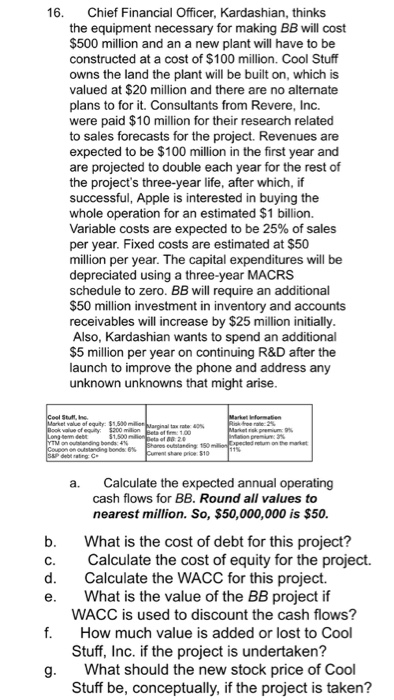

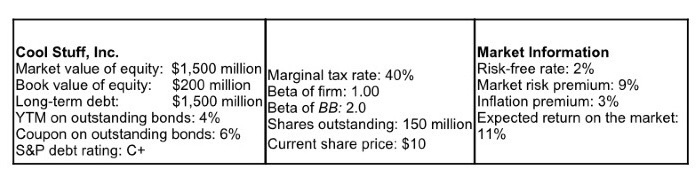

Neque Cool Stullin Market information Market Long term det 3500 20 itation premium YTM on ostanding bond Coupon on standing bondo Shorting 150 millioned SAP debut rating Current share price: 510 16. Chief Financial Officer, Kardashian, thinks the equipment necessary for making BB will cost $500 million and an a new plant will have to be constructed at a cost of $100 million. Cool Stuff owns the land the plant will be built on, which is valued at $20 million and there are no alternate plans to for it. Consultants from Revere, Inc. were paid $10 million for their research related to sales forecasts for the project. Revenues are expected to be $100 million in the first year and are projected to double each year for the rest of the project's three-year life, after which, if successful, Apple is interested in buying the whole operation for an estimated $1 billion. Variable costs are expected to be 25% of sales per year. Fixed costs are estimated at $50 million per year. The capital expenditures will be depreciated using a three-year MACRS schedule to zero. BB will require an additional $50 million investment in inventory and accounts receivables will increase by $25 million initially. Also, Kardashian wants to spend an additional $5 million per year on continuing R&D after the launch to improve the phone and address any unknown unknowns that might arise. a. b. C. d. e. Calculate the expected annual operating cash flows for BB. Round all values to nearest million. So, $50,000,000 is $50. What is the cost of debt for this project? Calculate the cost of equity for the project. Calculate the WACC for this project. What is the value of the BB project if WACC is used to discount the cash flows? How much value is added or lost to Cool Stuff, Inc. if the project is undertaken? What should the new stock price of Cool Stuff be, conceptually, if the project is taken? f. g. Cool Stuff, Inc. Market Information Market value of equity: $1,500 million Marginal tax rate: 40% Risk-free rate: 2% Book value of equity: $200 million Beta of firm: 1.00 Market risk premium: 9% Long-term debt: $1,500 million Beta of BB: 2.0 Inflation premium: 3% YTM on outstanding bonds: 4% Coupon on outstanding bonds: 6% Shares outstanding: 150 million Expected return on the market: 11% S&P debt rating: C+ Current share price: $10 Neque Cool Stullin Market information Market Long term det 3500 20 itation premium YTM on ostanding bond Coupon on standing bondo Shorting 150 millioned SAP debut rating Current share price: 510 16. Chief Financial Officer, Kardashian, thinks the equipment necessary for making BB will cost $500 million and an a new plant will have to be constructed at a cost of $100 million. Cool Stuff owns the land the plant will be built on, which is valued at $20 million and there are no alternate plans to for it. Consultants from Revere, Inc. were paid $10 million for their research related to sales forecasts for the project. Revenues are expected to be $100 million in the first year and are projected to double each year for the rest of the project's three-year life, after which, if successful, Apple is interested in buying the whole operation for an estimated $1 billion. Variable costs are expected to be 25% of sales per year. Fixed costs are estimated at $50 million per year. The capital expenditures will be depreciated using a three-year MACRS schedule to zero. BB will require an additional $50 million investment in inventory and accounts receivables will increase by $25 million initially. Also, Kardashian wants to spend an additional $5 million per year on continuing R&D after the launch to improve the phone and address any unknown unknowns that might arise. a. b. C. d. e. Calculate the expected annual operating cash flows for BB. Round all values to nearest million. So, $50,000,000 is $50. What is the cost of debt for this project? Calculate the cost of equity for the project. Calculate the WACC for this project. What is the value of the BB project if WACC is used to discount the cash flows? How much value is added or lost to Cool Stuff, Inc. if the project is undertaken? What should the new stock price of Cool Stuff be, conceptually, if the project is taken? f. g. Cool Stuff, Inc. Market Information Market value of equity: $1,500 million Marginal tax rate: 40% Risk-free rate: 2% Book value of equity: $200 million Beta of firm: 1.00 Market risk premium: 9% Long-term debt: $1,500 million Beta of BB: 2.0 Inflation premium: 3% YTM on outstanding bonds: 4% Coupon on outstanding bonds: 6% Shares outstanding: 150 million Expected return on the market: 11% S&P debt rating: C+ Current share price: $10