Answered step by step

Verified Expert Solution

Question

1 Approved Answer

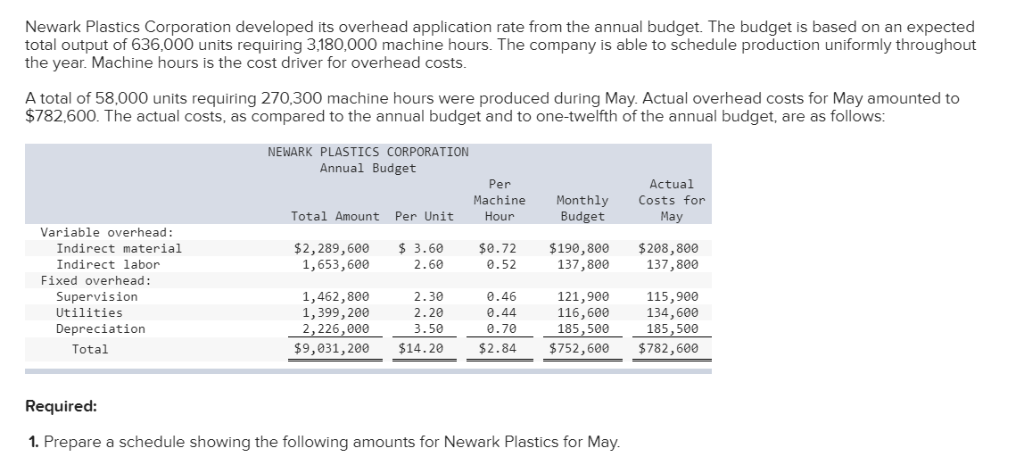

Newark Plastics Corporation developed its overhead application rate from the annual budget. The budget is based on an expected total output of 636,000 units requiring

