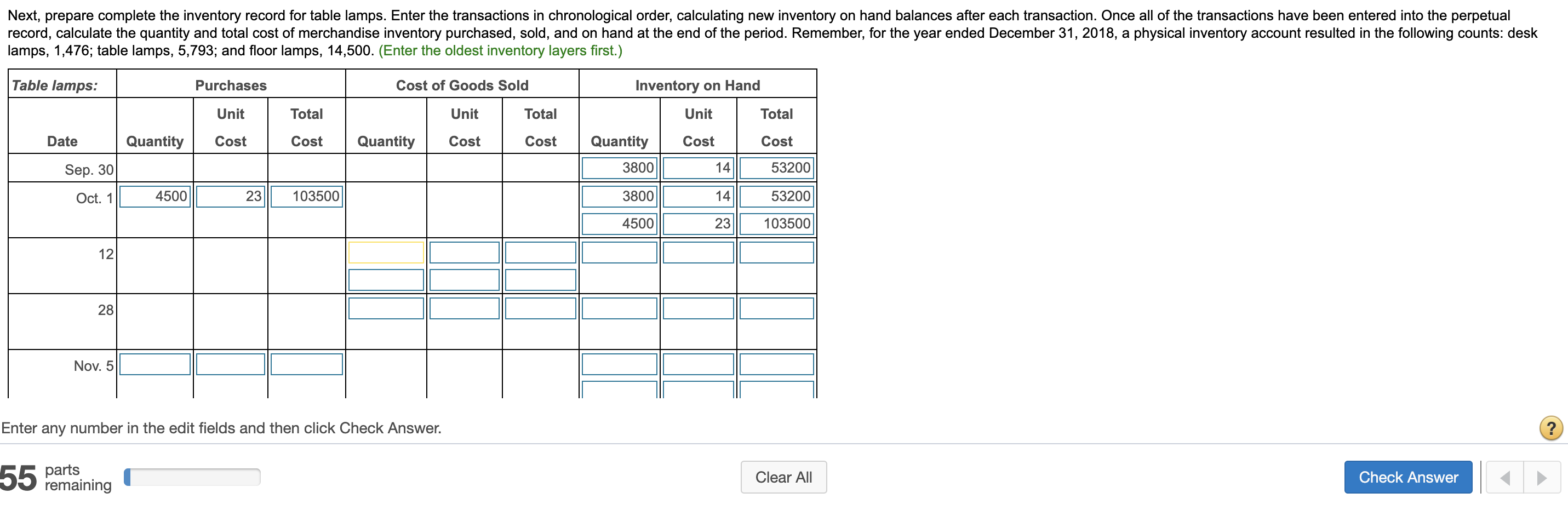

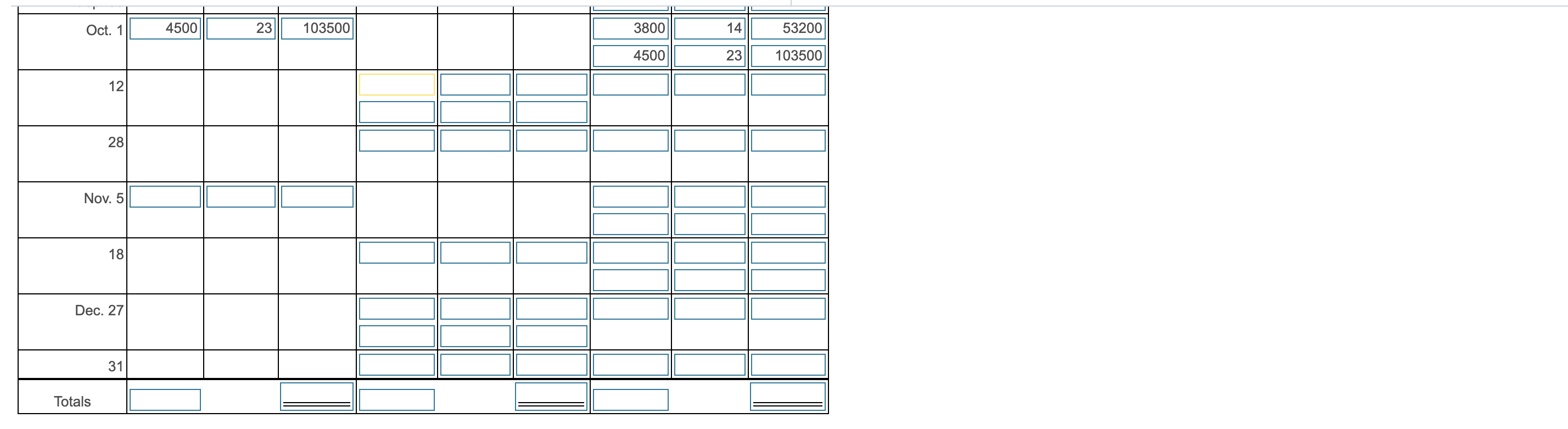

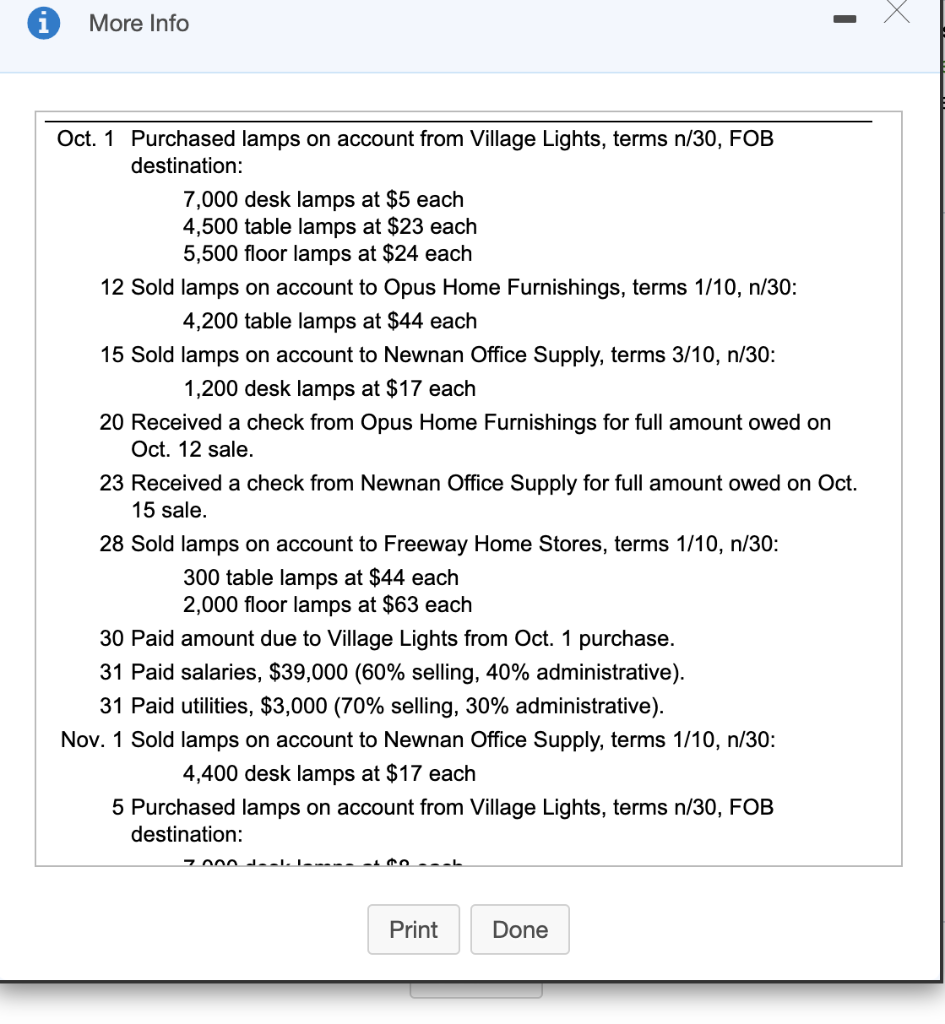

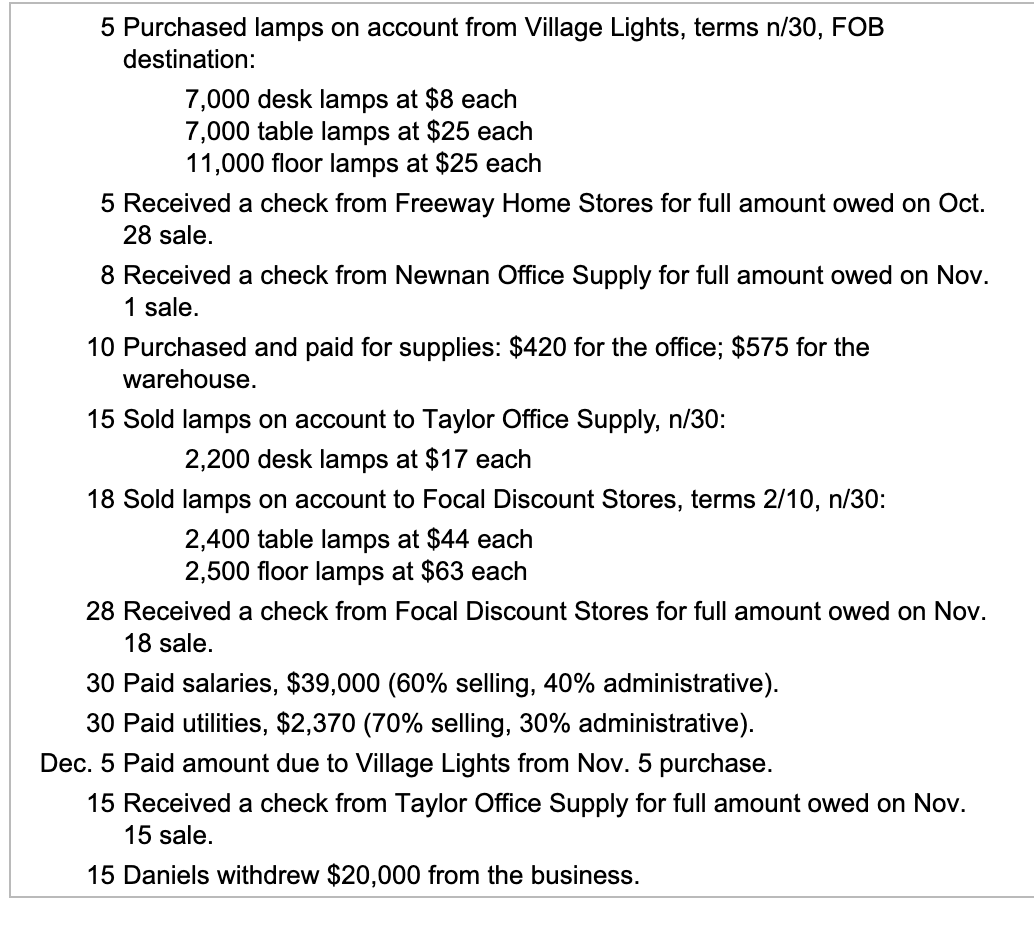

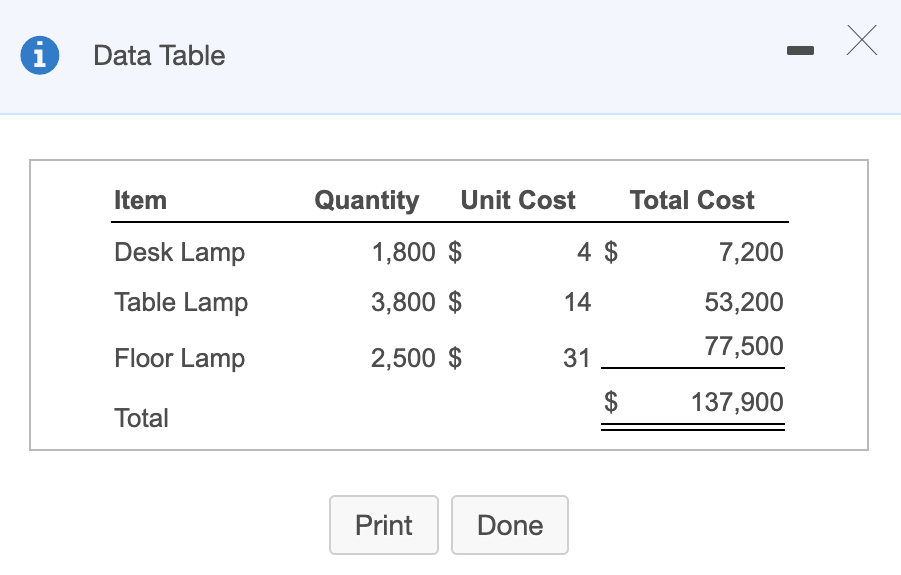

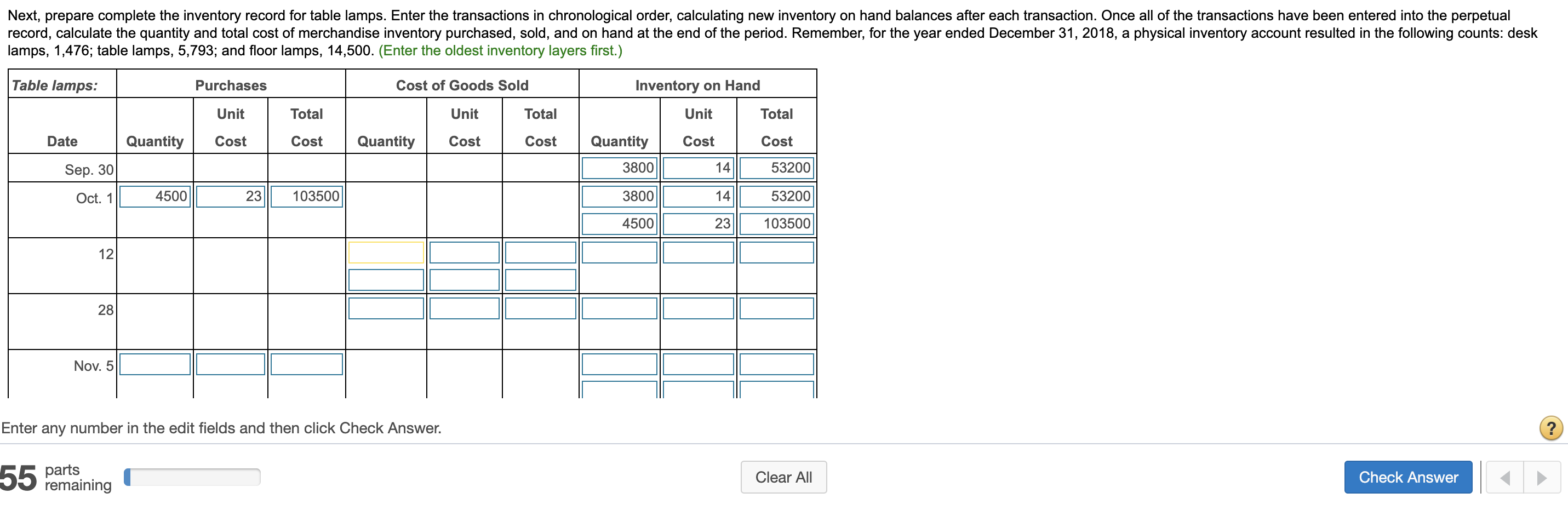

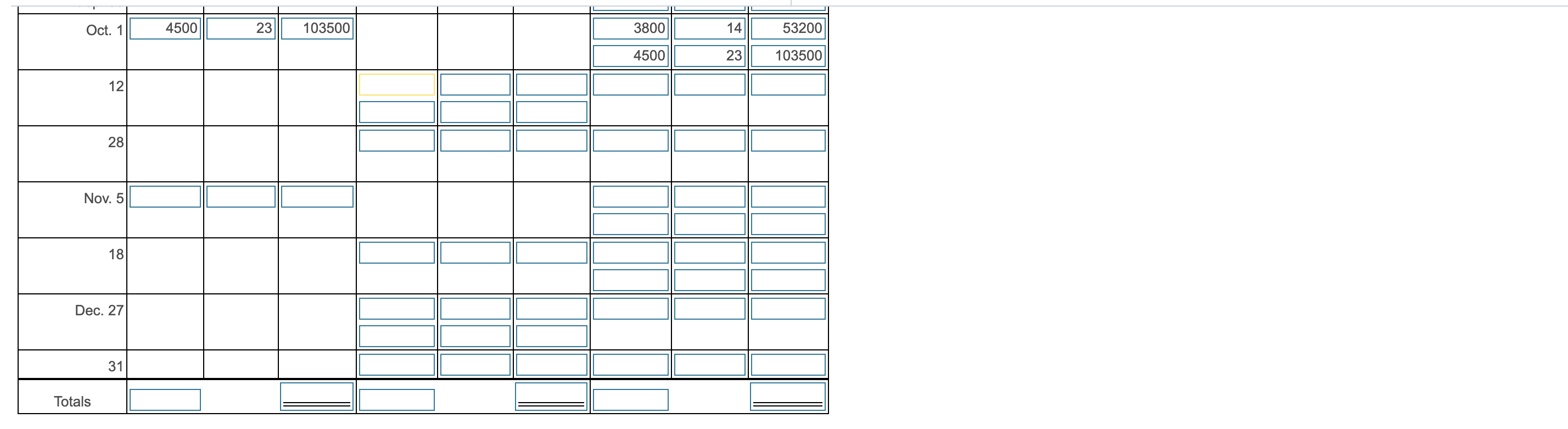

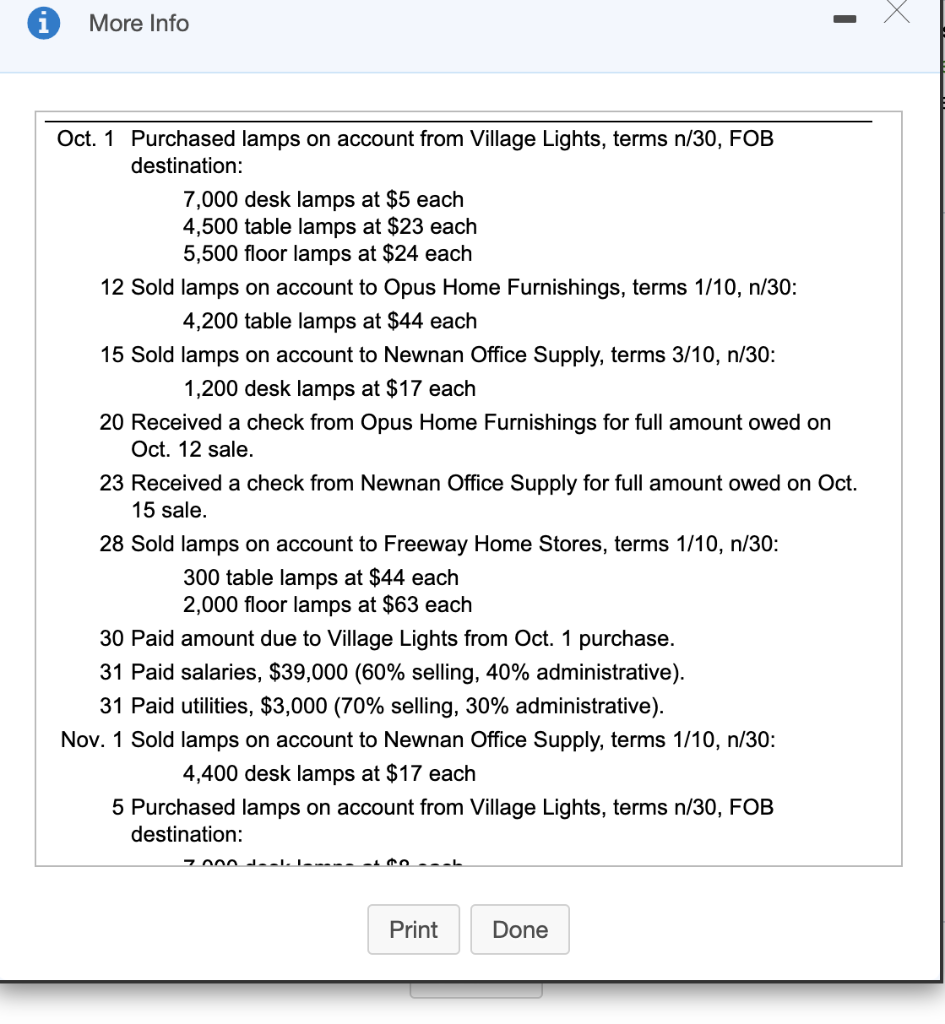

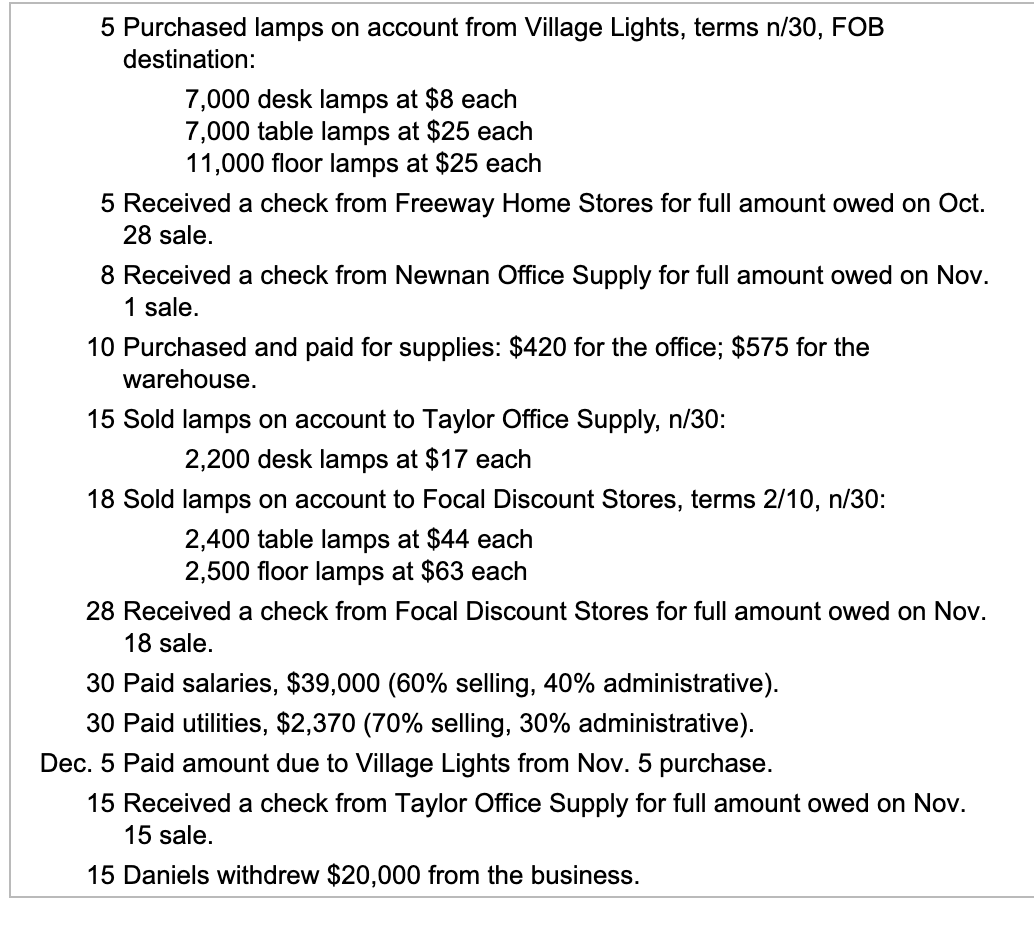

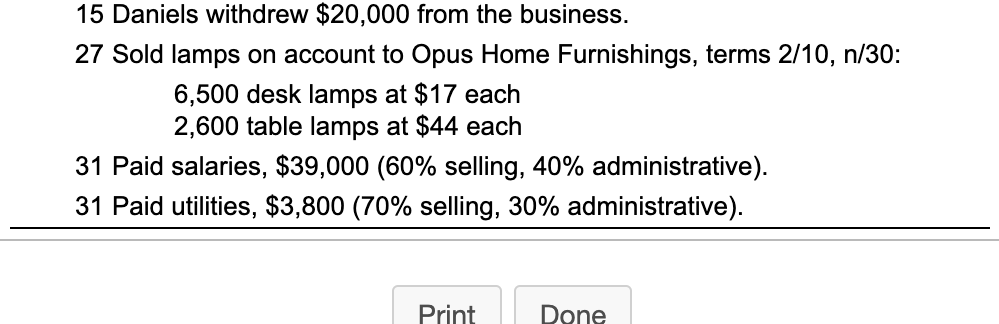

Next, prepare complete the inventory record for table lamps. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Remember, for the year ended December 31, 2018, a physical inventory account resulted in the following counts: desk lamps, 1,476; table lamps, 5,793; and floor lamps, 14,500. (Enter the oldest inventory layers first.) Table lamps: Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Sep. 30 3800 14 53200 Oct. 1 4500 23 103500 3800 14 53200 4500 23 103500 12 28 Nov. 5 Enter any number in the edit fields and then click Check Answer. ? 