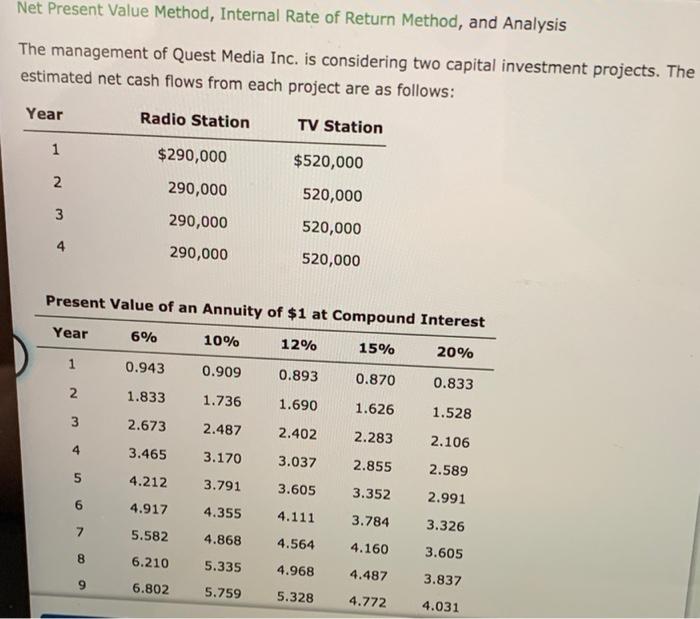

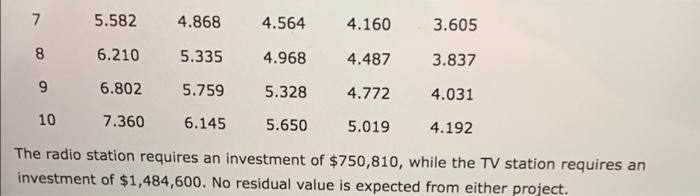

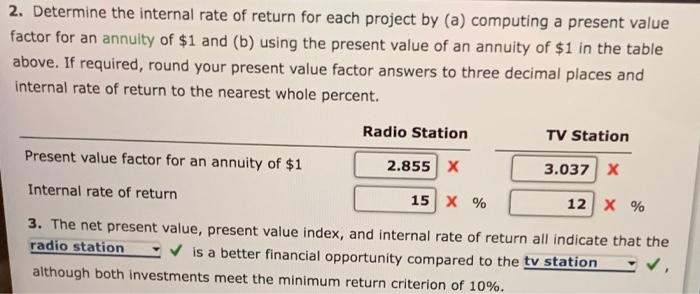

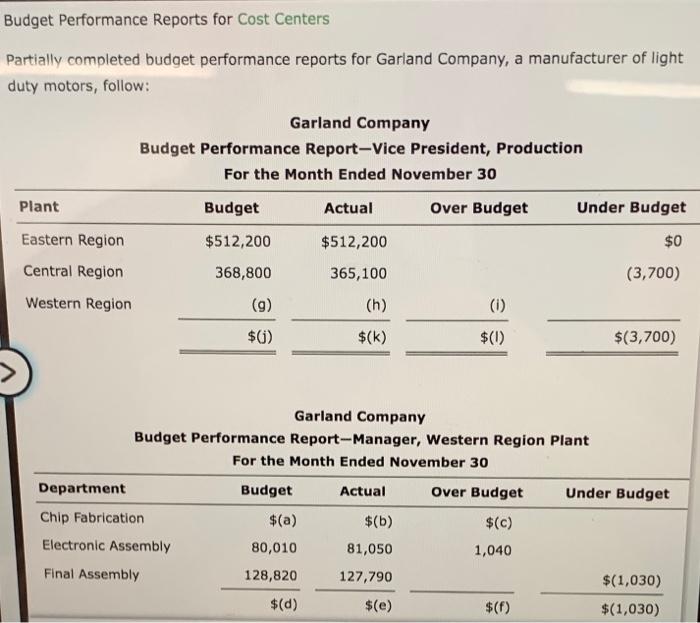

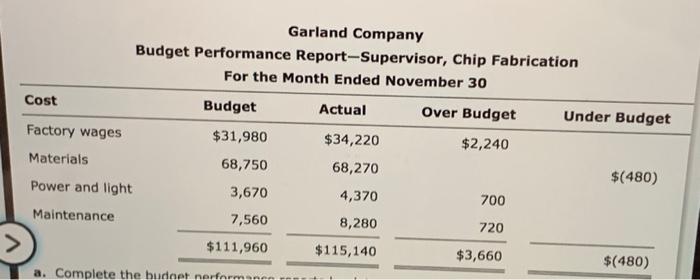

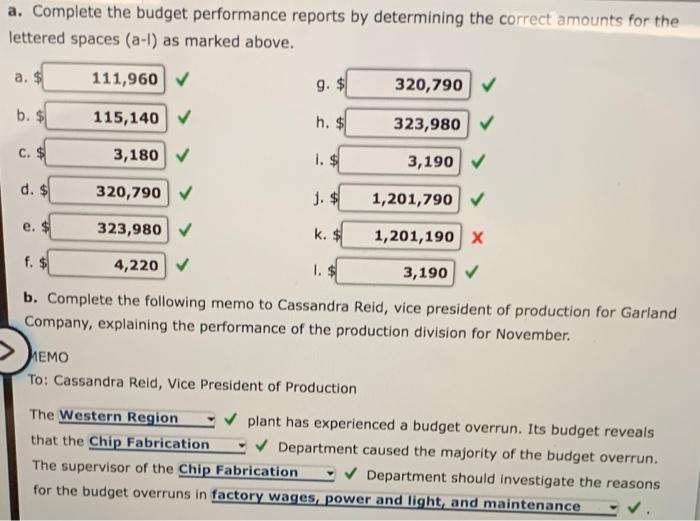

Net Present Value Method, Internal Rate of Return Method, and Analysis The management of Quest Media Inc. is considering two capital investment projects. The estimated net cash flows from each project are as follows: Year Radio Station TV Station 1 $290,000 $520,000 2 290,000 520,000 3 290,000 520,000 4 290,000 520,000 Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 The radio station requires an investment of $750,810, while the TV station requires an investment of $1,484,600. No residual value is expected from either project. 2. Determine the internal rate of return for each project by (a) computing a present value factor for an annuity of $1 and (b) using the present value of an annuity of $1 in the table above. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest whole percent. Radio Station TV Station Present value factor for an annuity of $1 2.855 X 3.037 X Internal rate of return 15 X % 12 X % 3. The net present value, present value index, and internal rate of return all indicate that the radio station is a better financial opportunity compared to the tv station although both investments meet the minimum return criterion of 10%. Budget Performance Reports for Cost Centers Partially completed budget performance reports for Garland Company, a manufacturer of light duty motors, follow: Garland Company Budget Performance Report-Vice President, Production For