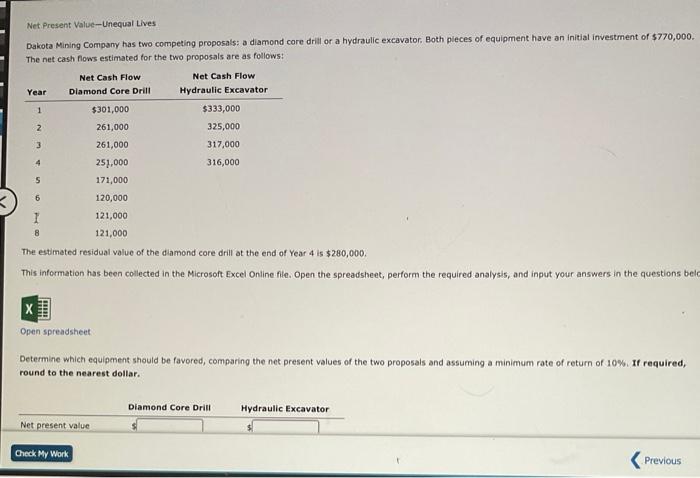

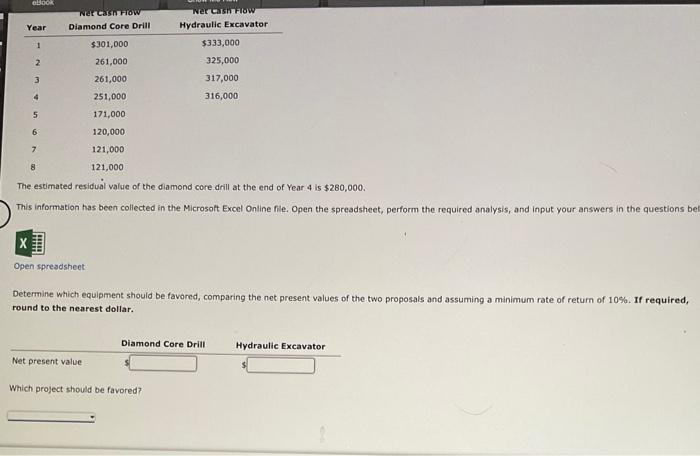

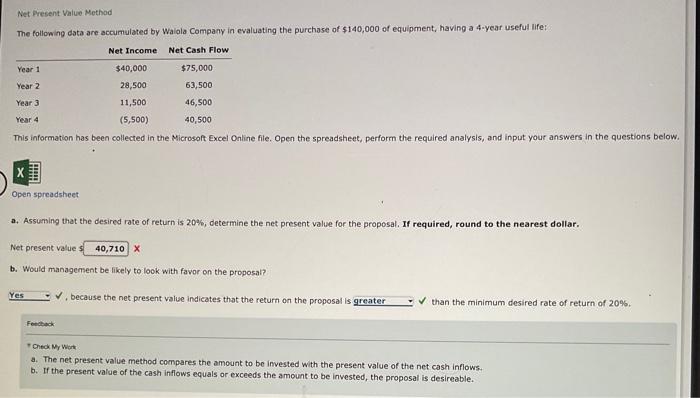

Net Present Value-Unequal Lives Dakota Mining Company has two competing proposals: a diamond core drill or a hydraulic excavator, Both pieces of equipment have an initial investment of \$770, 000. The net cash flows estimated for the two proposals are as follows: The estimeted residual value of the diamond core drill at the end of Year 4 is $280,000. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions bel, Open spreadsheet Determine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of return of 10%. If required, round to the nearest dollar. The estimated residual value of the diamond core drill at the end of Year 4 is $280,000. This information has been collected in the Microsoft Excel Online fie. Open the spreadsheet, perform the required analysis, and input your answers in the questions bel Open spresdsheet Determine which equipment should be favored, comparing the net present values of the two proposals and assuming a minimum rate of retum of 10%. If required, round to the nearest dollar. Net Present Value Method The following data are accumulated by Waiola Company in evaluating the purchase of $140,000 of equipment, having a 4 -year useful life: This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadshest a. Assuming that the desired rate of return is 20%, determine the net present value for the proposal. If required, round to the nearest dollar. Net present value s b. Would management be likely to look with favor on the proposal? , because the net present value indicates that the return on the proposal is than the minimum desired rate of return of 20%. Fenobed TCned Ny Wert a. The net present value method compares the amount to be invested with the present value of the net cash inflows. b. If the present value of the cash inflows equals or exceeds the amount to be invested, the proposal is desireable