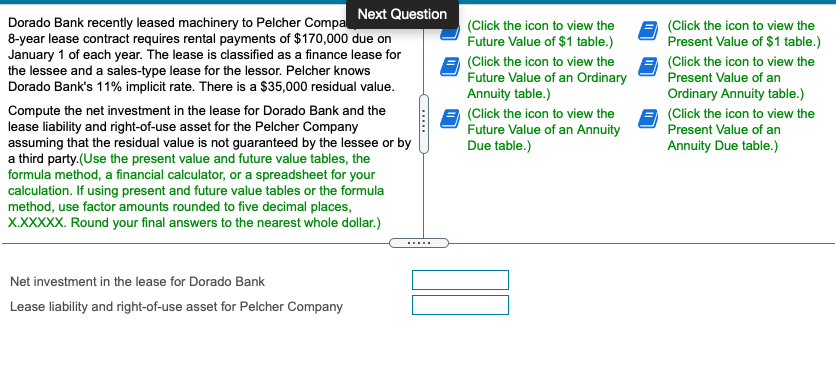

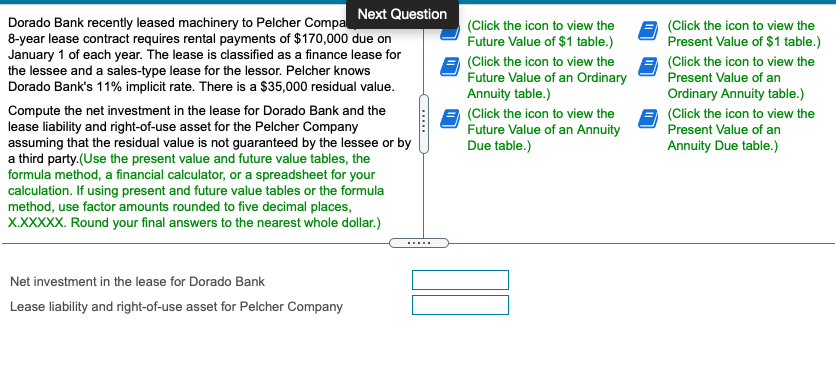

Next Question Dorado Bank recently leased machinery to Pelcher Compa 8-year lease contract requires rental payments of $170,000 due on January 1 of each year. The lease is classified as a finance lease for the lessee and a sales-type lease for the lessor. Pelcher knows Dorado Bank's 11% implicit rate. There is a $35,000 residual value. Compute the net investment in the lease for Dorado Bank and the lease liability and right-of-use asset for the Pelcher Company assuming that the residual value is not guaranteed by the lessee or by a third party.(Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculation. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answers to the nearest whole dollar.) (Click the icon to view the Future Value of $1 table.) (Click the icon to view the Future Value of an ordinary Annuity table.) (Click the icon to view the Future Value of an Annuity Due table.) (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of an Ordinary Annuity table.) (Click the icon to view the Present Value of an Annuity Due table.) Net investment in the lease for Dorado Bank Lease liability and right-of-use asset for Pelcher Company Next Question Dorado Bank recently leased machinery to Pelcher Compa 8-year lease contract requires rental payments of $170,000 due on January 1 of each year. The lease is classified as a finance lease for the lessee and a sales-type lease for the lessor. Pelcher knows Dorado Bank's 11% implicit rate. There is a $35,000 residual value. Compute the net investment in the lease for Dorado Bank and the lease liability and right-of-use asset for the Pelcher Company assuming that the residual value is not guaranteed by the lessee or by a third party.(Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculation. If using present and future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answers to the nearest whole dollar.) (Click the icon to view the Future Value of $1 table.) (Click the icon to view the Future Value of an ordinary Annuity table.) (Click the icon to view the Future Value of an Annuity Due table.) (Click the icon to view the Present Value of $1 table.) (Click the icon to view the Present Value of an Ordinary Annuity table.) (Click the icon to view the Present Value of an Annuity Due table.) Net investment in the lease for Dorado Bank Lease liability and right-of-use asset for Pelcher Company