Question

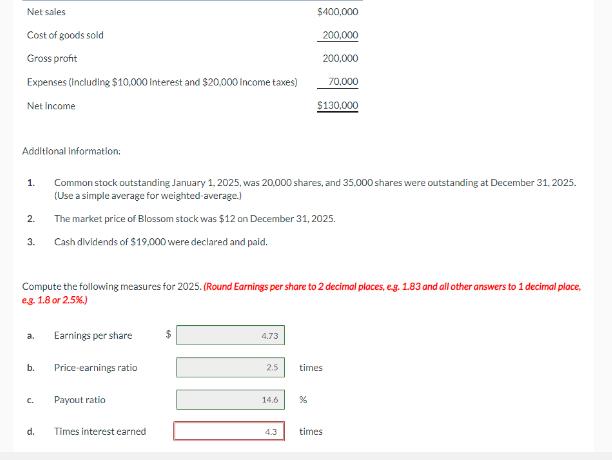

Net sales $400,000 Cost of goods sold 200,000 Gross profit 200,000 Expenses (including $10,000 interest and $20,000 Income taxes) 70,000 Net Income $130,000 Additional

Net sales $400,000 Cost of goods sold 200,000 Gross profit 200,000 Expenses (including $10,000 interest and $20,000 Income taxes) 70,000 Net Income $130,000 Additional information: 1. Common stock outstanding January 1, 2025, was 20,000 shares, and 35,000 shares were outstanding at December 31, 2025. (Use a simple average for weighted average.) 2. The market price of Blossom stock was $12 on December 31, 2025. 3. Cash dividends of $19,000 were declared and paid. Compute the following measures for 2025. (Round Earnings per share to 2 decimal places, eg. 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) a. Earnings per share 4.73 b. Price-earnings ratio 2.5 times C. Payout ratio 14.6 % d. Times interest earned 4.3 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App