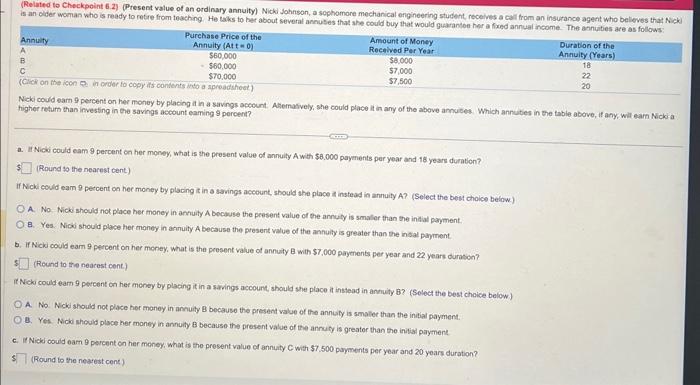

Neki could eam 9 percent on her money by placing at in a savings account. Aliemasvely, she could place it in any of the above annutes. Which annutes in the table above, if any, will eamn Nicki a higher retum than ifvesting in the savings account eaming 9 percent? a. It Nicki could eam 9 percent on her money, what is the present value of annulty Awith $6.000 payenents per year and 18 years duration? (Round to the nearest cent) If Ncki could eam 9 percent on her money by placing it in a savings acoount, should the place in instead in annuity A? (Select the bow cholce below.) A. No. Nicki sheuld not place her money in anhuity A because the peesent value of the annuty is smaler than the initial payment. B. Yes. Nicki should place her money in annuity A because the present value of the annully is greater than the insal payment. b. If Nicki couid eam 9 percent on her money, what is the present value of annuty B with $7,000 payenents per year and 22 years durason? (Round to the neacest cent) It Neki could earn 9 percent on her meney by placing it in a savings account, should the place it instead in annuity B? (Solect the best choice below.) A. No. Ncki should not place her money in annuity B because the present value of the annuly is smater than the initial payment. B. Yes. Nicki should plsce her monty in annuity B because the present value of the annuty is greater than the initial payment. c. If Nick oould oam percent on her money, what is the present value of annuity C with $7.500 puyments per year and 20 years duration? (Round to the nearest cent) c. If Nicki could eam 9 percent on her money. What is the present value of annuity C with $7,500 payments per year and 20 years duration? (Round to the nearest cent.) If Nicki could eam 9 percent on her money by placing it in a savings account, should she place it instead in annuity C? (Select the best choico below.) A. Yes. Nicki should place her money in annuity C because the present value of the annuity is greater than the initial payment. 8. No Nicki should not place her money in annuity C because the present value of the annuity is smailer than the initial payment