Negotiation Planning Document:

A planning document helps you assess the key issues of importance in a negotiation, your preferences regarding these issues, and your overall negotiation strategy as well as that of your negotiation partner. 1 page

Guide: Provided a sample to show the answer expectation from a different case at the very end!

Planning Quality - Self(covers key planning points, aware of own interests, priorities, batna, RP, target, etc.)

Planning Quality - Partner(covers key planning points, from partner's perspective)

Insightful and critical thinking(Integrates course material, readings, or lectures when formulating a negotiation strategy & anticipating a partners strategy)

Writing quality & format(Adheres to 1 page limit, Main points easily accessible, proper grammar, spelling & sentence structure, use of references/cites sources where appropriate)

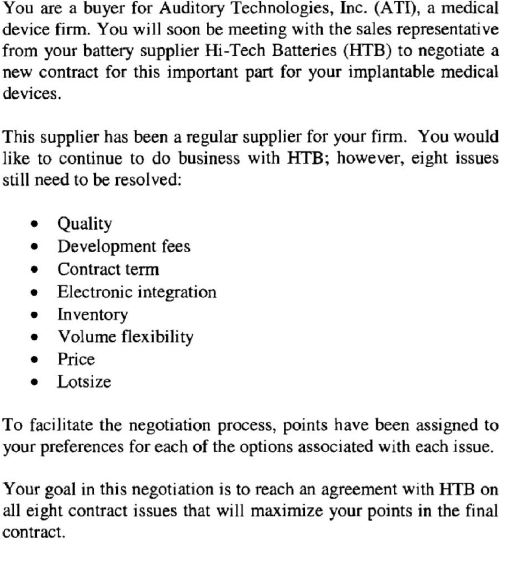

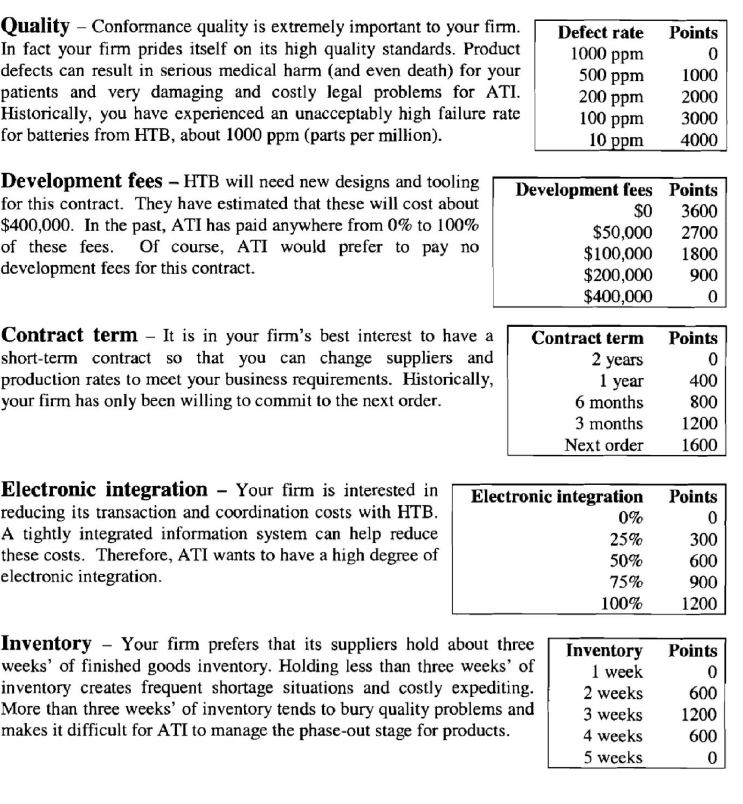

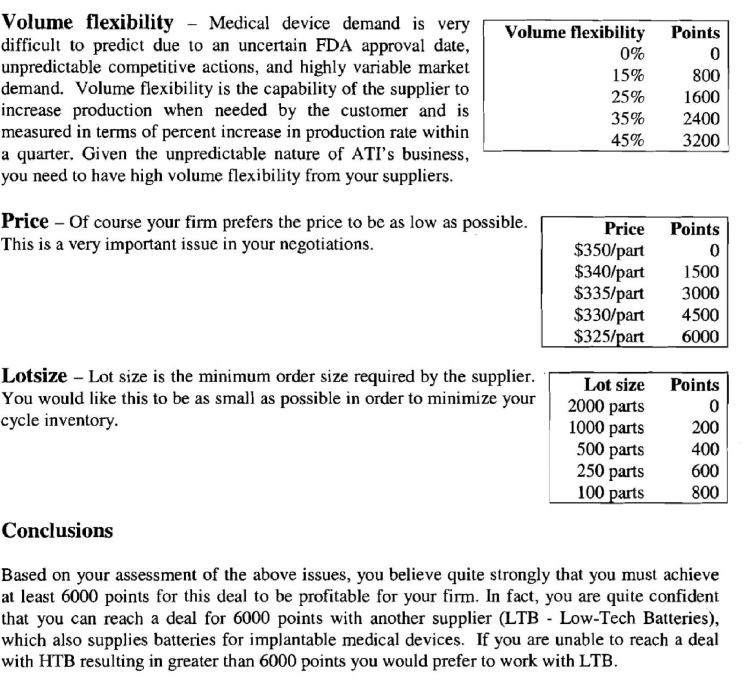

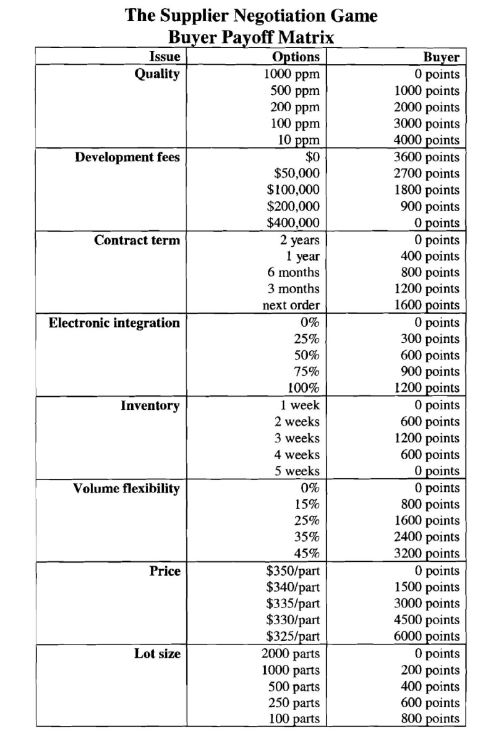

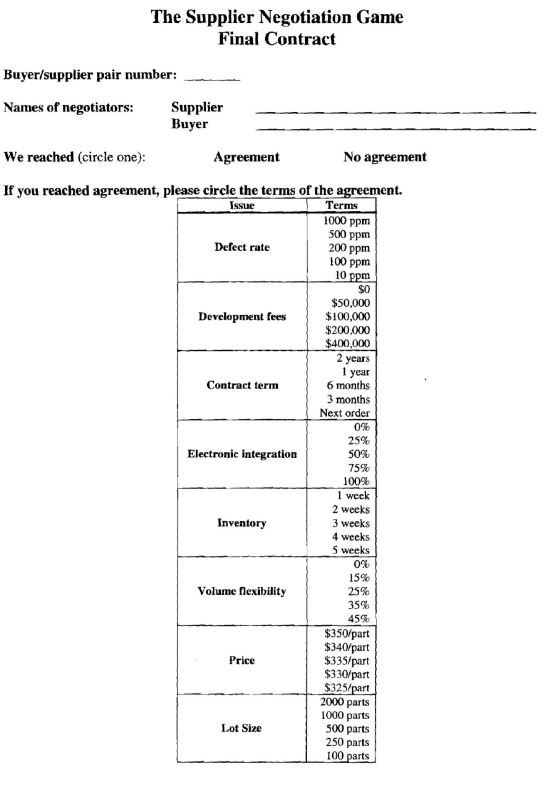

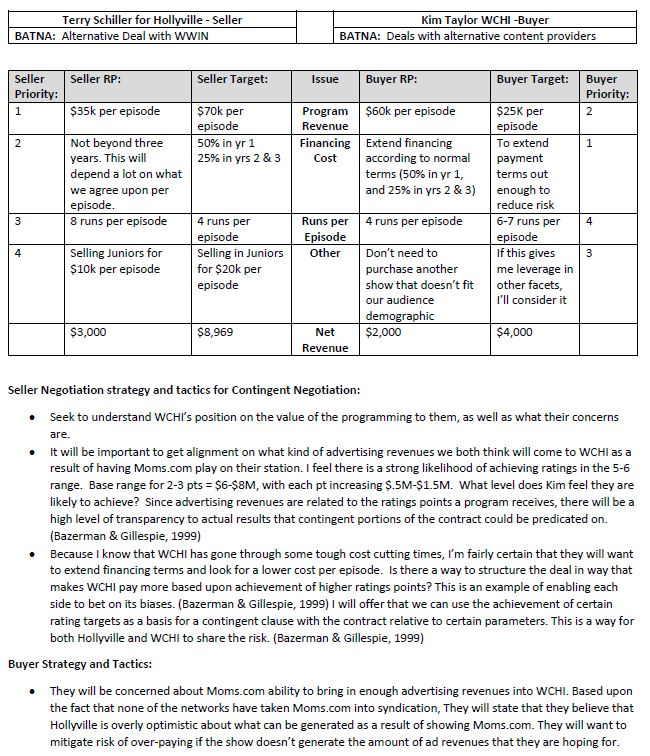

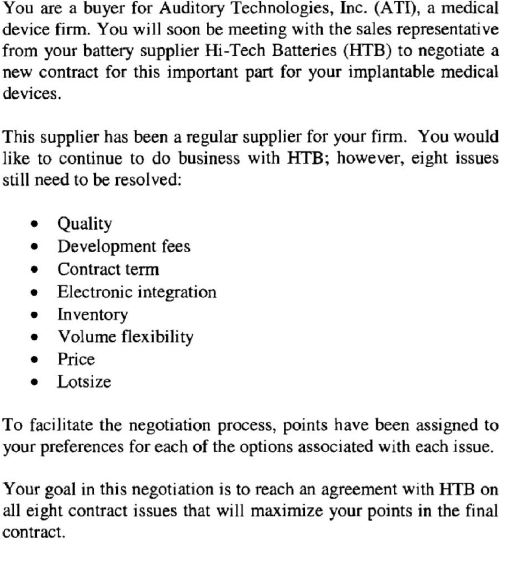

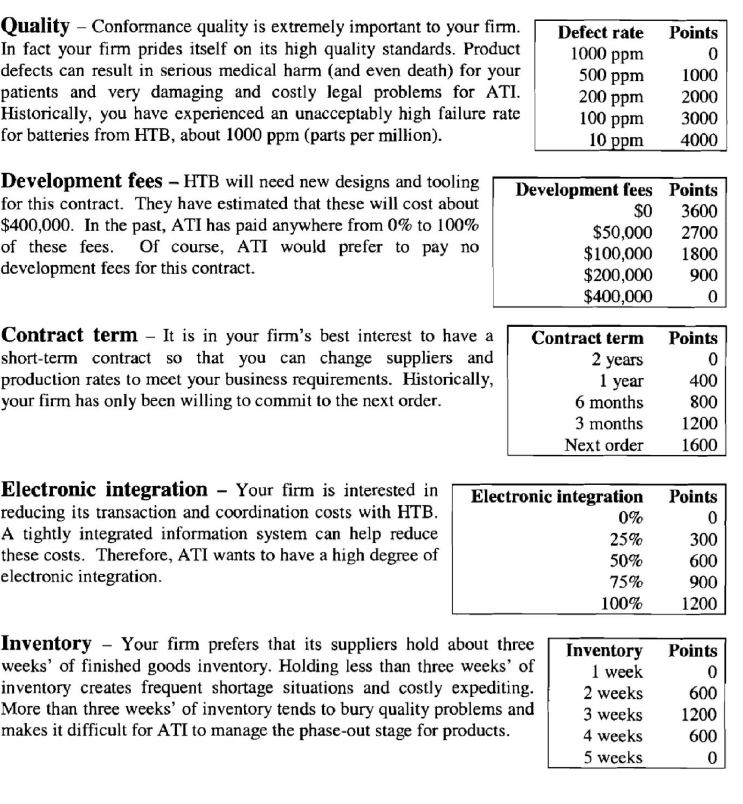

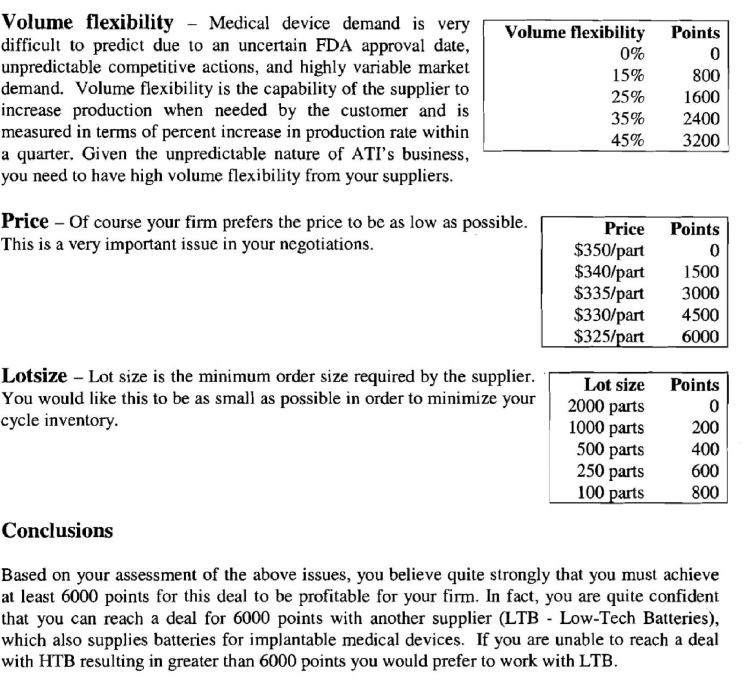

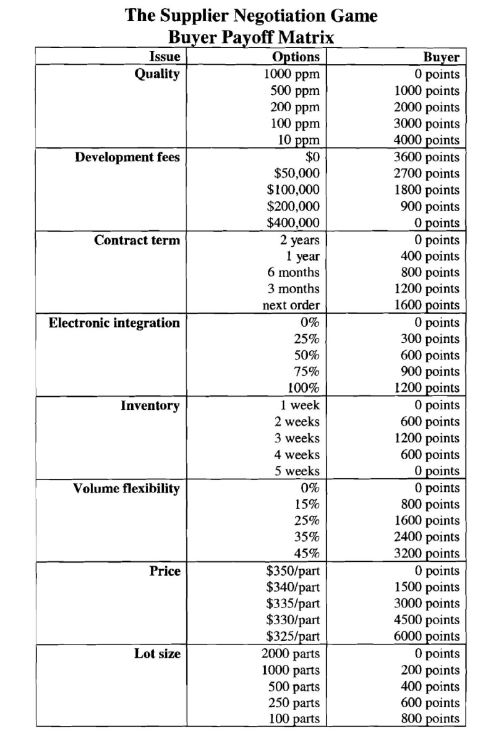

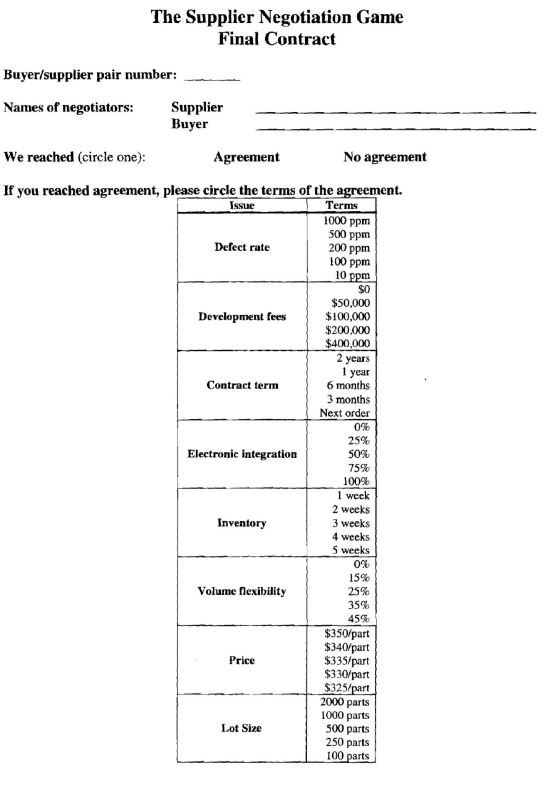

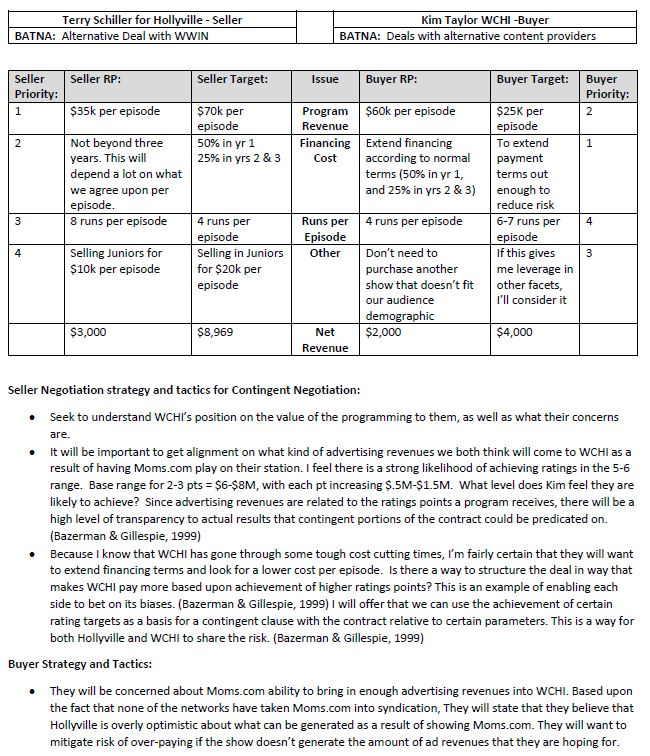

You are a buyer for Auditory Technologies, Inc. (ATI), a medical device firm. You will soon be meeting with the sales representative from your battery supplier Hi-Tech Batteries (HTB) to negotiate a new contract for this important part for your implantable medical devices. This supplier has been a regular supplier for your firm. You would like to continue to do business with HTB; however, eight issues still need to be resolved: Quality Development fees Contract term Electronic integration Inventory Volume flexibility Price Lotsize . . . To facilitate the negotiation process, points have been assigned to your preferences for each of the options associated with each issue. Your goal in this negotiation is to reach an agreement with HTB on all eight contract issues that will maximize your points in the final contract. Quality - Conformance quality is extremely important to your firm. In fact your firm prides itself on its high