Net Present Value - Make or Buy Decision?

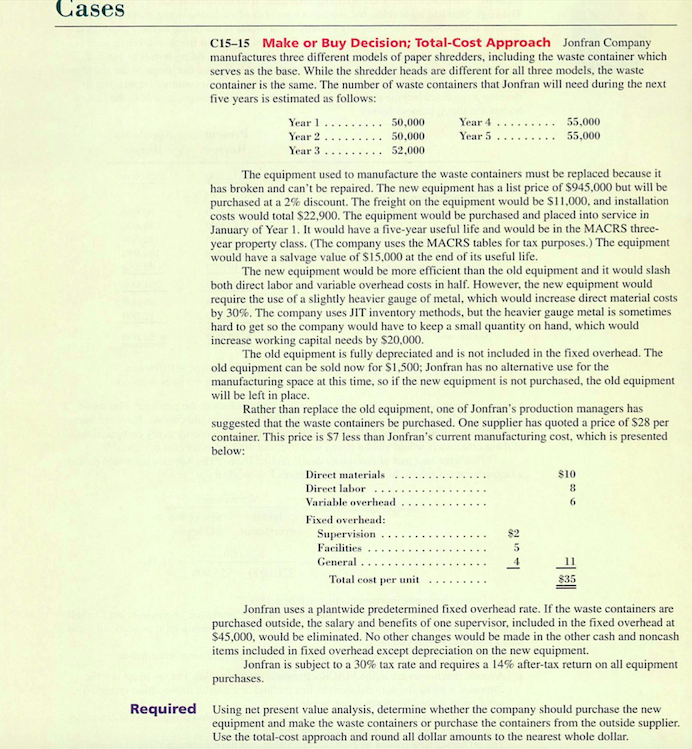

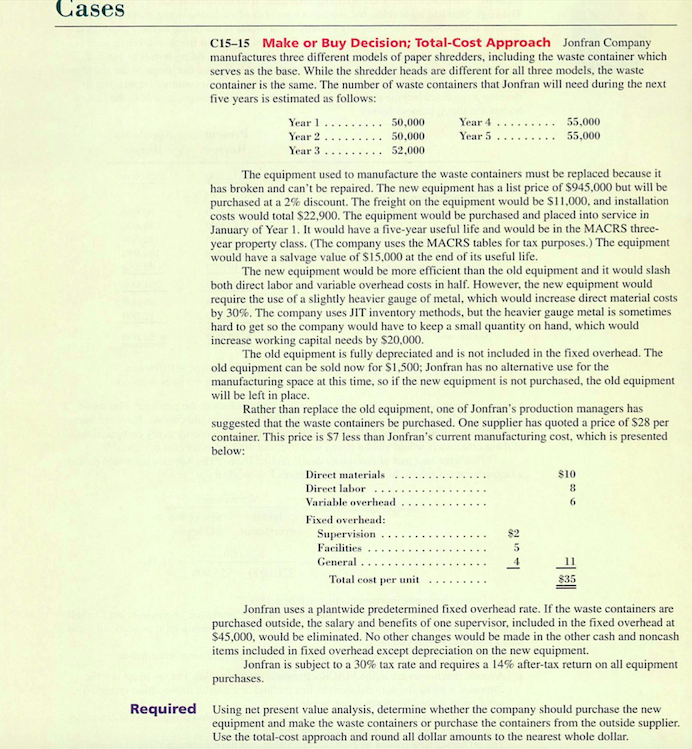

Jonfran Company manufactures three different models of paper shredders, including the waste container which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the next five years is estimated as follows: The equipment used to manufacture the waste containers must be replaced because it has broken and can't be repaired. The new equipment has a list price of $945,000 but will be purchased at a 2% discount. The freight on the equipment would be $11,000, and installation costs would total $22,900. The equipment would be purchased and placed into service in January of Year 1. It would have a five-year useful life and would be in the MACRS three-year property class. (The company uses the MACRS tables for tax purposes.) The equipment would have a salvage value of $15,000 at the end of its useful life. The new equipment would be more efficient than the old equipment and it would slash both direct labor and variable overhead costs in half. However, the new equipment would require the use of a slightly heavier gauge of metal, which would increase direct material costs by 30%. The company uses JIT inventory methods, but the heavier gauge metal is Sometimes hard to get so the company would have to keep a small quantity on hand, which would increase working capital needs by $20,000. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment can be sold now for $1,500: Jonfran has no alternative use for the manufacturing space at this time, so if the new equipment is not purchased, the old equipment will be left in place. Rather than replace the old equipment, one of Jonfran's production managers has suggested that the waste containers be purchased. One supplier has quoted a price of $28 per container. This price is $7 less than Jonfran's current manufacturing cost, which is presented below: Jonfran uses a plantwide predetermined fixed overhead rate. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in the fixed overhead at $45,000, would be eliminated. No other changes would be made in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 30% tax rate and requires a 14% after-tax return on all equipment purchases. Required Using net present value analysis, determine whether the company should purchase the new equipment and make the waste containers or purchase the containers from the outside supplier. Use the total-cost approach and round all dollar amounts to the nearest whole dollar