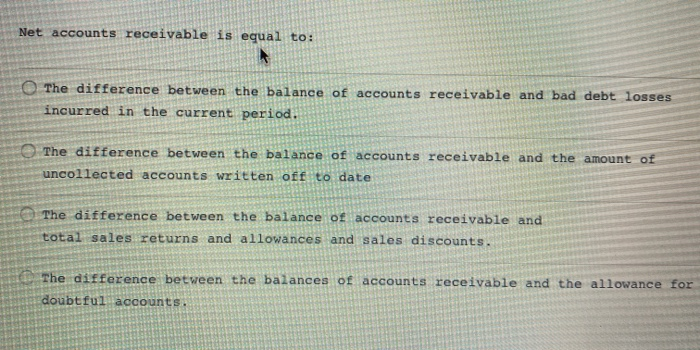

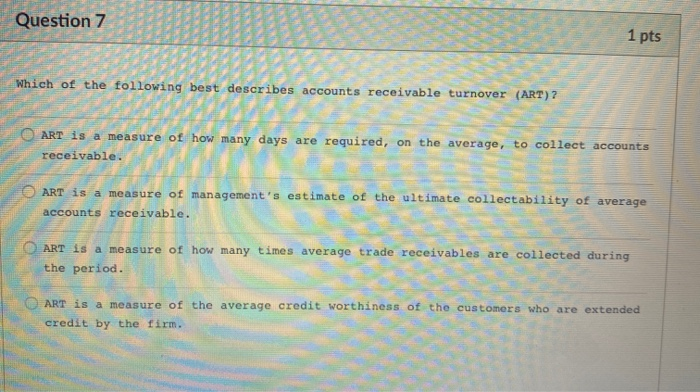

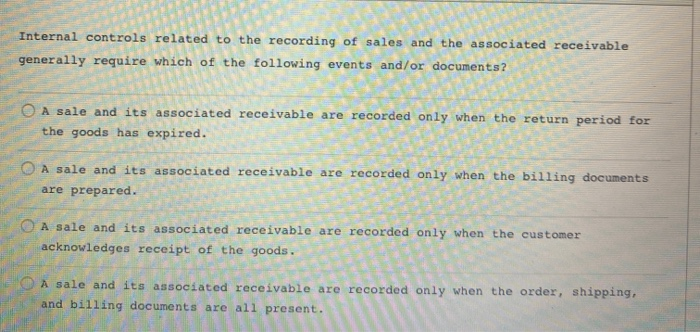

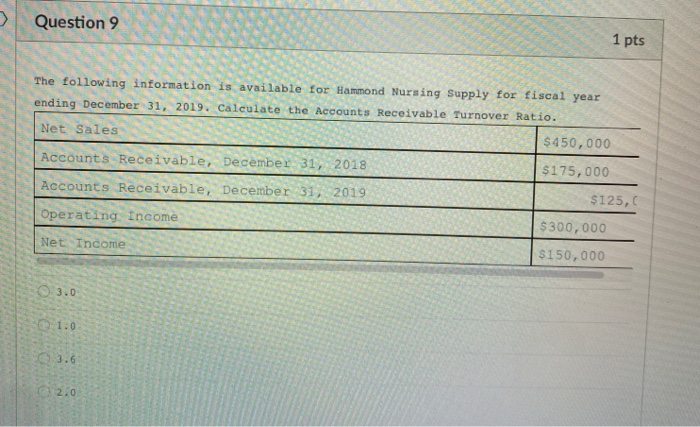

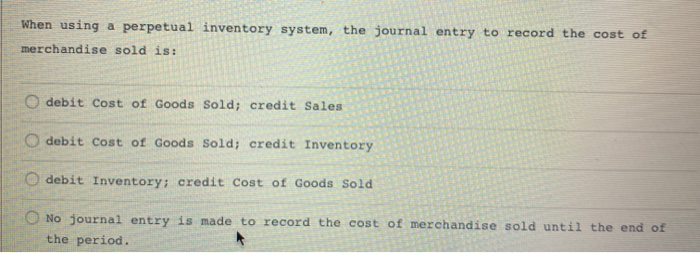

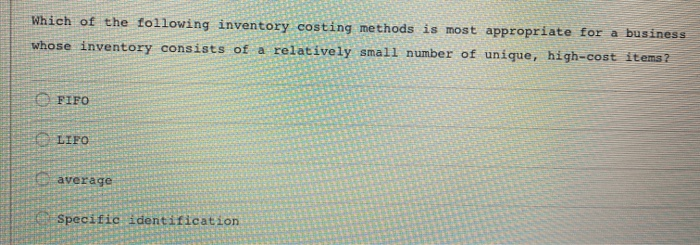

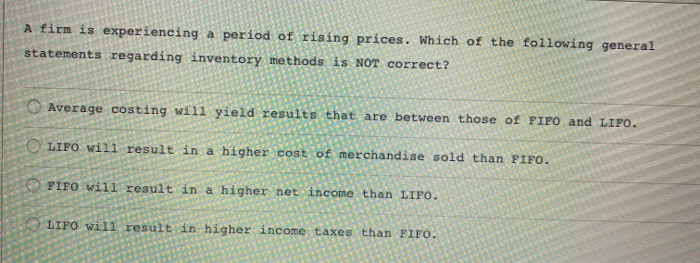

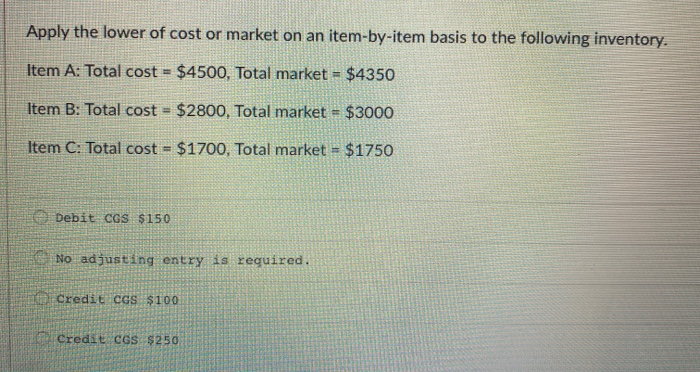

Net accounts receivable is equal to: The difference between the balance of accounts receivable and bad debt losses incurred in the current period. The difference between the balance of accounts receivable and the amount of uncollected accounts written off to date The difference between the balance of accounts receivable and total sales returns and allowances and sales discounts. The difference between the balances of accounts receivable and the allowance for doubtful accounts. Question 7 1 pts Which of the following best describes accounts receivable turnover (ART)? ART is a measure of how many days are required, on the average, to collect accounts receivable. ART is a measure of management's estimate of the ultimate collectability of average accounts receivable. ART is a measure of how many times average trade receivables are collected during the period. ART is a measure of the average credit worthiness of the customers who are extended credit by the firm. Internal controls related to the recording of sales and the associated receivable generally require which of the following events and/or documents? O A sale and its associated receivable are recorded only when the return period for the goods has expired. A sale and its associated receivable are recorded only when the billing documents are prepared. A sale and its associated receivable are recorded only when the customer acknowledges receipt of the goods. A sale and its associated receivable are recorded only when the order, shipping, and billing documents are all present. Question 9 1 pts The following information is available for Hammond Nursing Supply for fiscal year ending December 31, 2019. Calculate the accounts Receivable Turnover Ratio. Net Sales $450,000 Accounts Receivable, December 31, 2018 $175,000 Accounts Receivable, December 31, 2019 $125, Operating Income Net Income $300,000 $150,000 0.3.0 1.0 02.0 When using a perpetual inventory system, the journal entry to record the cost of merchandise sold is: debit Cost of Goods Sold; credit Sales debit cost of Goods Sold; credit Inventory O debit Inventory; credit cost of Goods Sold No journal entry is made to record the cost of merchandise sold until the end of the period. Which of the following inventory costing methods is most appropriate for a business whose inventory consists of a relatively small number of unique, high-cost items? FIFO LIFO average Specific identification A firm is experiencing a period of rising prices. Which of the following general statements regarding inventory methods is NOT correct? Average costing will yield results that are between those of FIFO and LIFO. LIFO will result in a higher cost of merchandise sold than FIFO. FIFO will result in a higher net income than LIFO. LIFO will result in higher income taxes than FIFO. Apply the lower of cost or market on an item-by-item basis to the following inventory. Item A: Total cost = $4500, Total market = $4350 Item B: Total cost = $2800, Total market = $3000 Item C: Total cost = $1700, Total market = $1750 Debit CGS $150 No adjusting entry is required. Credit CGS $100 Credit CGS $250 Net accounts receivable is equal to: The difference between the balance of accounts receivable and bad debt losses incurred in the current period. The difference between the balance of accounts receivable and the amount of uncollected accounts written off to date The difference between the balance of accounts receivable and total sales returns and allowances and sales discounts. The difference between the balances of accounts receivable and the allowance for doubtful accounts. Question 7 1 pts Which of the following best describes accounts receivable turnover (ART)? ART is a measure of how many days are required, on the average, to collect accounts receivable. ART is a measure of management's estimate of the ultimate collectability of average accounts receivable. ART is a measure of how many times average trade receivables are collected during the period. ART is a measure of the average credit worthiness of the customers who are extended credit by the firm. Internal controls related to the recording of sales and the associated receivable generally require which of the following events and/or documents? O A sale and its associated receivable are recorded only when the return period for the goods has expired. A sale and its associated receivable are recorded only when the billing documents are prepared. A sale and its associated receivable are recorded only when the customer acknowledges receipt of the goods. A sale and its associated receivable are recorded only when the order, shipping, and billing documents are all present. Question 9 1 pts The following information is available for Hammond Nursing Supply for fiscal year ending December 31, 2019. Calculate the accounts Receivable Turnover Ratio. Net Sales $450,000 Accounts Receivable, December 31, 2018 $175,000 Accounts Receivable, December 31, 2019 $125, Operating Income Net Income $300,000 $150,000 0.3.0 1.0 02.0 When using a perpetual inventory system, the journal entry to record the cost of merchandise sold is: debit Cost of Goods Sold; credit Sales debit cost of Goods Sold; credit Inventory O debit Inventory; credit cost of Goods Sold No journal entry is made to record the cost of merchandise sold until the end of the period. Which of the following inventory costing methods is most appropriate for a business whose inventory consists of a relatively small number of unique, high-cost items? FIFO LIFO average Specific identification A firm is experiencing a period of rising prices. Which of the following general statements regarding inventory methods is NOT correct? Average costing will yield results that are between those of FIFO and LIFO. LIFO will result in a higher cost of merchandise sold than FIFO. FIFO will result in a higher net income than LIFO. LIFO will result in higher income taxes than FIFO. Apply the lower of cost or market on an item-by-item basis to the following inventory. Item A: Total cost = $4500, Total market = $4350 Item B: Total cost = $2800, Total market = $3000 Item C: Total cost = $1700, Total market = $1750 Debit CGS $150 No adjusting entry is required. Credit CGS $100 Credit CGS $250