quality standards. Product defects can result in serious medical harm (and even death) for your patients and very damaging and costly legal problems for ATI. Historically, you have experienced an unacceptably high failure rate for batteries from HTB, about 1000 ppm (parts per million). Defect rate 1000 ppm 500 ppm 200 ppm 100 ppm 10 ppm Points 0 1000 2000 3000 4000 Development fees - HTB will need new designs and tooling for this contract. They have estimated that these will cost about $400,000. In the past, ATI has paid anywhere from 0% to 100% of these fees. Of course, ATI would prefer to pay no development fees for this contract. Development fees Points $0 3600 $50,000 2700 $100,000 1800 $200,000 900 $400,000 0 Contract term - It is in your firm's best interest to have a short-term contract so that you can change suppliers and production rates to meet your business requirements. Historically, your firm has only been willing to commit to the next order. Contract term 2 years 1 year 6 months 3 months Next order Points 0 400 800 1200 1600 Electronic integration - Your firm is interested in reducing its transaction and coordination costs with HTB. A tightly integrated information system can help reduce these costs. Therefore, ATI wants to have a high degree of electronic integration. Electronic integration 0% 25% 50% 75% 100% Points 0 300 600 900 1200 Inventory - Your firm prefers that its suppliers hold about three weeks' of finished goods inventory. Holding less than three weeks' of inventory creates frequent shortage situations and costly expediting. More than three weeks' of inventory tends to bury quality problems and makes it difficult for ATI to manage the phase-out stage for products. Inventory 1 week 2 weeks 3 weeks 4 weeks 5 weeks Points 0 600 1200 600 0 Volume flexibility - Medical device demand is very difficult to predict due to an uncertain FDA approval date, unpredictable competitive actions, and highly variable market demand. Volume flexibility is the capability of the supplier to increase production when needed by the customer and is measured in terms of percent increase in production rate within a quarter. Given the unpredictable nature of ATI's business, you need to have high volume flexibility from your suppliers. Volume flexibility 0% 15% 25% 35% 45% Points 0 