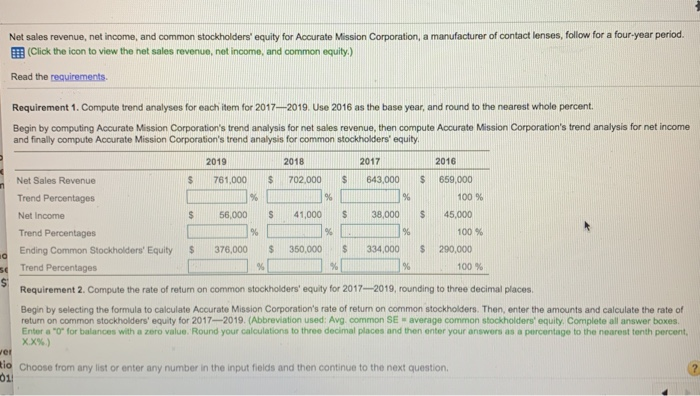

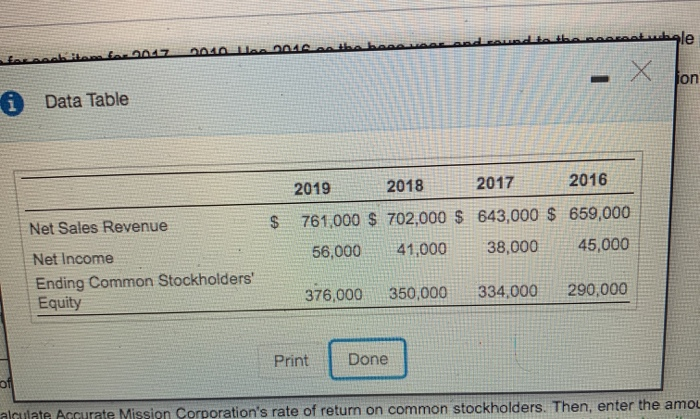

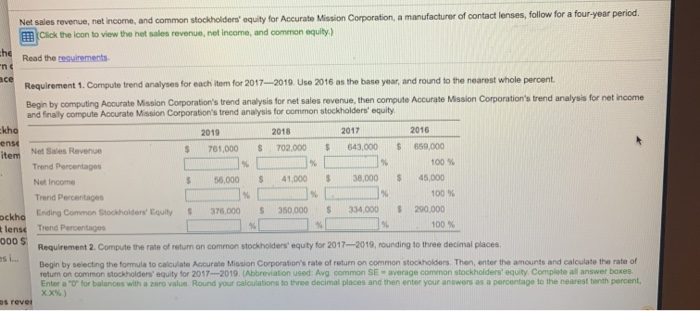

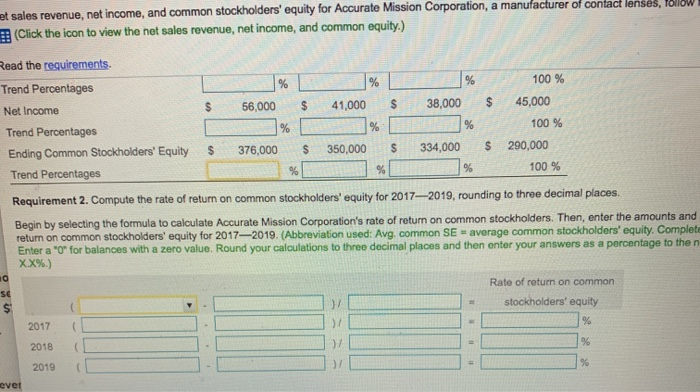

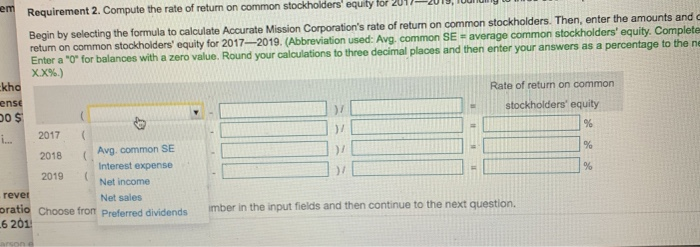

Net sales revenue, net income, and common stockholders' equity for Accurate Mission Corporation, a manufacturer of contact lenses, follow for a four-year period. (Click the icon to view the net sales revenue, net income, and common equity.) Read the requirements. Requirement 1. Compute trend analyses for each item for 2017-2019. Use 2016 as the base year, and round to the nearest whole percent. Begin by computing Accurate Mission Corporation's trend analysis for net sales revenue, then compute Accurate Mission Corporation's trend analysis for net income and finally compute Accurate Mission Corporation's trend analysis for common stockholders' equity 2017 2016 2019 2018 761,000 702.000 643,000 659,000 Net Sales Revenue Trend Percentages % % % 100 % 38,000 $ 45,000 56,000 41,000 Net Income % % % 100 % Trend Percentages 290,000 376,000 350,000 334,000 $ Ending Common Stockholders' Equity S % % 100 % Trend Percentages % se Requirement 2. Compute the rate of return on common stockholders' equity for 2017-2019, rounding to three decimal places. Begin by selecting the formula to calculate Accurate Mission Corporation's rate of return on common stockholders. Then, enter the amounts and calculate the rate of return on common stockholders' equity for 2017-2019. (Abbreviation used: Avg. common SE average common stockholders' equity. Complete all answer boxes. Enter a "0" for balances with a zero value. Round your calculations to three decimal places and then enter your answers as a percentage to the nearest tenth percent, XX%) ver tio Choose from any list or enter any number in the input fields and then continue to the next question. 01 ad roundta tha naeatubale 0010 Lloe 2016 tha hana on iData Table 2016 2017 2018 2019 761,000 $ 702,000 $ 643,000 $ 659,000 45,000 $ Net Sales Revenue 38,000 41,000 56,000 Net Income Ending Common Stockholders Equity 290,000 376,000 334,000 350,000 Done Print of alculate Accurate Mission Corporation's rate of return on common stockholders. Then, enter the amou Net sales revenue, net income, and common stockholders' equity for Accurate Mission Corporation, a manufacturer of contact lenses, follow for a four-year period. EBClick the icon to view the het sales revenue, net income, and common equity.) he Read the requirements n c ace Requirement 1. Compute trend analyses for each item for 2017-2019 Use 2016 as the base year, and round to the nearest whole percent. Begin by computing Accurate Mission Corporation's trend analysis for net sales revenue, then compute Accurate Mission Corporation's trend analysis for net income and finally compute