Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Net Present Value Analysis You have an opportunity to invest in a concession at a world exposition. To use the building and exhibits more fully,

Net Present Value Analysis

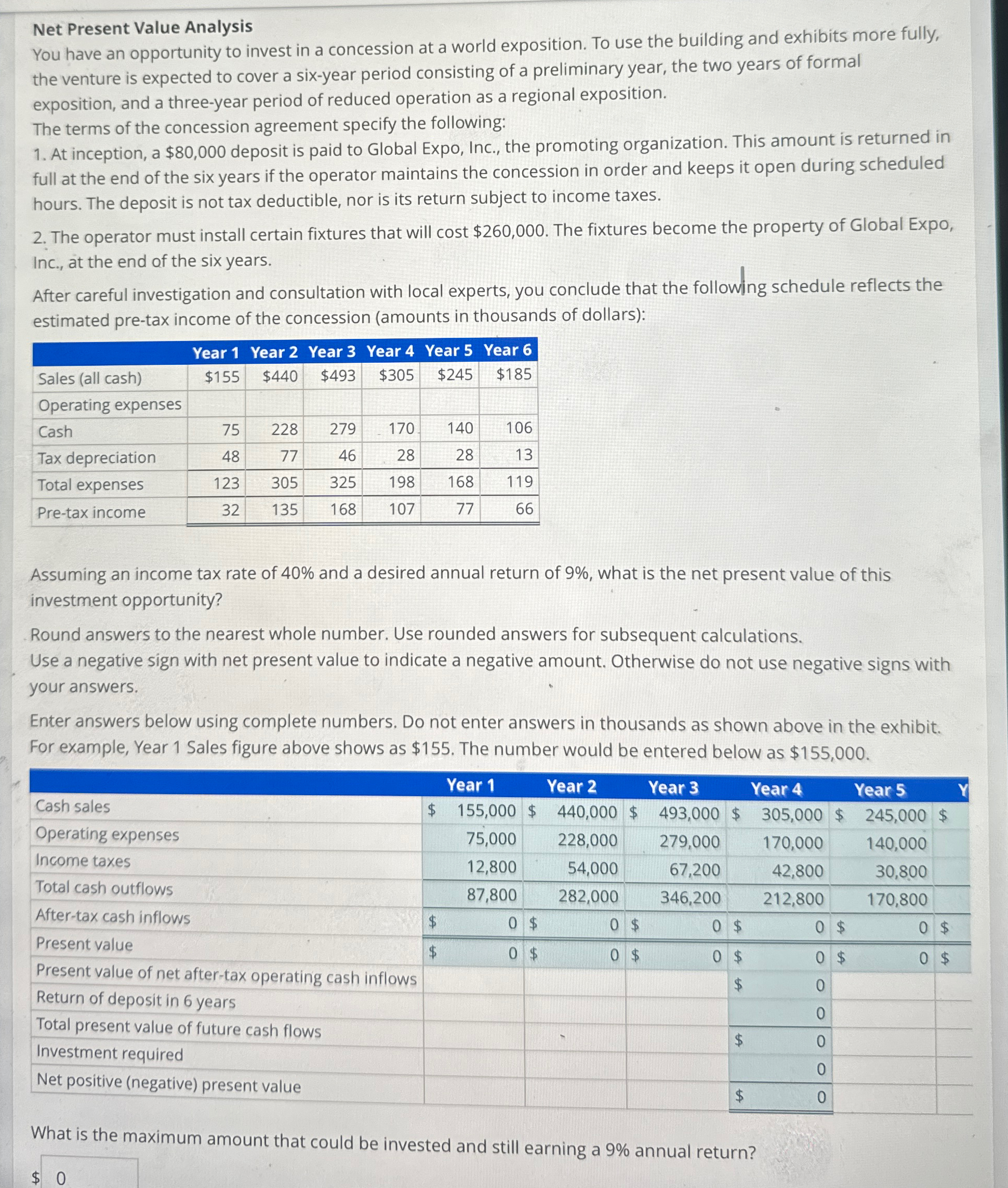

You have an opportunity to invest in a concession at a world exposition. To use the building and exhibits more fully, the venture is expected to cover a sixyear period consisting of a preliminary year, the two years of formal exposition, and a threeyear period of reduced operation as a regional exposition.

The terms of the concession agreement specify the following:

At inception, a $ deposit is paid to Global Expo, Inc., the promoting organization. This amount is returned in full at the end of the six years if the operator maintains the concession in order and keeps it open during scheduled hours. The deposit is not tax deductible, nor is its return subject to income taxes.

The operator must install certain fixtures that will cost $ The fixtures become the property of Global Expo, Inc., at the end of the six years.

After careful investigation and consultation with local experts, you conclude that the following schedule reflects the estimated pretax income of the concession amounts in thousands of dollars:

tableYear Year Year Year Year Year Sales all cash$$$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started