800 1600 2400 3200 Price - Of course your firm prefers the price to be as low as possible. This is a very important issue in your negotiations. Price $350/part $340/part $335/part $330/part $325/part Points 0 1500 3000 4500 6000 Lotsize - Lot size is the minimum order size required by the supplier. You would like this to be as small as possible in order to minimize your cycle inventory. Lot size 2000 parts 1000 parts 500 parts 250 parts 100 parts Points 0 200 400 600 800 Conclusions Based on your assessment of the above issues, you believe quite strongly that you must achieve at least 6000 points for this deal to be profitable for your firm. In fact, you are quite confident that you can reach a deal for 6000 points with another supplier (LTB - Low-Tech Batteries), which also supplies batteries for implantable medical devices. If you are unable to reach a deal with HTB resulting in greater than 6000 points you would prefer to work with LTB. $0 The Supplier Negotiation Game Buyer Payoff Matrix Issue Options Quality 1000 ppm 500 ppm 200 ppm 100 ppm 10 ppm Development fees $50,000 $100,000 $200,000 $400,000 Contract term 2 years 1 year 6 months 3 months next order Electronic integration 0% 25% 50% 75% 100% Inventory 1 week 2 weeks 3 weeks 4 weeks 5 weeks Volume flexibility 0% 15% 25% 35% 45% Price $350/part $340/part $335/part $330/part $325/part Lot size 2000 parts 1000 parts 500 parts 250 parts 100 parts Buyer 0 points 1000 points 2000 points 3000 points 4000 points 3600 points 2700 points 1800 points 900 points O points O points 400 points 800 points 1200 points 1600 points 0 points 300 points 600 points 900 points 1200 points 0 points 600 points 1200 points 600 points O points 0 points 800 points 1600 points 2400 points 3200 points O points 1500 points 3000 points 4500 points 6000 points O points 200 points 400 points 600 points 800 points The Supplier Negotiation Game Final Contract Buyer/supplier pair number: Names of negotiators: Supplier Buyer We reached (circle one): Agreement No agreement If you reached agreement, please circle the terms of the agreement. Issue Terms 1000 ppm 500 ppm Defect rate 200 ppm 100 ppm 10 ppm $0 $50,000 Development fees $100,000 $200.000 $400,000 2 years 1 year Contract term 6 months 3 months Next order 0% 25% Electronie integration 50% 75% 100% 1 week 