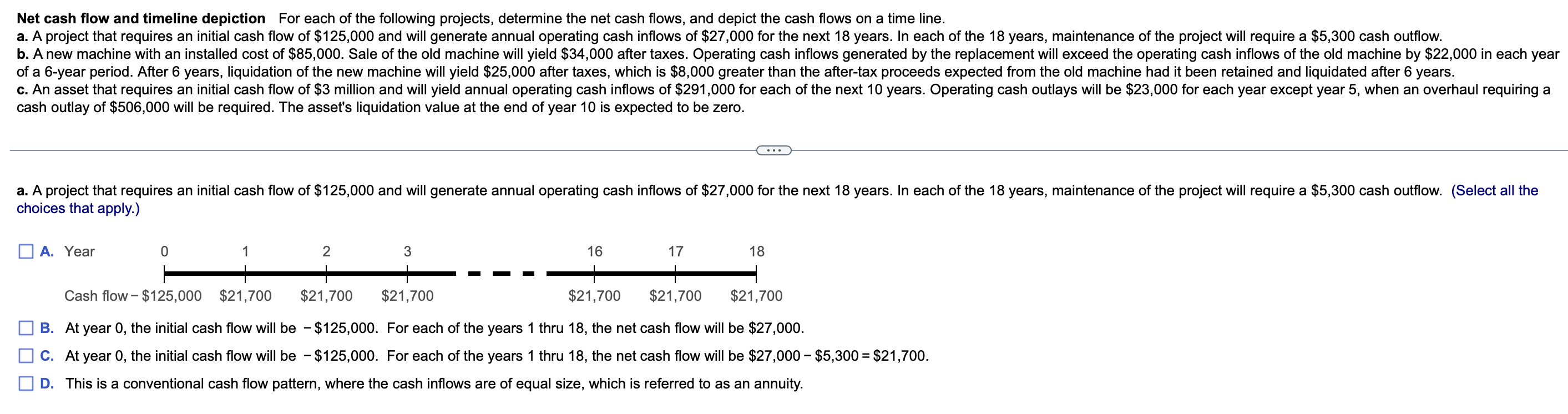

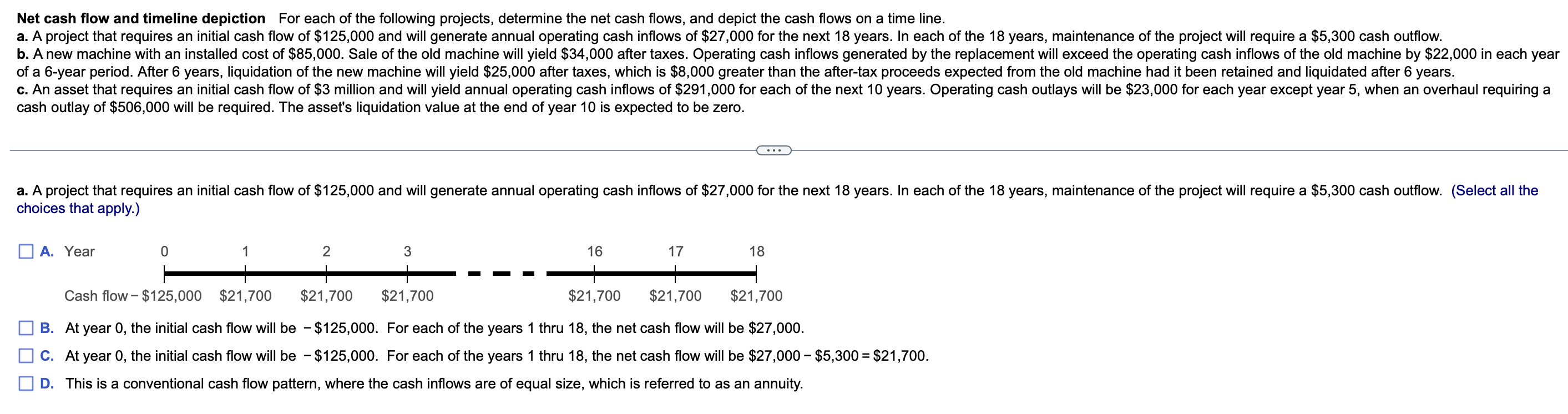

Net cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a time line. a. A project that requires an initial cash flow of $125,000 and will generate annual operating cash inflows of $27,000 for the next 18 years. In each of the 18 years, maintenance of the project will require a $5,300 cash outflow. b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $34,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $22,000 in each year of a 6-year period. After 6 years, liquidation of the new machine will yield $25,000 after taxes, which is $8,000 greater than the after-tax proceeds expected from the old machine had it been retained and liquidated after 6 years. c. An asset that requires an initial cash flow of $3 million and will yield annual operating cash inflows of $291,000 for each of the next 10 years. Operating cash outlays will be $23,000 for each year except year 5, when an overhaul requiring a cash outlay of $506,000 will be required. The asset's liquidation value at the end of year 10 is expected to be zero. a. A project that requires an initial cash flow of $125,000 and will generate annual operating cash inflows of $27,000 for the next 18 years. In each of the 18 years, maintenance of the project will require a $5,300 cash outflow. (Select all the choices that apply.) D A Year 0 1 2 3 16 17 18 Cash flow-$125,000 $21,700 $21,700 $21,700 $21,700 $21,700 $21,700 B. At year 0, the initial cash flow will be - $125,000. For each of the years 1 thru 18, the net cash flow will be $27,000. C. At year 0, the initial cash flow will be - $125,000. For each of the years 1 thru 18, the net cash flow will be $27,000 - $5,300 = $21,700. D. This is a conventional cash flow pattern, where the cash inflows are of equal size, which is referred to as an annuity. Net cash flow and timeline depiction For each of the following projects, determine the net cash flows, and depict the cash flows on a time line. a. A project that requires an initial cash flow of $125,000 and will generate annual operating cash inflows of $27,000 for the next 18 years. In each of the 18 years, maintenance of the project will require a $5,300 cash outflow. b. A new machine with an installed cost of $85,000. Sale of the old machine will yield $34,000 after taxes. Operating cash inflows generated by the replacement will exceed the operating cash inflows of the old machine by $22,000 in each year of a 6-year period. After 6 years, liquidation of the new machine will yield $25,000 after taxes, which is $8,000 greater than the after-tax proceeds expected from the old machine had it been retained and liquidated after 6 years. c. An asset that requires an initial cash flow of $3 million and will yield annual operating cash inflows of $291,000 for each of the next 10 years. Operating cash outlays will be $23,000 for each year except year 5, when an overhaul requiring a cash outlay of $506,000 will be required. The asset's liquidation value at the end of year 10 is expected to be zero. a. A project that requires an initial cash flow of $125,000 and will generate annual operating cash inflows of $27,000 for the next 18 years. In each of the 18 years, maintenance of the project will require a $5,300 cash outflow. (Select all the choices that apply.) D A Year 0 1 2 3 16 17 18 Cash flow-$125,000 $21,700 $21,700 $21,700 $21,700 $21,700 $21,700 B. At year 0, the initial cash flow will be - $125,000. For each of the years 1 thru 18, the net cash flow will be $27,000. C. At year 0, the initial cash flow will be - $125,000. For each of the years 1 thru 18, the net cash flow will be $27,000 - $5,300 = $21,700. D. This is a conventional cash flow pattern, where the cash inflows are of equal size, which is referred to as an annuity