55 remaining Clear All Check Answer Oct. 1 4500 23 103500 3800 14 53200 4500 23 103500 12 28 Nov. 5 18 Dec. 27 31 Totals More Info Oct. 1 Purchased lamps on account from Village Lights, terms n/30, FOB destination: 7,000 desk lamps at $5 each 4,500 table lamps at $23 each 5,500 floor lamps at $24 each 12 Sold lamps on account to Opus Home Furnishings, terms 1/10, n/30: 4,200 table lamps at $44 each 15 Sold lamps on account to Newnan Office Supply, terms 3/10, n/30: 1,200 desk lamps at $17 each 20 Received a check from Opus Home Furnishings for full amount owed on Oct. 12 sale. 23 Received a check from Newnan Office Supply for full amount owed on Oct. 15 sale. 28 Sold lamps on account to Freeway Home Stores, terms 1/10, n/30: 300 table lamps at $44 each 2,000 floor lamps at $63 each 30 Paid amount due to Village Lights from Oct. 1 purchase. 31 Paid salaries, $39,000 (60% selling, 40% administrative). 31 Paid utilities, $3,000 (70% selling, 30% administrative). Nov. 1 Sold lamps on account to Newnan Office Supply, terms 1/10, n/30: 4,400 desk lamps at $17 each 5 Purchased lamps on account from Village Lights, terms n/30, FOB destination: 7 Andellene...L Print Done 5 Purchased lamps on account from Village Lights, terms n/30, FOB destination: 7,000 desk lamps at $8 each 7,000 table lamps at $25 each 11,000 floor lamps at $25 each 5 Received a check from Freeway Home Stores for full amount owed on Oct. 28 sale. 8 Received a check from Newnan Office Supply for full amount owed on Nov. 1 sale. 10 Purchased and paid for supplies: $420 for the office; $575 for the warehouse. 