2 weeks Inventory 3 weeks 4 weeks 5 weeks 0% 15% Volume flexibility 25% 35% 45% $350/part $340/part Price $335/part $330/past $325/part 2000 parts 1000 parts Lot Size 500 parts 250 parts 100 parts Terry Schiller for Hollyville - Seller BATNA: Alternative Deal with WWIN Kim Taylor WCHI-Buyer BATNA: Deals with alternative content providers Seller RP: Seller Target: Issue Buyer RP: Seller Priority: 1 $35k per episode $70k per episode 50% in yr 1 25% in yrs 2 & 3 2 Not beyond three years. This will depend a lot on what we agree upon per episode. 8 runs per episode Program $60k per episode Revenue Financing Extend financing Cost according to normal terms (50% in yr 1, and 25% in yrs 2 & 3) Buyer Target: Buyer Priority: $25K per 2 episode To extend 1 payment terms out enough to reduce risk 6-7 runs per 4 episode If this gives 3 me leverage in other facets, I'll consider it 3 4 runs per episode Runs per Episode Other 4 4 runs per episode Selling in Juniors for $20k per episode Selling Juniors for $10k per episode Don't need to purchase another show that doesn't fit our audience demographic $2,000 $3,000 $8,969 $4,000 Net Revenue Seller Negotiation strategy and tactics for contingent Negotiation: Seek to understand WCHI's position on the value of the programming to them, as well as what their concerns are. It will be important to get alignment on what kind of advertising revenues we both think will come to WCHI as a result of having Moms.com play on their station. I feel there is a strong likelihood of achieving ratings in the 5-6 range. Base range for 2-3 pts = $6-$8M, with each pt increasing $.5M-$1.5M. What level does Kim feel they are likely to achieve? Since advertising revenues are related to the ratings points a program receives, there will be a high level of transparency to actual results that contingent portions of the contract could be predicated on. (Bazerman & Gillespie, 1999) Because I know that WCHI has gone through some tough cost cutting times, I'm fairly certain that they will want to extend financing terms and look for a lower cost per episode. Is there a way to structure the deal in way that makes WCHI pay more based upon achievement of higher ratings points? This is an example of enabling each side to bet on its biases. (Bazerman & Gillespie, 1999) I will offer that we