. Note: Three depreciation schedules must be prepared. 2. Which method tracks the wear and tear on the equipment most closely? Print Print Done Done ter any number in the input fields and then click Check Answer. Clear All Homework: Homework Chapter 9 Save Score: 0 of 10 pts 3 of 6 (4 complete) HW Score: 54.17%, 54.17 of 100 pts E9-21 (similar to) Question Help Salem Hardware Consultants purchased a building for $638,000 and depreciated on a straight-line basis over a 30-year period. The estimated residual value is $98,000. After using the building for 15 years, Salem realized that wear and tear on the building would wear it out before 30 years and that the estimated residual value should be $88,000. Starting with the 16th year, Salem began depreciating the building over a revised total life of 20 years using the new residual value. Journalize depreciation expense on the building for years 15 and 16. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) o Begin by journalizing the depreciation on the building for year 15. Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then click Check Answer 1 Pemaining Clear All Check