15 Sold lamps on account to Taylor Office Supply, n/30: 2,200 desk lamps at $17 each 18 Sold lamps on account to Focal Discount Stores, terms 2/10, n/30: 2,400 table lamps at $44 each 2,500 floor lamps at $63 each 28 Received a check from Focal Discount Stores for full amount owed on Nov. 18 sale. 30 Paid salaries, $39,000 (60% selling, 40% administrative). 30 Paid utilities, $2,370 (70% selling, 30% administrative). Dec. 5 Paid amount due to Village Lights from Nov. 5 purchase. 15 Received a check from Taylor Office Supply for full amount owed on Nov. 15 sale. 15 Daniels withdrew $20,000 from the business. 15 Daniels withdrew $20,000 from the business. 27 Sold lamps on account to Opus Home Furnishings, terms 2/10, n/30: 6,500 desk lamps at $17 each 2,600 table lamps at $44 each 31 Paid salaries, $39,000 (60% selling, 40% administrative). 31 Paid utilities, $3,800 (70% selling, 30% administrative). Print Done 1 Data Table Item Quantity Unit Cost Total Cost 1,800 $ 4 $ 7,200 Desk Lamp Table Lamp 3,800 $ 14 53,200 77,500 Floor Lamp 2,500 $ 31 $ Total 137,900 Print Done Next, prepare complete the inventory record for table lamps. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Remember, for the year ended December 31, 2018, a physical inventory account resulted in the following counts: desk lamps, 1,476; table lamps, 5,793; and floor lamps, 14,500. (Enter the oldest inventory layers first.) Table lamps: Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Sep. 30 3800 14 53200 Oct. 1 4500 23 103500 3800 14 53200 4500 23 103500 12 28 Nov. 5 Enter any number in the edit fields and then click Check Answer. ? 