can use the achievement of certain rating targets as a basis for a contingent clause with the contract relative to certain parameters. This is a way for both Hollyville and WCHI to share the risk. (Bazerman & Gillespie, 1999) Buyer Strategy and Tactics: They will be concerned about Moms.com ability to bring in enough advertising revenues into WCHI. Based upon the fact that none of the networks have taken Moms.com into syndication, They will state that they believe that Hollyville is overly optimistic about what can be generated as a result of showing Moms.com. They will want to mitigate risk of over-paying if the show doesn't generate the amount of ad revenues that they are hoping for. You are a buyer for Auditory Technologies, Inc. (ATI), a medical device firm. You will soon be meeting with the sales representative from your battery supplier Hi-Tech Batteries (HTB) to negotiate a new contract for this important part for your implantable medical devices. This supplier has been a regular supplier for your firm. You would like to continue to do business with HTB; however, eight issues still need to be resolved: Quality Development fees Contract term Electronic integration Inventory Volume flexibility Price Lotsize . . . To facilitate the negotiation process, points have been assigned to your preferences for each of the options associated with each issue. Your goal in this negotiation is to reach an agreement with HTB on all eight contract issues that will maximize your points in the final contract. Quality - Conformance quality is extremely important to your firm. In fact your firm prides itself on its high quality standards. Product defects can result in serious medical harm (and even death) for your patients and very damaging and costly legal problems for ATI. Historically, you have experienced an unacceptably high failure rate for batteries from HTB, about 1000 ppm (parts per million). Defect rate 1000 ppm 500 ppm 200 ppm 100 ppm 10 ppm Points 0 1000 2000 3000 4000 Development fees - HTB will need new designs and tooling for this contract. They have estimated that these will cost about $400,000. In the past, ATI has paid anywhere from 0% to 100% of these fees. Of course, ATI would prefer to pay no development fees for this contract. Development fees Points $0 3600 $50,000 2700 $100,000 