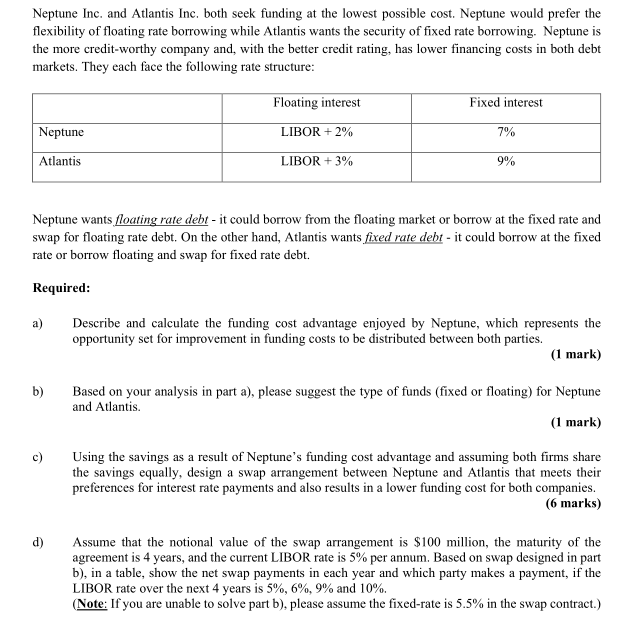

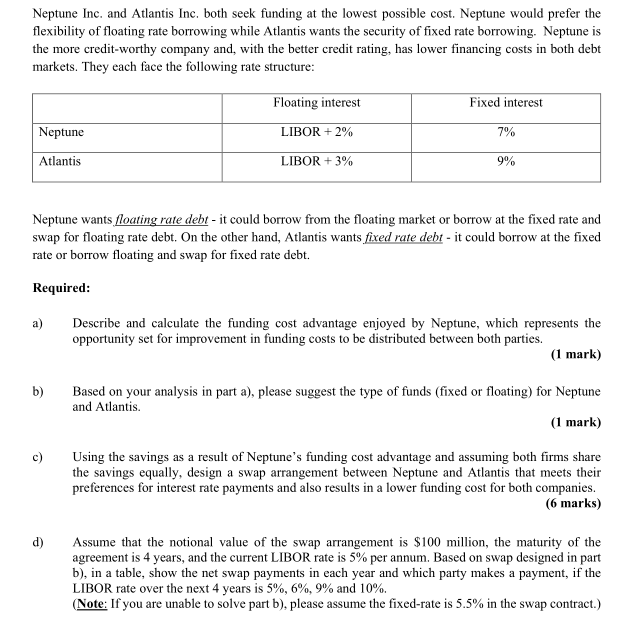

Neptune Inc. and Atlantis Inc. both seek funding at the lowest possible cost. Neptune would prefer the flexibility of floating rate borrowing while Atlantis wants the security of fixed rate borrowing. Neptune is the more credit-worthy company and, with the better credit rating, has lower financing costs in both debt markets. They each face the following rate structure: Floating interest Fixed interest Neptune LIBOR + 2% 7% Atlantis LIBOR + 3% 9% Neptune wants floating rate debt - it could borrow from the floating market or borrow at the fixed rate and swap for floating rate debt. On the other hand, Atlantis wants fixed rate debt - it could borrow at the fixed rate or borrow floating and swap for fixed rate debt. Required: a) Describe and calculate the funding cost advantage enjoyed by Neptune, which represents the opportunity set for improvement in funding costs to be distributed between both parties. (1 mark) b) Based on your analysis in part a), please suggest the type of funds (fixed or floating) for Neptune and Atlantis. (1 mark) c) Using the savings as a result of Neptune's funding cost advantage and assuming both firms share the savings equally, design a swap arrangement between Neptune and Atlantis that meets their preferences for interest rate payments and also results in a lower funding cost for both companies. (6 marks) d) Assume that the notional value of the swap arrangement is $100 million, the maturity of the agreement is 4 years, and the current LIBOR rate is 5% per annum. Based on swap designed in part b), in a table, show the net swap payments in each year and which party makes a payment, if the LIBOR rate over the next 4 years is 5%, 6%, 9% and 10%. (Note: If you are unable to solve part b), please assume the fixed-rate is 5.5% in the swap contract.) Neptune Inc. and Atlantis Inc. both seek funding at the lowest possible cost. Neptune would prefer the flexibility of floating rate borrowing while Atlantis wants the security of fixed rate borrowing. Neptune is the more credit-worthy company and, with the better credit rating, has lower financing costs in both debt markets. They each face the following rate structure: Floating interest Fixed interest Neptune LIBOR + 2% 7% Atlantis LIBOR + 3% 9% Neptune wants floating rate debt - it could borrow from the floating market or borrow at the fixed rate and swap for floating rate debt. On the other hand, Atlantis wants fixed rate debt - it could borrow at the fixed rate or borrow floating and swap for fixed rate debt. Required: a) Describe and calculate the funding cost advantage enjoyed by Neptune, which represents the opportunity set for improvement in funding costs to be distributed between both parties. (1 mark) b) Based on your analysis in part a), please suggest the type of funds (fixed or floating) for Neptune and Atlantis. (1 mark) c) Using the savings as a result of Neptune's funding cost advantage and assuming both firms share the savings equally, design a swap arrangement between Neptune and Atlantis that meets their preferences for interest rate payments and also results in a lower funding cost for both companies. (6 marks) d) Assume that the notional value of the swap arrangement is $100 million, the maturity of the agreement is 4 years, and the current LIBOR rate is 5% per annum. Based on swap designed in part b), in a table, show the net swap payments in each year and which party makes a payment, if the LIBOR rate over the next 4 years is 5%, 6%, 9% and 10%. (Note: If you are unable to solve part b), please assume the fixed-rate is 5.5% in the swap contract.)