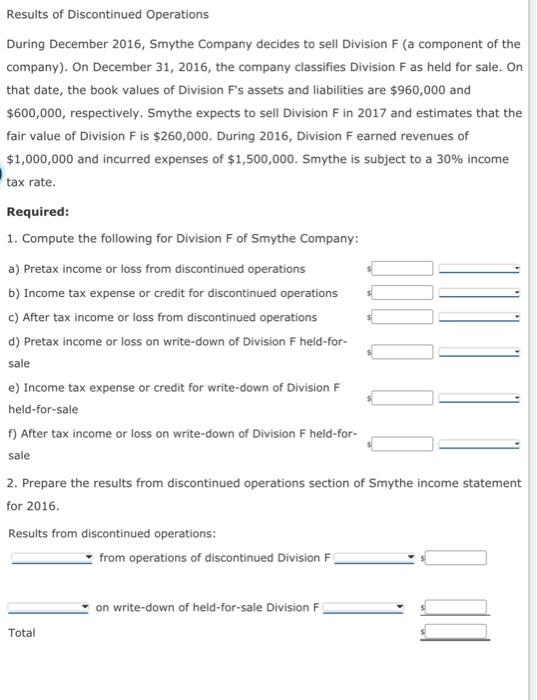

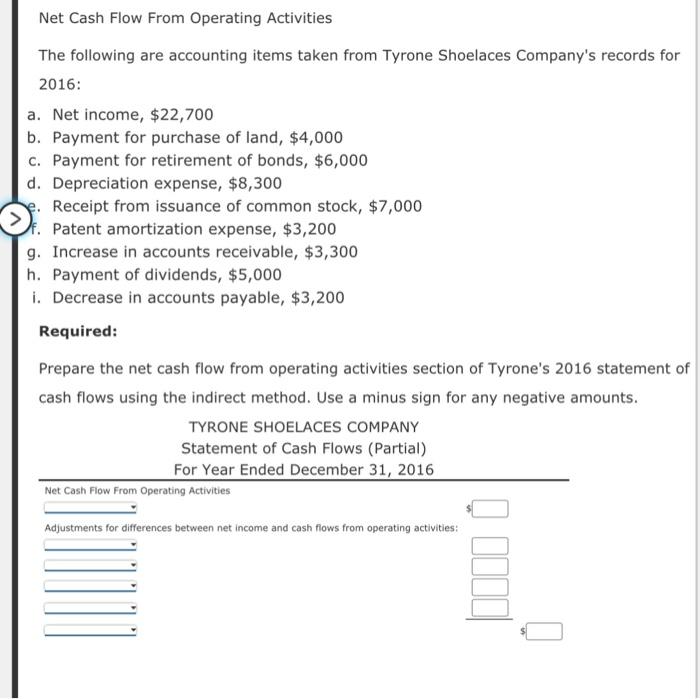

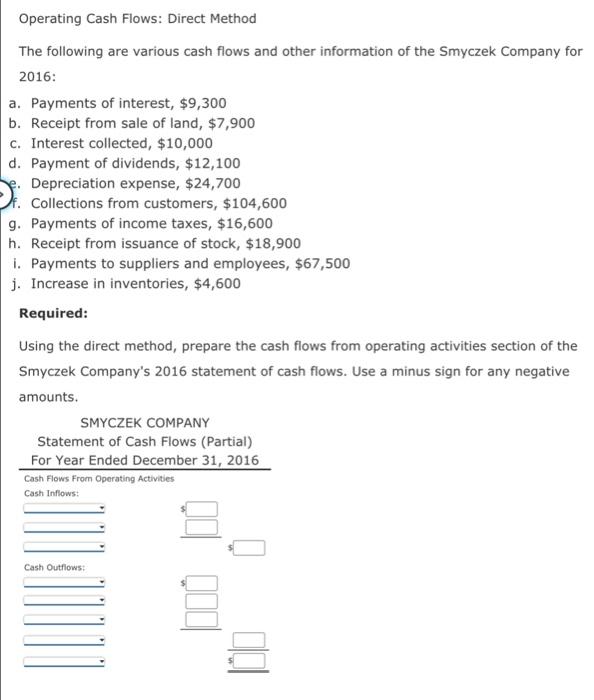

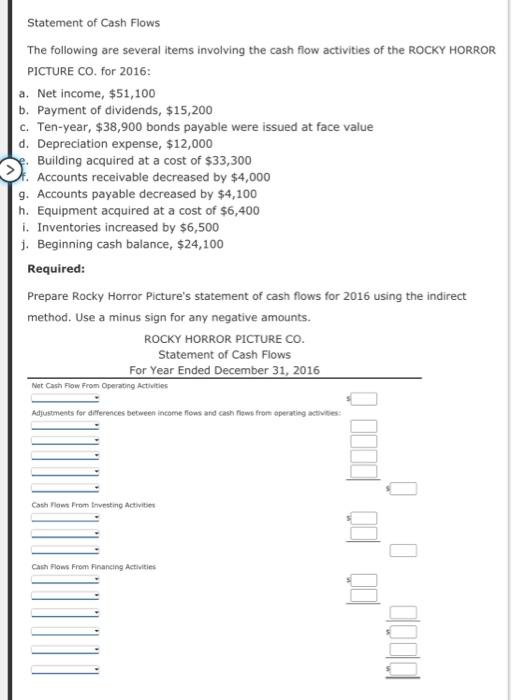

Net Cash Flow From Operating Activities The following are accounting items taken from Tyrone Shoelaces Company's records for 2016: a. Net income, $22,700 b. Payment for purchase of land, $4,000 c. Payment for retirement of bonds, $6,000 d. Depreciation expense, $8,300 f. Receipt from issuance of common stock, $7,000 f. Patent amortization expense, $3,200 g. Increase in accounts receivable, $3,300 h. Payment of dividends, $5,000 i. Decrease in accounts payable, $3,200 Required: Prepare the net cash flow from operating activities section of Tyrone's 2016 statement of cash flows using the indirect method. Use a minus sign for any negative amounts. TYRONE SHOELACES COMPANY Statement of Cash Flows (Partial) For Year Ended December 31, 2016 Results of Discontinued Operations During December 2016, Smythe Company decides to sell Division F (a component of the company). On December 31, 2016, the company classifies Division F as held for sale. On that date, the book values of Division F's assets and liabilities are $960,000 and $600,000, respectively. Smythe expects to sell Division F in 2017 and estimates that the fair value of Division F is $260,000. During 2016, Division F earned revenues of $1,000,000 and incurred expenses of $1,500,000. Smythe is subject to a 30% income tax rate. Required: 1. Compute the following for Division F of Smythe Company: a) Pretax income or loss from discontinued operations b) Income tax expense or credit for discontinued