1800 $200,000 900 $400,000 0 Contract term - It is in your firm's best interest to have a short-term contract so that you can change suppliers and production rates to meet your business requirements. Historically, your firm has only been willing to commit to the next order. Contract term 2 years 1 year 6 months 3 months Next order Points 0 400 800 1200 1600 Electronic integration - Your firm is interested in reducing its transaction and coordination costs with HTB. A tightly integrated information system can help reduce these costs. Therefore, ATI wants to have a high degree of electronic integration. Electronic integration 0% 25% 50% 75% 100% Points 0 300 600 900 1200 Inventory - Your firm prefers that its suppliers hold about three weeks' of finished goods inventory. Holding less than three weeks' of inventory creates frequent shortage situations and costly expediting. More than three weeks' of inventory tends to bury quality problems and makes it difficult for ATI to manage the phase-out stage for products. Inventory 1 week 2 weeks 3 weeks 4 weeks 5 weeks Points 0 600 1200 600 0 Volume flexibility - Medical device demand is very difficult to predict due to an uncertain FDA approval date, unpredictable competitive actions, and highly variable market demand. Volume flexibility is the capability of the supplier to increase production when needed by the customer and is measured in terms of percent increase in production rate within a quarter. Given the unpredictable nature of ATI's business, you need to have high volume flexibility from your suppliers. Volume flexibility 0% 15% 25% 35% 45% Points 0 800 1600 2400 3200 Price - Of course your firm prefers the price to be as low as possible. This is a very important issue in your negotiations. Price $350/part $340/part $335/part $330/part $325/part Points 0 1500 3000 4500 6000 Lotsize - Lot size is the minimum order size required by the supplier. You would like this to be as small as possible in order to minimize your cycle inventory. Lot size 2000 parts 1000 parts 500 parts 250 parts 100 parts Points 0 200 400 600 800 Conclusions Based on your assessment of the above issues, you believe quite strongly that you must achieve at least 6000 points for this deal to be profitable for your firm. In fact, you are quite confident that you