the Month Ended November 30 Budget Actual Over Budget Under Budget Plant Eastern Region $512,200 $512,200 $0 Central Region 368,800 365,100 (3,700) Western Region (9) (h) (0) $(1) $(k) $(1) $(3,700) Garland Company Budget Performance Report-Manager, Western Region Plant For the Month Ended November 30 Department Budget Actual Over Budget Under Budget Chip Fabrication $(a) $(b) $(c) Electronic Assembly 80,010 81,050 1,040 Final Assembly 128,820 127,790 $(1,030) $(d) $(e) $(f) $(1,030) Garland Company Budget Performance Report-Supervisor, Chip Fabrication For the Month Ended November 30 Cost Budget Actual Over Budget Under Budget Factory wages $31,980 $34,220 $2,240 Materials 68,750 68,270 $(480) Power and light 3,670 4,370 700 Maintenance 7,560 8,280 720 $111,960 $115,140 $3,660 $(480) a. Complete the budnet nerformanent > a. Complete the budget performance reports by determining the correct amounts for the lettered spaces (a-I) as marked above. a. $ 111,960 9. $ 320,790 b. $ 115,140 h. $ 323,980 c. $ 3,180 1. $ 3,190 d. $ 320,790 1. $ 1,201,790 323,980 k. $ 1,201,190 X f. $ 4,220 1. $ 3,190 b. Complete the following memo to Cassandra Reid, vice president of production for Garland Company, explaining the performance of the production division for November MEMO To: Cassandra Reid, Vice President of Production The Western Region plant has experienced a budget overrun. Its budget reveals that the Chip Fabrication Department caused the majority of the budget overrun. The supervisor of the Chip Fabrication Department should investigate the reasons for the budget overruns in factory wages, power and light, and maintenance