operations c) After tax income or loss from discontinued operations d) Pretax income or loss on write-down of Division F held-forsale e) Income tax expense or credit for write-down of Division F held-for-sale f) After tax income or loss on write-down of Division F held-forsale Statement of Cash Flows The following are several items involving the cash flow activities of the ROCKY HORROR PICTURE CO, for 2016: a. Net income, $51,100 b. Payment of dividends, $15,200 c. Ten-year, $38,900 bonds payable were issued at face value d. Depreciation expense, $12,000 e. Building acquired at a cost of $33,300 f. Accounts receivable decreased by $4,000 g. Accounts payable decreased by $4,100 h. Equipment acquired at a cost of $6,400 i. Inventories increased by $6,500 j. Beginning cash balance, $24,100 Required: Prepare Rocky Horror Picture's statement of cash flows for 2016 using the indirect method. Use a minus sign for any negative amounts. Operating Cash Flows: Direct Method The following are various cash flows and other information of the Smyczek Company for 2016: a. Payments of interest, $9,300 b. Receipt from sale of land, $7,900 c. Interest collected, $10,000 d. Payment of dividends, $12,100 e. Depreciation expense, $24,700 f. Collections from customers, $104,600 g. Payments of income taxes, $16,600 h. Receipt from issuance of stock, $18,900 i. Payments to suppliers and employees, $67,500 j. Increase in inventories, $4,600 Required: Using the direct method, prepare the cash flows from operating activities section of the Smyczek Company's 2016 statement of cash flows. Use a minus sign for any negative amounts