can reach a deal for 6000 points with another supplier (LTB - Low-Tech Batteries), which also supplies batteries for implantable medical devices. If you are unable to reach a deal with HTB resulting in greater than 6000 points you would prefer to work with LTB. $0 The Supplier Negotiation Game Buyer Payoff Matrix Issue Options Quality 1000 ppm 500 ppm 200 ppm 100 ppm 10 ppm Development fees $50,000 $100,000 $200,000 $400,000 Contract term 2 years 1 year 6 months 3 months next order Electronic integration 0% 25% 50% 75% 100% Inventory 1 week 2 weeks 3 weeks 4 weeks 5 weeks Volume flexibility 0% 15% 25% 35% 45% Price $350/part $340/part $335/part $330/part $325/part Lot size 2000 parts 1000 parts 500 parts 250 parts 100 parts Buyer 0 points 1000 points 2000 points 3000 points 4000 points 3600 points 2700 points 1800 points 900 points O points O points 400 points 800 points 1200 points 1600 points 0 points 300 points 600 points 900 points 1200 points 0 points 600 points 1200 points 600 points O points 0 points 800 points 1600 points 2400 points 3200 points O points 1500 points 3000 points 4500 points 6000 points O points 200 points 400 points 600 points 800 points The Supplier Negotiation Game Final Contract Buyer/supplier pair number: Names of negotiators: Supplier Buyer We reached (circle one): Agreement No agreement If you reached agreement, please circle the terms of the agreement. Issue Terms 1000 ppm 500 ppm Defect rate 200 ppm 100 ppm 10 ppm $0 $50,000 Development fees $100,000 $200.000 $400,000 2 years 1 year Contract term 6 months 3 months Next order 0% 25% Electronie integration 50% 75% 100% 1 week 2 weeks Inventory 3 weeks 4 weeks 5 weeks 0% 15% Volume flexibility 25% 35% 45% $350/part $340/part Price $335/part $330/past $325/part 2000 parts 1000 parts Lot Size 500 parts 250 parts 100 parts Terry Schiller for Hollyville - Seller BATNA: Alternative Deal with WWIN Kim Taylor WCHI-Buyer BATNA: Deals with alternative content providers Seller RP: Seller Target: Issue Buyer RP: Seller Priority: 1 $35k per episode $70k per episode 50% in yr 1 25% in yrs 2 & 3 2 Not beyond three years. This will depend a lot on what we agree upon per episode. 