Answered step by step

Verified Expert Solution

Question

1 Approved Answer

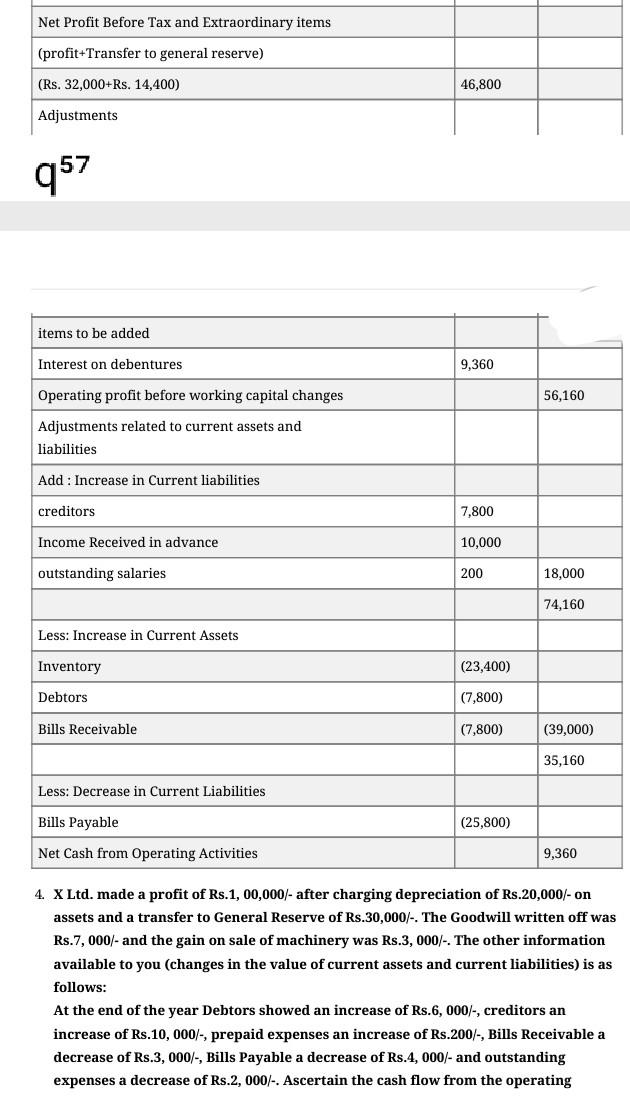

Net Profit Before Tax and Extraordinary items (profit+Transfer to general reserve) (Rs. 32,000+Rs. 14,400) 46,800 Adjustments 957 items to be added Interest on debentures 9,360

Net Profit Before Tax and Extraordinary items (profit+Transfer to general reserve) (Rs. 32,000+Rs. 14,400) 46,800 Adjustments 957 items to be added Interest on debentures 9,360 Operating profit before working capital changes 56,160 Adjustments related to current assets and liabilities Add : Increase in Current liabilities creditors 7,800 Income Received in advance 10,000 outstanding salaries 200 18,000 74,160 Less: Increase in Current Assets Inventory (23,400) Debtors (7,800) Bills Receivable (7,800) (39,000) 35,160 Less: Decrease in Current Liabilities Bills Payable (25,800) Net Cash from Operating Activities 9,360 4. X Ltd. made a profit of Rs.1,00,000/- after charging depreciation of Rs.20,000/- on assets and a transfer to General Reserve of Rs.30,000/-. The Goodwill written off was Rs.7, 000/- and the gain on sale of machinery was Rs.3, 000/-. The other information available to you (changes in the value of current assets and current liabilities) is as follows: At the end of the year Debtors showed an increase of Rs.6, 000/-, creditors an increase of Rs.10, 000/-, prepaid expenses an increase of Rs.200/-, Bills Receivable a decrease of Rs.3, 000/-, Bills Payable a decrease of Rs.4, 000/- and outstanding expenses a decrease of Rs.2, 000/-. Ascertain the cash flow from the operating

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started