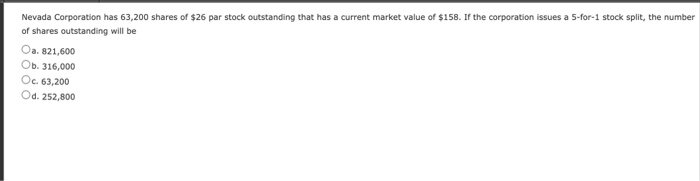

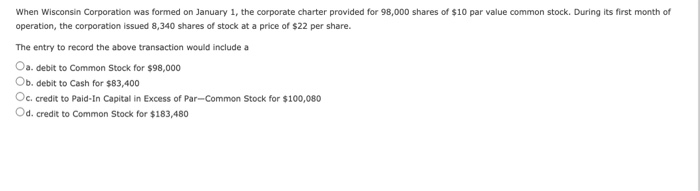

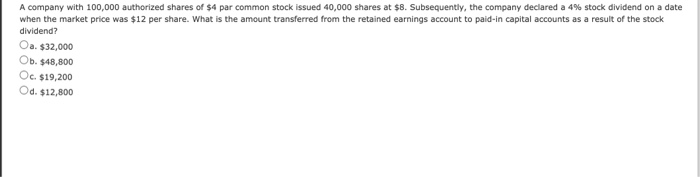

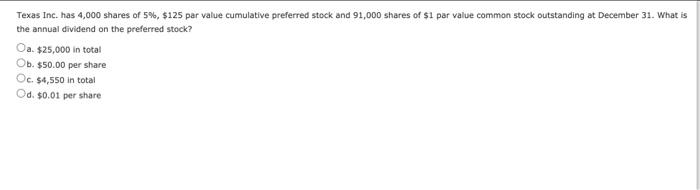

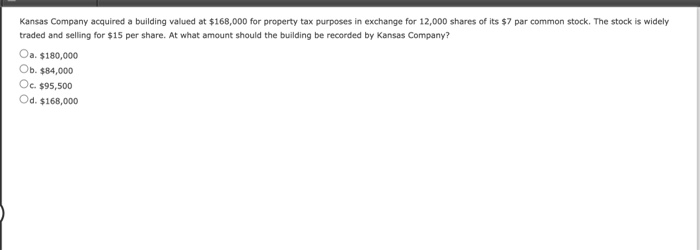

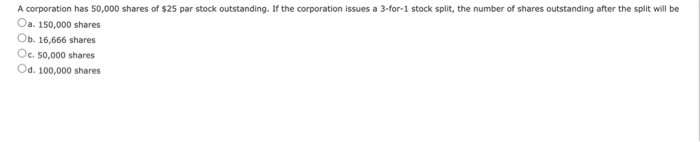

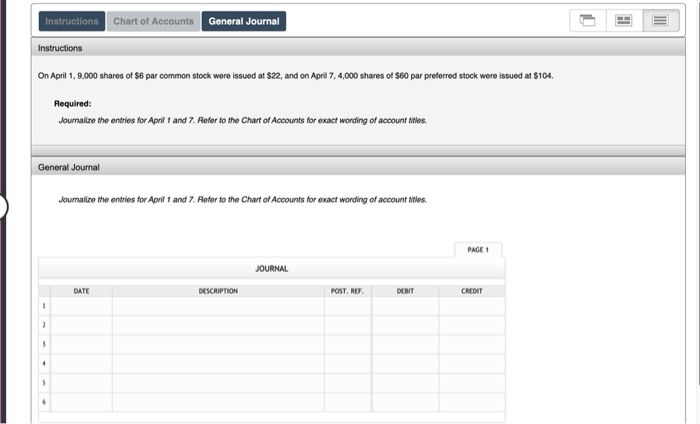

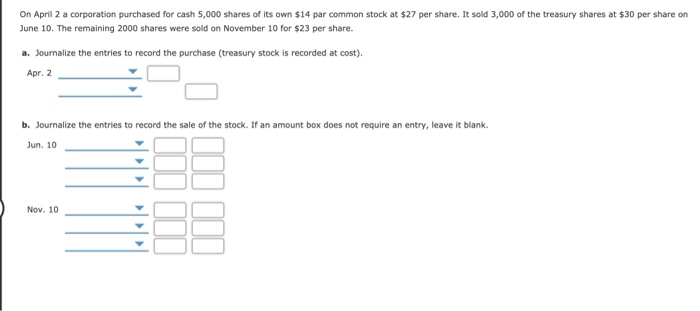

Nevada Corporation has 63,200 shares of $26 par stock outstanding that has a current market value of $158. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be Oa 821,600 Ob. 316,000 Oc. 63,200 Od. 252,800 When Wisconsin Corporation was formed on January 1, the corporate charter provided for 98,000 shares of $10 par value common stock. During its first month of operation, the corporation issued 8,340 shares of stock at a price of $22 per share. The entry to record the above transaction would include a Oa. debit to Common Stock for $98,000 Ob. debit to Cash for $83,400 Occredit to Paid-in Capital in excess of Par-Common Stock for $100,080 Od.credit to Common Stock for $183,480 A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 4% stock dividend on a date when the market price was $12 per share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend? Oa. $32,000 Ob. $48,800 Oc. $19,200 Od. $12,800 Texas Inc. has 4,000 shares of 5%, $125 par value cumulative preferred stock and 91,000 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? Oa $25,000 in total Ob. $50.00 per share Oc. $4,550 in total Od. $0.01 per share Kansas Company acquired a building valued at $168,000 for property tax purposes in exchange for 12,000 shares of its $7 par common stock. The stock is widely traded and selling for $15 per share. At what amount should the building be recorded by Kansas Company? Oa $180,000 Ob. $84,000 Oc. $95,500 Od $168,000 A corporation has 50,000 shares of $25 par stock outstanding. If the corporation issues a 3-for-1 stock split, the number of shares outstanding after the split will be Oa. 150,000 shares Ob. 16,666 shares Oc. 50,000 shares Od. 100,000 shares III Instructions Chart of Accounts General Journal Instructions On April 1, 9,000 shares of S6 par common stock were issued at $22, and on April 7, 4,000 shares of $60 par proferred stock were issued at $104. Required: Journalize the entries for April 1 and 7. Refer to the Chart of Accounts for exact wording of account titles. General Journal Journalize the entries for April 1 and 7. Refer to the Chart of Accounts for exact wording of account titles. PAGE 1 JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT 2 3 4 On April 2 a corporation purchased for cash 5,000 shares of its own $14 par common stock at $27 per share. It sold 3,000 of the treasury shares at $30 per share on June 10. The remaining 2000 shares were sold on November 10 for $23 per share. a. Journalize the entries to record the purchase (treasury stock is recorded at cost). Apr. 2 b. Journalize the entries to record the sale of the stock. If an amount box does not require an entry, leave it blank. Jun. 10 III Nov. 10