8 runs per episode Program $60k per episode Revenue Financing Extend financing Cost according to normal terms (50% in yr 1, and 25% in yrs 2 & 3) Buyer Target: Buyer Priority: $25K per 2 episode To extend 1 payment terms out enough to reduce risk 6-7 runs per 4 episode If this gives 3 me leverage in other facets, I'll consider it 3 4 runs per episode Runs per Episode Other 4 4 runs per episode Selling in Juniors for $20k per episode Selling Juniors for $10k per episode Don't need to purchase another show that doesn't fit our audience demographic $2,000 $3,000 $8,969 $4,000 Net Revenue Seller Negotiation strategy and tactics for contingent Negotiation: Seek to understand WCHI's position on the value of the programming to them, as well as what their concerns are. It will be important to get alignment on what kind of advertising revenues we both think will come to WCHI as a result of having Moms.com play on their station. I feel there is a strong likelihood of achieving ratings in the 5-6 range. Base range for 2-3 pts = $6-$8M, with each pt increasing $.5M-$1.5M. What level does Kim feel they are likely to achieve? Since advertising revenues are related to the ratings points a program receives, there will be a high level of transparency to actual results that contingent portions of the contract could be predicated on. (Bazerman & Gillespie, 1999) Because I know that WCHI has gone through some tough cost cutting times, I'm fairly certain that they will want to extend financing terms and look for a lower cost per episode. Is there a way to structure the deal in way that makes WCHI pay more based upon achievement of higher ratings points? This is an example of enabling each side to bet on its biases. (Bazerman & Gillespie, 1999) I will offer that we can use the achievement of certain rating targets as a basis for a contingent clause with the contract relative to certain parameters. This is a way for both Hollyville and WCHI to share the risk. (Bazerman & Gillespie, 1999) Buyer Strategy and Tactics: They will be concerned about Moms.com ability to bring in enough advertising revenues into WCHI. Based upon the fact that none of the networks have taken Moms.com into syndication, They will state that they believe that Hollyville is overly optimistic about what can be generated as a result of showing Moms.com. They will want to mitigate risk of over-paying if the show doesn't generate the amount of ad revenues that they are hoping for