55 remaining Clear All Check Answer Oct. 1 4500 23 103500 3800 14 53200 4500 23 103500 12 28 Nov. 5 18 Dec. 27 31 Totals More Info Oct. 1 Purchased lamps on account from Village Lights, terms n/30, FOB destination: 7,000 desk lamps at $5 each 4,500 table lamps at $23 each 5,500 floor lamps at $24 each 12 Sold lamps on account to Opus Home Furnishings, terms 1/10, n/30: 4,200 table lamps at $44 each 15 Sold lamps on account to Newnan Office Supply, terms 3/10, n/30: 1,200 desk lamps at $17 each 20 Received a check from Opus Home Furnishings for full amount owed on Oct. 12 sale. 23 Received a check from Newnan Office Supply for full amount owed on Oct. 15 sale. 28 Sold lamps on account to Freeway Home Stores, terms 1/10, n/30: 300 table lamps at $44 each 2,000 floor lamps at $63 each 30 Paid amount due to Village Lights from Oct. 1 purchase. 31 Paid salaries, $39,000 (60% selling, 40% administrative). 31 Paid utilities, $3,000 (70% selling, 30% administrative). Nov. 1 Sold lamps on account to Newnan Office Supply, terms 1/10, n/30: 4,400 desk lamps at $17 each 5 Purchased lamps on account from Village Lights, terms n/30, FOB destination: 7 Andellene...L Print Done 5 Purchased lamps on account from Village Lights, terms n/30, FOB destination: 7,000 desk lamps at $8 each 7,000 table lamps at $25 each 11,000 floor lamps at $25 each 5 Received a check from Freeway Home Stores for full amount owed on Oct. 28 sale. 8 Received a check from Newnan Office Supply for full amount owed on Nov. 1 sale. 10 Purchased and paid for supplies: $420 for the office; $575 for the warehouse. 15 Sold lamps on account to Taylor Office Supply, n/30: 2,200 desk lamps at $17 each 18 Sold lamps on account to Focal Discount Stores, terms 2/10, n/30: 2,400 table lamps at $44 each 2,500 floor lamps at $63 each 28 Received a check from Focal Discount Stores for full amount owed on Nov. 18 sale. 30 Paid salaries, $39,000 (60% selling, 40% administrative). 30 Paid utilities, $2,370 (70% selling, 30% administrative). Dec. 5 Paid amount due to Village Lights from Nov. 5 purchase. 15 Received a check from Taylor Office Supply for full amount owed on Nov. 15 sale. 15 Daniels withdrew $20,000 from the business. 15 Daniels withdrew $20,000 from the business. 27 Sold lamps on account to Opus Home Furnishings, terms 2/10, n/30: 6,500 desk lamps at $17 each 2,600 table lamps at $44 each 31 Paid salaries, $39,000 (60% selling, 40% administrative). 31 Paid utilities, $3,800 (70% selling, 30% administrative). Print Done 1 Data Table Item Quantity Unit Cost Total Cost 1,800 $ 4 $ 7,200 Desk Lamp Table Lamp 3,800 $ 14 53,200 77,500 Floor Lamp 2,500 $ 31 $ Total 137,900 Print Done