Accurate Mission Corporation's trend analysis for common stockholders' equity. kho ense item 2017 2016 2018 2019 659,000 643,000 702,000 761,000 Net Sales Revenue % 100 % % % Trend Percentages 45,000 38,000 41,000 56,000 Net Income 100 % % Trend Percentages 350,000 S 290,000 334,000 Ending Common Stockholders' Equity 376,000 ockho % 100 % Trend Percentages lense 000 $ Requirement 2. Compute the rate of retun on common stockholders equity for 2017-2019, rounding to three decimal places es i... Begin by selecting the formula to calculate Accurate Mission Corporation's rate of return on common stockholders. Then, enter the amounts and calculate the rate of return on common stockholders' equity for 2017-20199. (Abbreviation used: Avg common SE average common stockholders' equity Complete all answer boxes. Enter a "0 for balances with a zero value. Round your caloulations to three decimal places and then enter your answers as a percentage to the nearest tenth percent, XX% ) es rever et sales revenue, net income, and common stockholders' equity for Accurate Mission Corporation, a manufacturer of contact lenses, follow (Click the icon to view the net sales revenue, net income, and common equity.) Read the requirements Trend Percentages BEES 100 % % % 45,000 $ 38,000 41,000 56,000 $ Net Income 100 % % % % Trend Percentages 290,000 334,000 350,000 376,000 Ending Common Stockholders' Equity 100 % % % Trend Percentages Requirement 2. Compute the rate of return on common stockholders' equity for 2017-2019, rounding to three decimal places. Begin by selecting the formula to calculate Accurate Mission Corporation's rate of return on common stockholders. Then, enter the amounts and return on common stockholders' equity for 2017-2019. (Abbreviation used: Avg. common SE average common stockholders' equity. Complete Enter a "0" for balances with a zero value. Round your calculations to three decimal places and then enter your answers as a percentage to the n XX %.) Rate of return on common se stockholders' equity $t % 2017 % 2018 2019 ever in em Requirement 2. Compute the rate of return on common stockholders' equity for 2017201, Begin by selecting the formula to calculate Accurate Mission Corporation's rate of return on common stockholders. Then,, enter the amounts and retum on common stockholders' equity for 2017-2019. (Abbreviation used: Avg., common SE average common stockholders' equity. Complete Enter a "O" for balances with a zero value. Round your calculations to three decimal places and then enter your answers as a percentage to the ne XX %.) kho Rate of return on common ense stockholders equity 2017 % Avg. common SE (. Interest expense 2018 % 2019 Net income rever oratio 6 201 Net sales imber in the input fields and then continue to the next question. Choose from preferred dividends