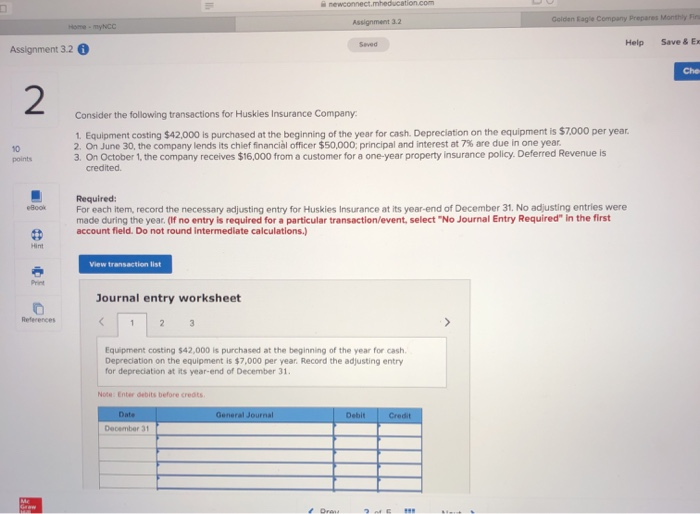

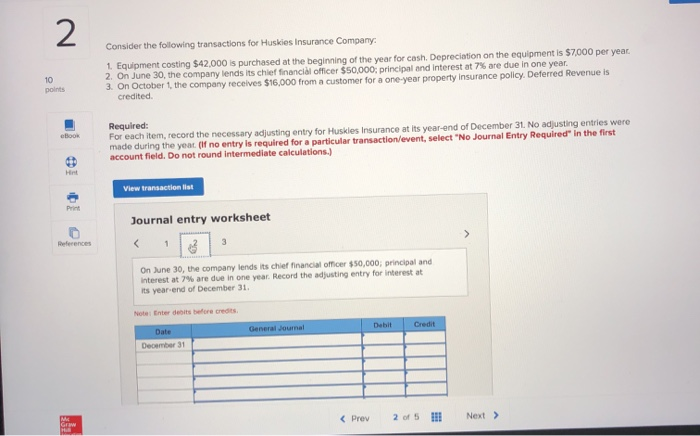

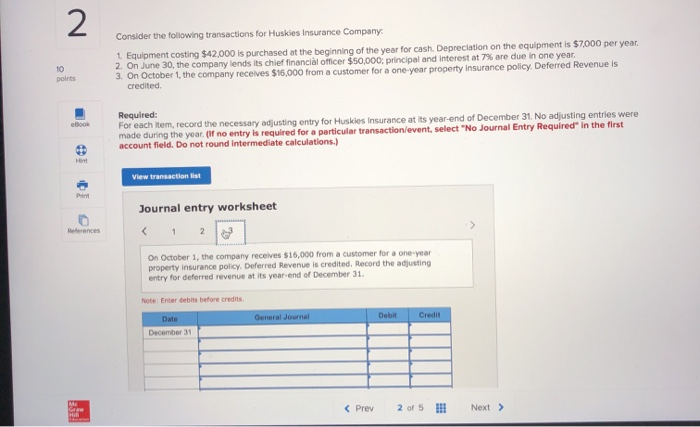

newconnect. meducation.com Assignment 32 Golden Eagle Company Prepares Month Home NCC Help Save & EX Assignment 3.2 Che Consider the following transactions for Huskles Insurance Company 1. Equipment costing $42,000 is purchased at the beginning of the year for cash. Depreciation on the equipment is $7,000 per year. 2. On June 30, the company lends its chief financial officer $50,000 principal and interest at 7% are due in one year. 3. On October 1, the company receives $16,000 from a customer for a one-year property insurance policy. Deferred Revenue is credited 10 points Required: For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field. Do not round Intermediate calculations.) View transaction list Journal entry worksheet 3 Equipment costing $42,000 is purchased at the beginning of the year for cash Depreciation on the equipment is $7,000 per year. Record the adjusting entry for depreciation at its year-end of December 31. Hote: Enter debits before credits General Journal Debit Credit December 31 Consider the following transactions for Huskies Insurance Company n 1 Equipment costing $42.000 is purchased at the beginning of the year for cash. Depreciation on the equipment is $7,000 per year 2. On June 30, the company lends its chief financil officer $50,000, principal and interest at 7% are due in one year. 3. On October 1, the company receives $16,000 from a customer for a one-year property insurance policy. Deferred Revenue is credited points Required: For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year (if no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field. Do not round Intermediate calculations.) View transaction list foto 1e i Journal entry worksheet On June 30, the company lends its chief Financial officer $50.000, principal and Interest at 7% are due in one year Record the adjusting entry for interest at its year end of December 31 Note Enter de bore credits General Journal I Dotill Credit December 31 n Consider the following transactions for Huskies Insurance Company 1 Equipment costing $42,000 is purchased at the beginning of the year for cash. Depreciation on the equipment is $7,000 per year. 2. On June 30, the company lends its chief financial officer $50,000 principal and interest at 7% are due in one year. 3. On October 1, the company receives $15,000 from a customer for a one-year property insurance policy. Deferred Revenue is credited Required: For each item, record the necessary adjusting entry for Huskies Insurance at its year-end of December 31. No adjusting entries were made during the year (if no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field. Do not round Intermediate calculations.) ! 91 0 View transaction list Journal entry worksheet