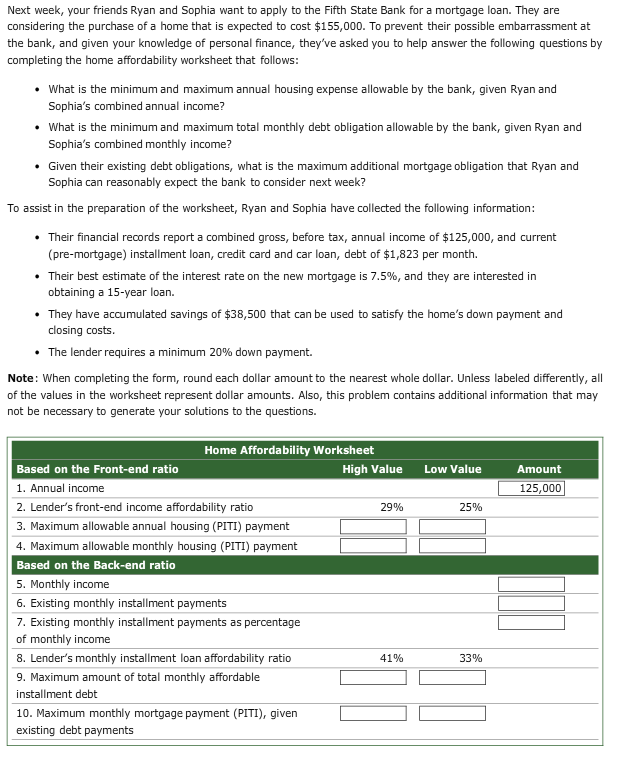

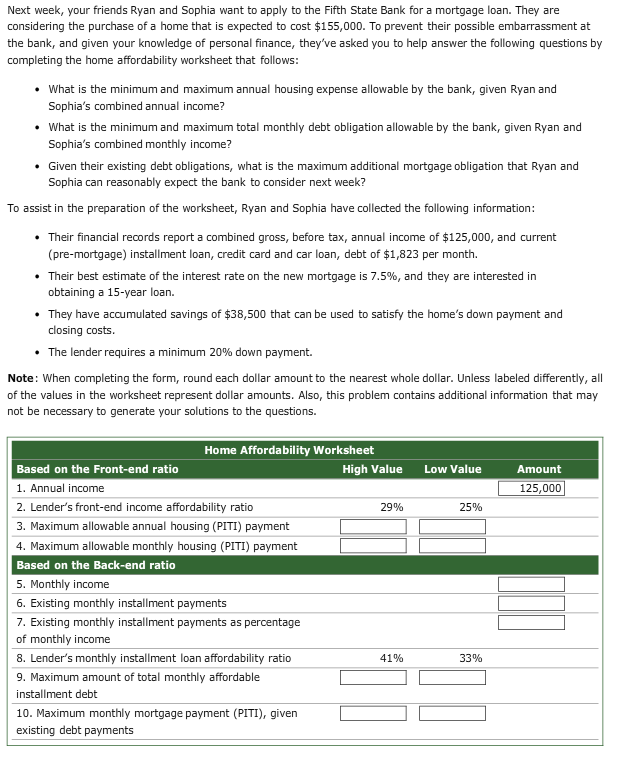

Next week, your friends Ryan and Sophia want to apply to the Fifth State Bank for a mortgage loan. They are considering the purchase of a home that is expected to cost $155,000. To prevent their possible embarrassment at the bank, and given your knowledge of personal finance, they've asked you to help answer the following questions by completing the home affordability worksheet that follows . What is the minimum and maximum annual housing expense allowable by the bank, given Ryan and Sophia's combined annual income? What is the minimum and maximum total monthly debt obligation allowable by the bank, given Ryan and Sophia's combined monthly income? Given their existing debt obligations, what is the maximum additional mortgage obligation that Ryan and Sophia can reasonably expect the bank to consider next week? To assist in the preparation of the worksheet, Ryan and Sophia have collected the following information: . Their financial records report a combined gross, before tax, annual income of $125,000, and current (pre-mortgage) installment loan, credit card and car loan, debt of $1,823 per month. obtaining a 15-year loan. closing costs. * Their best estimate of the interest rate on the new mortgage is 7.5%, and they are interested in . They have accumulated savings of $38,500 that can be used to satisfy the home's down payment and * The lender requires a minimum 20% down payment. Note: When completing the form, round each dollar amount to the nearest whole dollar. Unless labeled differently, all of the values in the worksheet represent dollar amounts. Also, this problem contains additional information that may not be necessary to generate your solutions to the questions. Home Affordability Worksheet Based on the Front-end ratio 1. Annual income 2. Lender's front-end income affordability ratio 3. Maximum allowable annual housing (PITI) payment 4. Maximum allowable monthly housing (PITI) payment Based on the Back-end ratio 5. Monthly income 6. Existing monthly installment payments 7. Existing monthly installment payments as percentage of monthly income 8. Lender's monthly installment loan affordability ratio 9. Maximum amount of total monthly affordable installment debt 10. Maximum monthly mortgage payment (PITI), given existing debt payments High Value Low Value Amount 125,000 29 % 25% 41% 33%