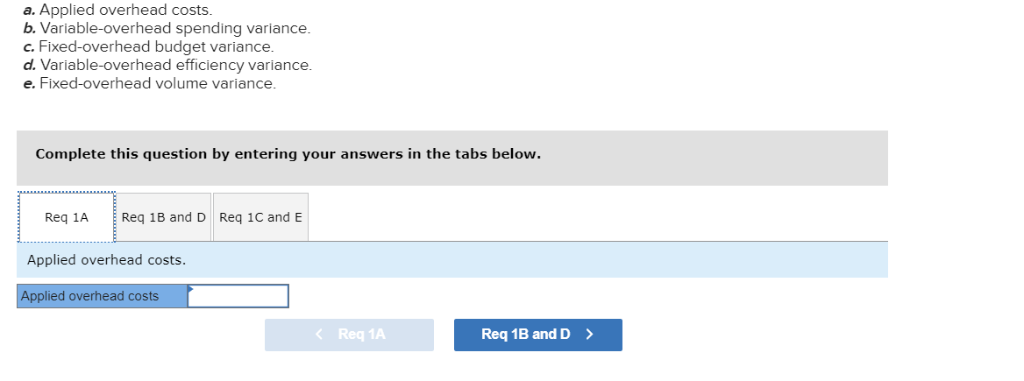

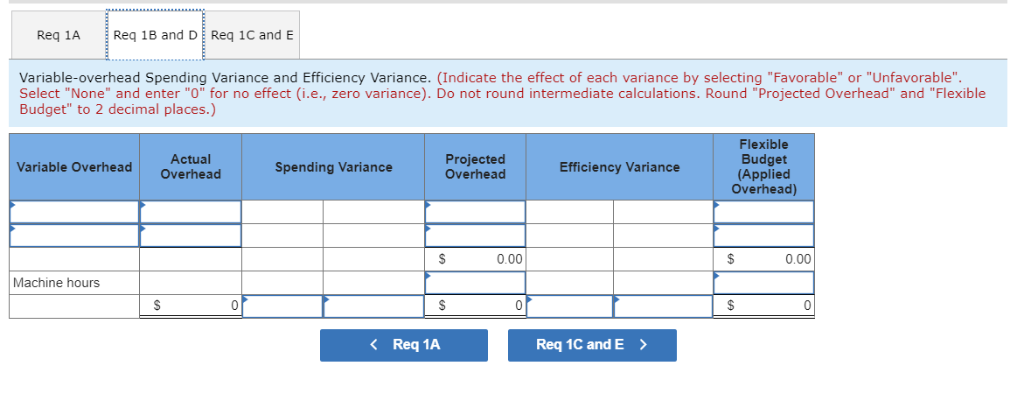

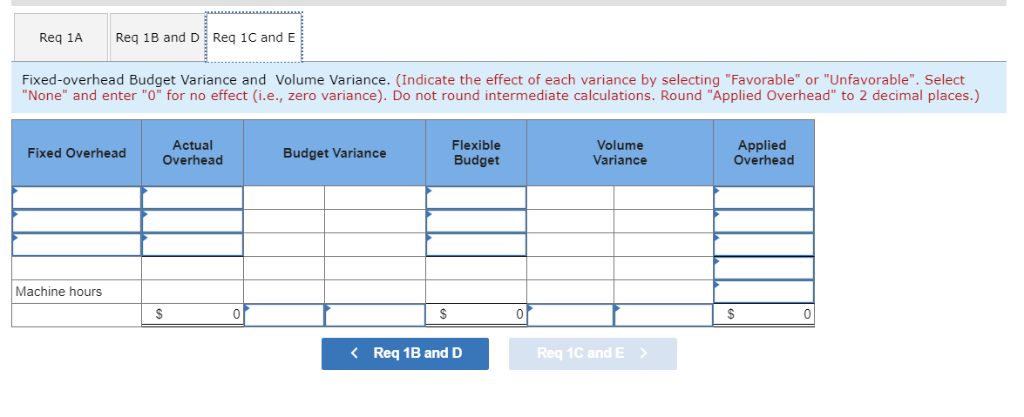

Newark Plastics Corporation developed its overhead application rate from the annual budget. The budget is based on an expected total output of 636,000 units requiring 3,180,000 machine hours. The company is able to schedule production uniformly throughout the year. Machine hours is the cost driver for overhead costs. A total of 58,000 units requiring 270,300 machine hours were produced during May. Actual overhead costs for May amounted to $782,600. The actual costs, as compared to the annual budget and to one-twelfth of the annual budget, are as follows: NEWARK PLASTICS CORPORATION Annual Budget Per Machine Total Amount Per Unit Hour Actual Costs for Monthly Budget May $2,289,600 1,653,600 $ 3.60 2.60 $0.72 0.52 $190,800 137,800 $208,800 137,800 Variable overhead: Indirect material Indirect labor Fixed overhead: Supervision Utilities Depreciation Total 1,462,800 1,399,200 2,226,000 $9,031,200 2.30 2.20 3.50 $14.20 0.46 0.44 0.70 $2.84 121,900 116,600 185,500 $752,600 1 15,900 134,600 185,500 $782,600 Required: 1. Prepare a schedule showing the following amounts for Newark Plastics for May. a. Applied overhead costs. b. Variable-overhead spending variance. c. Fixed-overhead budget variance. d. Variable-overhead efficiency variance. e. Fixed-overhead volume variance. Complete this question by entering your answers in the tabs below. Req 1A Req 1B and D Req 1C and E Applied overhead costs. Applied overhead costs Req 1A Req 1B and D > Req 1A Req 1B and D Req 1C and E Variable-overhead Spending Variance and Efficiency Variance. (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance). Do not round intermediate calculations. Round "Projected Overhead" and "Flexible Budget" to 2 decimal places.) Variable Overhead Actual Overhead Spending Variance Projected Overhead Efficiency Variance Flexible Budget (Applied Overhead) $ 0.00 $ Machine hours $ Req 1A Req 18 and D Req 1C and E Fixed-overhead Budget Variance and Volume Variance. (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "O" for no effect (i.e., zero variance). Do not round intermediate calculations. Round "Applied Overhead" to 2 decimal places.) Fixed Overhead Actual Overhead Budget Variance Flexible Budget Volume Variance Applied Overhead Machine hours sos

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started