Answered step by step

Verified Expert Solution

Question

1 Approved Answer

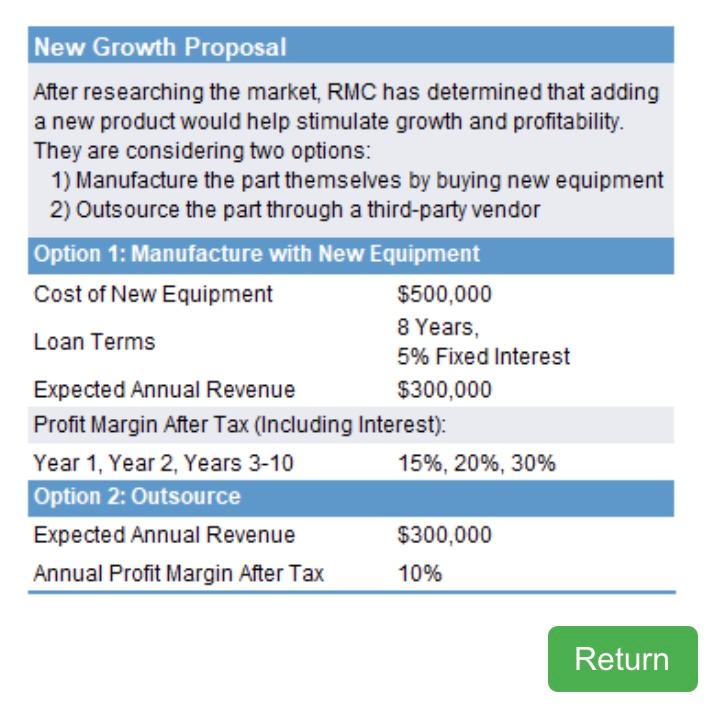

New Growth Proposal After researching the market, RMC has determined that adding a new product would help stimulate growth and profitability. They are considering two

New Growth Proposal After researching the market, RMC has determined that adding a new product would help stimulate growth and profitability. They are considering two options: 1) Manufacture the part themselves by buying new equipment 2) Outsource the part through a third-party vendor Option 1: Manufacture with New Equipment Cost of New Equipment $500,000 8 Years, Loan Terms 5% Fixed Interest Expected Annual Revenue $300,000 Profit Margin After Tax (Including Interest): Year 1, Year 2, Years 3-10 15%, 20%, 30% Option 2: Outsource Expected Annual Revenue $300,000 Annual Profit Margin After Tax 10% Return For Option 1 of the Growth Proposal, how long would it take RMC to pay back the investment on new equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started